COVID 2019 has caused this year to be quite complicated for the spine market. According to Reportlinker.com, the global spine implants market is expected to decline from $12.44 billion in 2019 to $11.83 billion in 2020 at a compound annual growth rate (CAGR) of -4.92%.

The decline is mainly due to the COVID-19 outbreak that has led to restrictive containment measures involving social distancing, remote working, and the closure of industries and other commercial activities. The outbreak decreased the demand for spine implants as the treatments for spinal problems were on hold to serve the COVID patients, impacting the market negatively. The market is then expected to recover and reach $13.81 billion in 2023 at a CAGR of 5.31%.

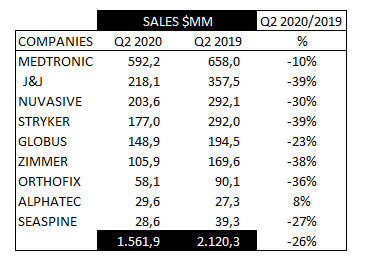

In Q1, the average decline of the main spine companies (Medtronic already included) was -14%, but in Q2 it was –26%. (CHART 1)

The results of the first six months have been generally quite bad for most of the companies. The nine companies considered (see chart 2) have decrease an average of 20%. Globus Medical performed very well compared to the rest of the competitors with a decrease in the semester of only 10%. This result was due to an important double-digit growth in June as well as the increase in interest in robotic technology. We must also mention Alphatec Spine that although starting from lower figures than its competitors, but has managed to increase its sales by 15%

1.- STRYKER

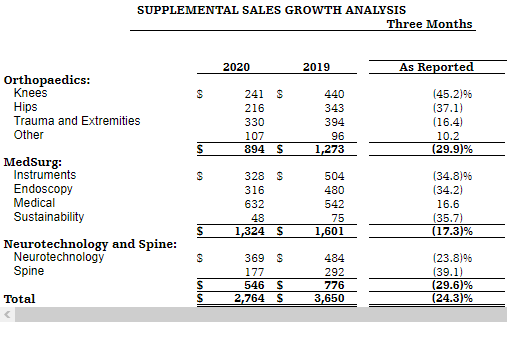

Consolidated net sales were significantly negatively impacted by the global response to the COVID-19 pandemic, resulting in lower unit volume across all segments.

Consolidated net sales of $2.8 billion decreased 24.3% in the quarter and 23.5% in constant currency. Organic net sales decreased 24.0% in the quarter including 23.8% from decreased unit volume and 0.2% from lower prices.

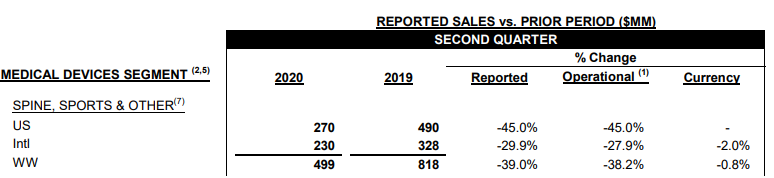

Neurotechnology and Spine net sales of $0.5 billion decreased 29.6% in the quarter and 28.9% in constant currency. Organic net sales decreased 29.9% in the quarter including 30.4% from decreased unit volume partially offset by 0.5% from higher prices. Spine sales decreased in Q2, -39,1%.

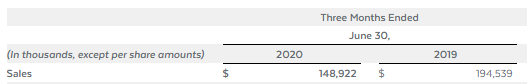

2.-GLOBUS MEDICAL

Worldwide sales for the second quarter were $148.9 million, a decrease of 23.4% over the second quarter of 2019 on an as-reported basis and 23.3% on a constant currency basis. Second quarter sales in the U.S., including robotics, decreased by 21.8% compared to the second quarter of 2019. International sales decreased by 31.2% over the second quarter of 2019 on an as-reported basis and 30.5% on a constant currency basis.

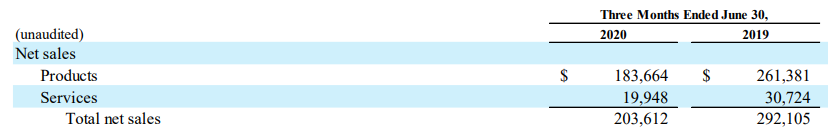

3.- NUVASIVE

NuVasive reported second quarter 2020 total net sales of $203.6 million, a -30.3% decrease compared to $292.1 million for the second quarter 2019. On a constant currency basis, second quarter 2020 total net sales decreased -30.2% compared to the same period last year.

