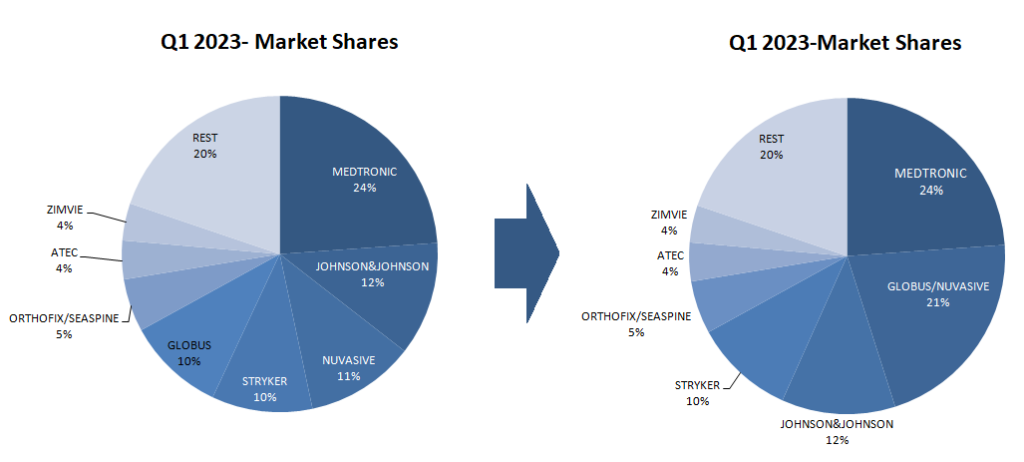

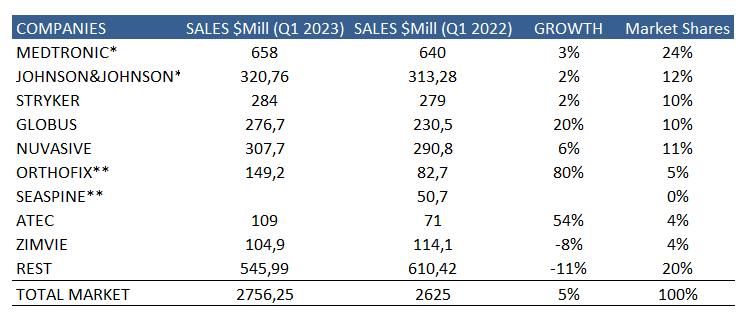

The acquisition of Nuvasive by Globus Medical last February, has undoubtedly been the big news in the first quarter of 2023. This action will change market shares and leadership positions. Another fact to consider is the consequence of the merger of Orthofix with Seaspine, which places them among the top 5 in the world spine market. As we see in chart 1, according to the results of Q1, Medtronic is the market leader with 24%, Nuvasive is number 3 (11%), and Globus is number 5 (10%). With the acquisition of Nuvasive, Globus jumps to number 2 (21% of the market share) and gets very close to the leadership.

What have been the results Q1 2O23?

The first quarter of 2023 has been generally good for leading spine companies. All of them (except Zimvie) have grown compared to 2022. It is noteworthy that Medtronic, Johnson&Johnson, and Stryker have increased sales but are below what the market is doing. We can highlight the growth of ATEC (54%) and Globus Medical (20%) unstoppable. Nuvasive also continues to rise with 6% growth.

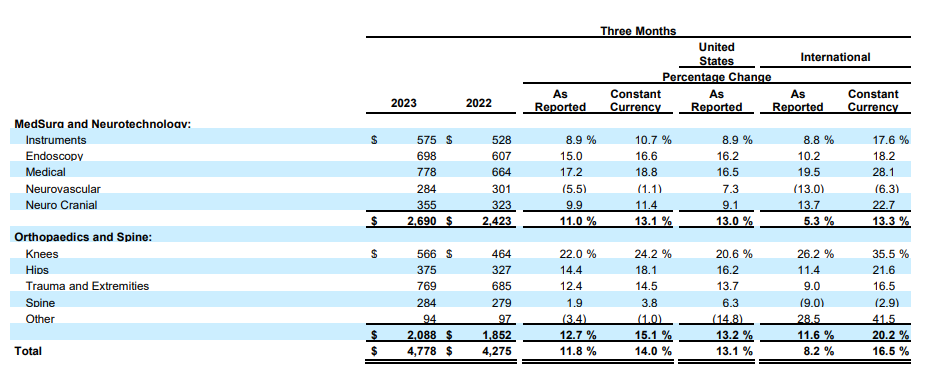

MEDTRONIC

- As we have commented many times, since 2021, it is very difficult to obtain the spine figures since they appear included together with Cranial. In any case, we have made our estimate and we see a growth of between 3% and 5% in spine. Its market share is around 24%.Spine growth globally and in the U.S. on continued adoption of the Aible™ spine technology ecosystem.

NUVASIVE

- NuVasive reported first quarter 2023 total net sales of $307.7 million, a 5.8% increase as reported and a 7.7% increase on a constant currency basis, compared to $290.8 million in the prior year period. First quarter 2023 total net sales were primarily driven by further adoption of new products and higher procedural volumes in the U.S.

- Chris Barry, chief executive officer of NuVasive Comments: “Our solid performance—led by anterior and cervical procedural solutions—reflects the strength of our core spine business, positioning us well to combine with Globus Medical to deliver compelling long-term value creation for shareholders. We remain focused on operating our business and delivering on our commitments, while preparing for the merger to build a leading musculoskeletal technology company.”

GLOBUS MEDICAL

- Worldwide net sales for the first quarter of 2023 were $276.7 million, an as-reported increase of 20.0% over the first quarter of 2022, and an increase of 21.0% on a constant currency basis. U.S. net sales for the first quarter of 2023 increased by 19.2% compared to the first quarter of 2022. International net sales increased by 24.7% over the first quarter of 2022 on an as-reported basis, and an increase of 31.5% on a constant currency basis.

