Lyon and New York, September 4, 2020 – The MEDICREA® Group (Euronext Growth Paris: FR0004178572– ALMED ; OTCQX Best Market –MRNTF), pioneering the transformation of spinal surgery through Artificial Intelligence, predictive modeling and patient specific implants with its UNiD™ ASI (Adaptive Spine Intelligence) proprietary software platform, services and technologies, reports its unaudited results for the first half of 2020, as approved by the Board of Directors on August 28, 2020.

(1) : Earnings before interest depreciation and amortization

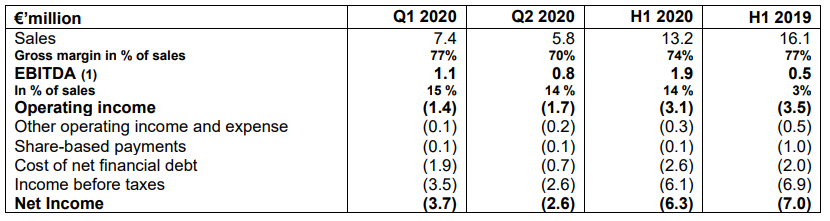

Sales for the first half of 2020 amounted to 13.2 million euros, down 18% compared to the first half of 2019 due to the COVID-19 pandemic. Despite a sharp decline in sales in April and May related to the temporary suspension of spinal surgery in most hospitals and clinics, sales have since recovered, increasing by +3% in June and +5% in July compared to 2019. In the United States, the number of UNiD® personalized surgeries also rebounded sharply with two consecutive record months of 144 surgeries in June and 165 in July, up 33% and 40% respectively compared to the same periods in 2019.

Gross margin rate was 74% for the first half of the year, down 3 points compared with the same period last year, as a consequence of the rate dropping to 70% in the second quarter. This decrease is explained by the shutdown of manufacturing and employees placed under partial unemployment for 2 months. The strengthening of the business since June should have a positive impact on Q3 2020 gross margin which should move back to the normative rate of 80%.

Operating expenses decreased by 3.1 million euros at constant exchange rates compared to the first half of 2019. The partial unemployment schemes implemented in France and Belgium and the temporary suspension of employment contracts in the United States (furlough mechanism) led to a decrease in wages and salaries costs in the second quarter. Travel restrictions and cancellation of industry congresses also contributed to the reduction of costs and fully offset the drop in gross margin in value, thus limiting the operating loss.

Operating income before interest, depreciation and amortization (EBITDA) is positive at 1.9 million euros, a 4x increase compared to the same period in 2019.

Taking into account these elements, operating loss before non-recurring charges was -3.1 million euros for the first half of 2020, an improvement of 0.4 million euros compared to the first half of 2019.

The cost of net financial debt increased by 0.6 million euros due to the implementation in September 2019 of a new stake for $6 million of an initial $30 million bond issued in November 2018.

As of August 31, 2020, cash on hand stood at 16 million euros, compared to 13.2 million euros as of June 30, 2020. This reinforcement is mainly linked to the exercise of warrants issued during past capital increases.

Outlook

« We announced in a press release dated July 15th the proposed friendly public offer from MEDTRONIC on MEDICREA® shares. This merger aims to use MEDICREA®’s capabilities and solutions in terms of data analysis and personalized implants and allow MEDTRONIC to become the 1st company in the world to offer a fully integrated solution including artificial intelligence driven surgical planning, personalized spinal implants and robotic assisted surgical delivery, which will significantly benefit customers and patients. The steps to bring this merger to a successful conclusion are in progress. We are confident and are doing everything possible to ensure that the operation is carried out within the announced deadlines » commented Denys Sournac, Founder, President and CEO of MEDICREA®.

Next publication: 2020 Third-Quarter sales: October 8, 2020 after market

About MEDICREA® (www.medicrea.com)

Through the lens of predictive medicine, MEDICREA® leverages its proprietary software analysis tools with big data and machine learning technologies supported by an expansive collection of clinical and scientific data. The Company is well-placed to streamline the efficiency of spinal care, reduce procedural complications and limit time spent in the operating room.

Operating in a $10 billion marketplace, MEDICREA® is a Small and Medium sized Enterprise (SME) with 175 employees worldwide, which includes 35 who are based in the U.S. The Company has an ultra-modern manufacturing facility in Lyon, France housing the development and production of 3D-printed titanium patient-specific implants.

For further information, please visit: medicrea.com.