4.-JOHNSON&JOHNSON

Spine, Sports&Other worldwide operational sales, declined 39% driven by the estimated net negative impact of the COVID-19 pandemic and the associated deferral of medical procedures. Our Spine estimates for Q2 2020 is 218,1$MM.

5.-SEASPINE

Revenue for the second quarter of 2020 was $28.6 million, a decrease of 27% compared to the same period of the prior year. U.S. Spinal Implants revenue was $13.2 million, a 22% decrease compared to the same period of the prior year. U.S. Orthobiologics revenue was $12.7 million, a 30% decrease compared to the same period of the prior year. Both decreases were driven by low single-digit unit price declines and a significant decline in procedure volumes, particularly in April and May, due to the COVID-19 pandemic.

6.-ORTHOFIX

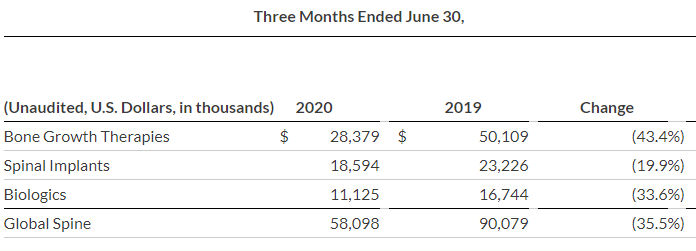

Orthofix Medical Inc. Global Spine sales were $58 million decreased 35,5% in the quarter.

7.-ZIMMER BIOMET

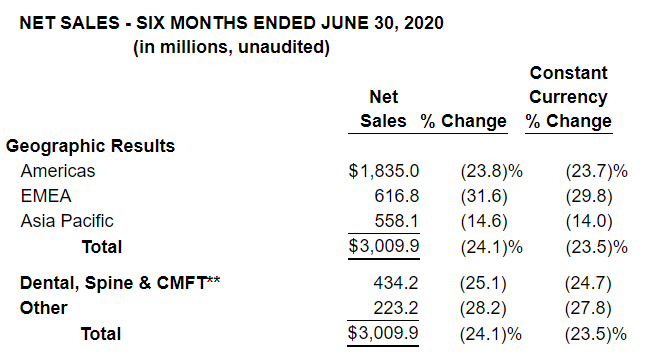

Zimmer Biomet reported second quarter net sales of Dental, Spine and CMFT $434,2 Million, a decrease of 25%. We have estimated the Spine Sales considering that represents 58% of the Dental, Spine and CMF Business.

Second quarter performance was negatively impacted by COVID-19, which reached a pandemic level in March and has resulted in a global decline in elective procedure volumes. The deepest decline in those procedures to-date was seen by the Company in April 2020, with incremental improvement in May and June.

8.-ALPHATEC SPINE

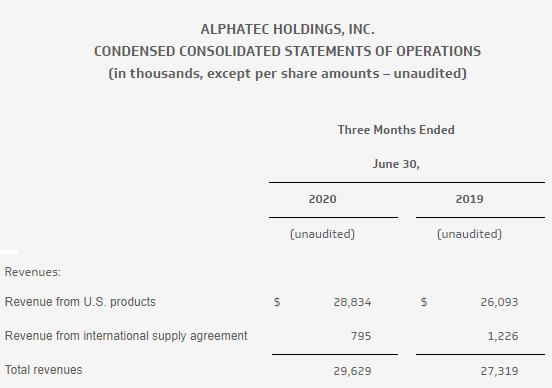

Total revenue for the second quarter 2020 was $29.6 million, up 11% compared to the second quarter 2019. Revenue growth generated by new products and the strategic distribution channel continues to outpace the ongoing revenue impacts of transitioning or discontinuing non-strategic distributor relationships.

9.- MEDTRONIC

Cranial and Spinal Technologies first quarter revenue of $944 million decreased 10 percent as reported and mid-teens organic, including mid-teens declines in Spine and high-teens declines in Enabling Technology. Core Spine declined in the low-double digits globally, including high-single digit declines in the U.S. Sales of bone morphogenetic protein (BMP) declined in the low-twenties. In Q2 2019 (Medtronic´s Q1 2020-May-July), they performed $658 million. With the decline of 10%, the Core Spine results in Q2 2020 (Medtronic´s Q1 2021-May-July) have been $592 million.