- Dan Scavilla, President and CEO comments: “Spine business grew an impressive 14%, with notable gains across our product portfolio in expandables, biologics, MIS screws, and 3D printed implants. International Spine sales increased 21% on an as-reported basis, and 28% on a constant currency basis as we continue to increase our brand recognition on the global healthcare stage. Enabling Technologies grew 91% to $25 million, driven by continued robotic system demand and new interest in our Excelsius3D™ imaging system.”

- “We are also excited about our pending merger with NuVasive,” said Mr. Scavilla. “Shareholders of both companies provided overwhelming support for this combination of leading innovators in spine care. Globus Medical remains well positioned to continue providing innovative procedural solutions to help patients with musculoskeletal disorders.”

STRYKER

With first-quarter sales of $284 million, Stryker has grown by 1.9% in Spine compared to Q1 2022. Despite the K2M acquisition in 2018, Stryker remains fourth in the world market with an estimation of 10%.

ZIMVIE

- Third party spine sales of $104.9 million decreased by ($9.2) million, or (8.1%).

- Vafa Jamali, President and Chief Executive Officer of ZimVie comments:“I am pleased with the progress our team is making to evolve our product portfolio and shift our focus from operational enhancements to innovation and commercial execution.We have introduced several new dental product launches year-to-date, opened our expanded, state-of-the-art, North America training institute at our flagship Dental facility in Palm Beach Gardens, Florida, and have had a number of commercial wins in spine. Concurrently, we have taken definitive actions to continue reducing operating expenses to improve our operating profile. I am optimistic about the future of ZimVie.”

Recent Business Highlights

- Initiated a global restructuring program with the objective of reducing our global cost structure and streamlining our organizational infrastructure across all regions, functions, and levels

- Launched RegenerOss® CC Allograft Particulate and RegenerOss® Bone Graft Plug, expanding the Bone Graft Solutions portfolio

- Opened an expanded Education and Training Institute at our flagship Palm Beach Gardens Dental Facility

- Launched RealGUIDE™ CAD and FULL SUITE software modules enhancing our digital dentistry platform

- Received recognition for Puros® Cancellous Particulate Allograft Dental Bone Grafting Solution in landmark comparative study in The International Journal of Oral & Maxillofacial Implants

- Received the highest quality rating from the Orthopaedic Data Evaluation Panel in the United Kingdom for Mobi-C®

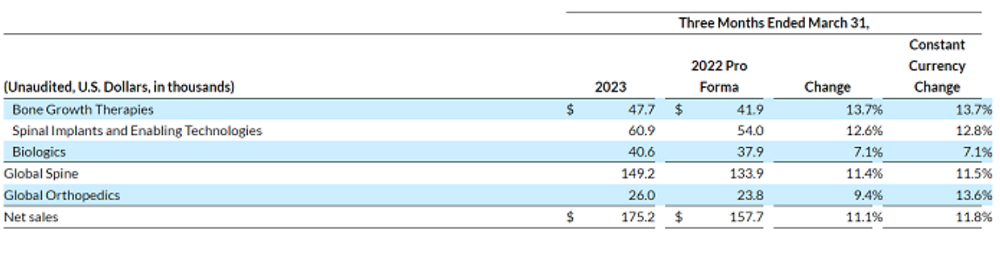

ORTHOFIX/SEASPINE

- On January 5, 2023, the Orthofix and Seaspine merger officially became effective. So, the Q1 2023 Orthofix results include the Seaspine sales.

- Net sales in Spine were $175.2 million with a 11,4% growth.

Keith Valentine, President and Chief Executive Officer of Orthofix comments: “Orthofix delivered an exceptionally strong quarter with 12% year-over-year growth on a proforma basis and by minimizing any disruption associated with the business combination in January. We are encouraged by the meaningful pro forma growth we’ve seen across all channels in the combined company and remain enthusiastic about the opportunities afforded by our complementary portfolios. Our team was successful in leveraging cross-selling strategies throughout the quarter and we believe these initiatives will promote meaningful market share gains in the future.”

ATEC

- Total revenue grew 54% to $109 million, including surgical revenue growth of 55%

- Pat Miles, Chairman and Chief Executive Officer comments: “We continue to execute against our mission to revolutionize the approach to spine surgery. As many in our industry capitulate, or seek to drive growth through acquired revenues, ATEC is content to be the outlier: methodically applying our 100% spine focus and unmatched know-how to integrate and evolve technologies that improve the predictability and reproducibility of spine care. ATEC’s innovation is not only driving rapid adoption today, it will also set new clinical standards for years to come.”

- Recent Business Highlights:

- Extended momentum of PTPTM (Prone TransPsoas) procedure, the strongest contributor to Q1 revenue growth;

- Advanced lateral sophistication with full commercial release of LTPTM (Lateral TransPsoas) procedure;

- Introduced ATEC AIS (Adolescent Idiopathic Scoliosis) Approach, with adaptable InVictusTM instrumentation designed to streamline and optimize de-rotation;

- Drove 40% increase in surgical volume and 11% increase in average revenue per procedure;

- Acquired navigation-enabled robotics platform to enhance precision of ATEC’s procedural strategy.

####

IMPORTANT NOTE:

- The data in this article are obtained directly from the results published by the companies. If there is any transcription error, we would appreciate that information to make the due corrections.

- In the cases of Medtronic and Johnson&Johnson, it is an estimate made by us since these two companies do not publish the Spine data independently but together with those of other business units. Our estimation could be inaccurate. Please, contact us if you want us to replace the figures with the official data.