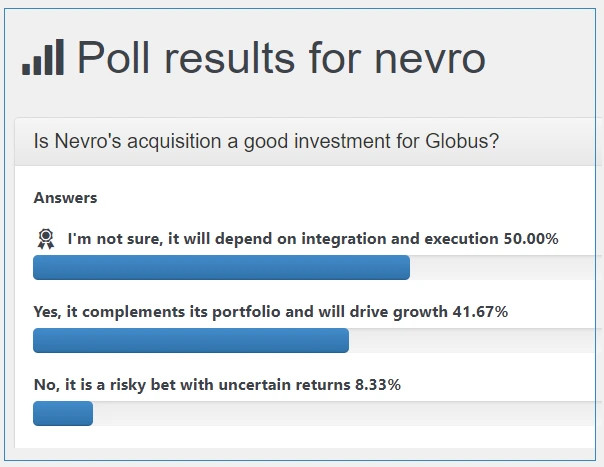

Last week, after the announcement of Globus’s acquisition of Nevro, we wanted to learn the opinion of our visitors about this move. To do so, we published a poll with the following question: Is Nevro’s acquisition a good investment for Globus? and the following answers:

a) I’m not sure, it will depend on integration and execution

b) Yes, it complements its portfolio and will drive growth

c) No, it is a risky bet with uncertain returns.

The Results:

The acquisition of Nevro by Globus has generated divided opinions. While 41.67% of voters see it as a smart and strategic move, half remain cautious, emphasizing that the real test will be how well the two companies can merge their operations and cultures, and 8.33% see it as a risky move.

As highlighted in the article “What Are the Strategic Reasons Behind Globus Medical’s Acquisition of Nevro Corp.?”, there are plenty of strategic reasons to support this deal. Personally, I find it hard not to be impressed by the leadership of Globus’s founder and the management team. Their track record gives me confidence that this acquisition is a step in the right direction.

Let’s break it down:

First off, the deal was structured as a stock exchange rather than a cash transaction. This is a smart move because it allows Globus to preserve its strong financial position, keeping the company debt-free and financially flexible.

Second, the price seems reasonable. Under the terms of the agreement—unanimously approved by both boards—Globus will pay 5.85 per share for Nevro,valuing the deal at around 250 million. That’s not a small sum, but given Nevro’s potential, it feels like a fair price.

Third, and perhaps most exciting, is what Nevro brings to the table. Beyond its innovative technology, Nevro’s leadership team seems deeply committed to expanding globally and advancing chronic pain management. In a recent statement, Kevin Thornal, Nevro’s CEO, shared his enthusiasm: “Joining forces with Globus Medical is a game-changer for us. It means we can reach more patients worldwide with our proven solutions for chronic pain. With Globus’s resources and global reach, we’re poised to become a true leader in pain management.” This alignment of vision between the two companies seems like a promising sign for a smooth integration..Finally, the combination of Nevro’s cutting-edge tech and Globus’s robust infrastructure and resources creates a synergy that could revolutionize chronic pain treatment.

Final Thoughts

While I understand the skepticism from some voters—integration is always a challenge—I’m optimistic. Globus has already proven it can handle complex acquisitions, like its integration of Nuvasive. With that experience under its belt, bringing Nevro into the fold feels like a manageable next step.

###