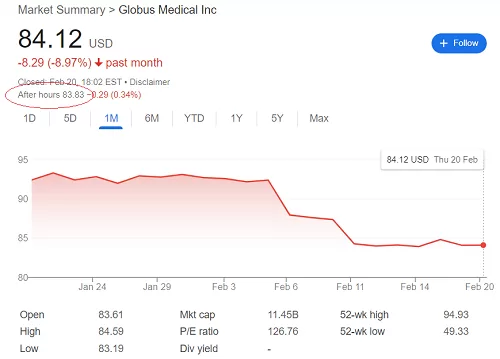

Globus Medical’s results published yesterday were excellent, with a 6.6% increase in fourth-quarter sales for 2024 and an impressive 60.6% annual growth in sales. However, despite these solid numbers, the company’s stock did not experience the expected rise and dropped slightly.

Full Year 2024:

- Worldwide net sales were $2,519.4 million, an increase of 60.6% on an as-reported basis and an increase of 61.1% on a constant currency basis.

- GAAP net income for the year was $103.0 million

- GAAP diluted EPS was $0.75 and non-GAAP diluted EPS was $3.04

- Non-GAAP adjusted EBITDA was $735.0 million, or 29.2% of net sales.

So What Happened Yesterday?

While these numbers are undeniably strong, the market response was not in line with expectations. The stock opened at $83.61, and closed at $84.12, but fell to $83.83 in after-hours trading following the publication of these figures.

What’s Behind This Market Reaction?

One possible explanation is that investors had already anticipated these positive results, incorporating them into the stock price beforehand. Sometimes, when a company releases good results that were already expected, the stock price doesn’t rise significantly because investors have already adjusted their expectations based on those numbers.

Additionally, the recent $250 million acquisition of Nevro Corp. may be causing caution in the market. While the acquisition could be a long-term strategy, the integration of the company and the associated costs could create short-term uncertainty. This, along with potential financial risks from the purchase, could be affecting investor sentiment and, in turn, the stock price.

Outlook for the Coming Months

Despite these short-term setbacks, Globus Medical’s strong financial results and its expansion through the acquisition of Nevro present a positive outlook for the future. If the company can overcome the challenges related to Nevro’s integration and continue reporting good numbers, the stock may see significant growth in the coming months.

Thoughts

As we have said before, we trust in the leadership of David Paul, Dan Scavilla, and their entire team. Globus has focus, talent, and determination to succeed and win. While we are not in the business of stock trading or advising on this matter, we will simply say that we are holding onto our Globus shares because we believe they will soon bring us great rewards. As some might say: HOLD or HODL (“Hold On for Dear Life”)!

###