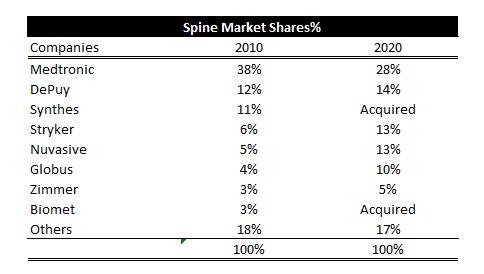

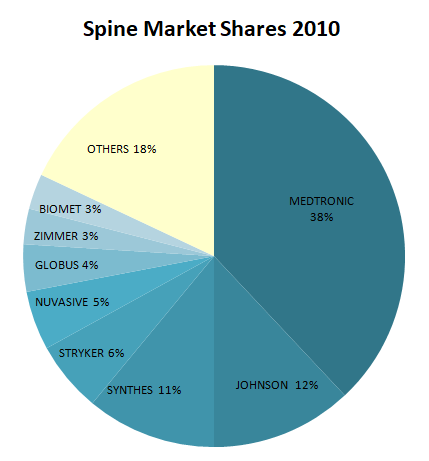

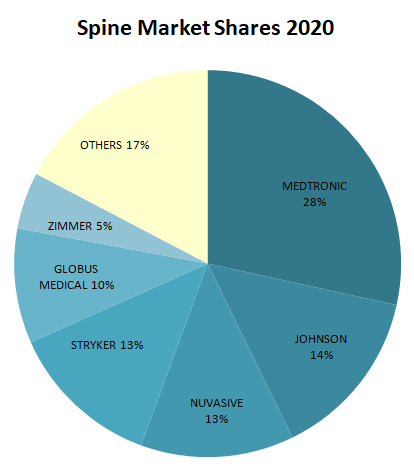

A few days ago we published an article about the market shares of the spine in 2020. Today, we received a comment suggesting us (Thanks to Jon Wait from Aurora Spine!) to compare them with the situation of 10 years ago. Fortunately, we have that information, and we have done it. The results are the following:

Medtronic: It continues leading the market, but it has lost 10 share points (from 38% to 28%). In these years it has acquired several companies gaining technology with Mazor Robotics, adding new products to its portfolio (Titan spine, Vertera Spine, Osteotech) and increasing its position in China (Kanghui) or in France (Medicrea).

Johnson&Johnson: In these 10 years it has increased its market share by two points (from 12% to 14%), maintaining the second position. It seems to be a good result, but it is not considering that it acquired Synthes with an 11% share. Today it should be about 23%. Recently it also acquired EIT technology to add new products to its portfolio.

Stryker: In these years, it has grown seven points of market share to reach 13% like Nuvasive and just one point behind Johnson. The acquisition of K2M has been fundamental in this growth. It also acquired in 2013 the Chinese manufacturer Trauson Holdings Company as an opportunity to drive growth in China and other emerging markets.

Nuvasive: They have done a magnificent job in these years, gaining eight share points and going from being the fifth to third in the market together with Stryker.

Globus Medical: Although it has the same competitors ahead of it as before, it has grown six quota points and only organically. Magnificent work from Globus. Additionally, in these years it has also positioned itself as the market leader for robots with Excelsus GPS ahead of Medtronic.

Zimmer Biomet:

Despite acquiring several companies, including Biomet, it is still stuck in the same position and with an inorganic growth of two points, losing one on the way. It is not strange why Zimmer Biomet has made a spin-off of its spine business

Others: This share has decreased by 1% (from 18% to 17%). It is made up of the rest of the competitors, among which the growths of Alphatec Spine and Seaspine stand out.