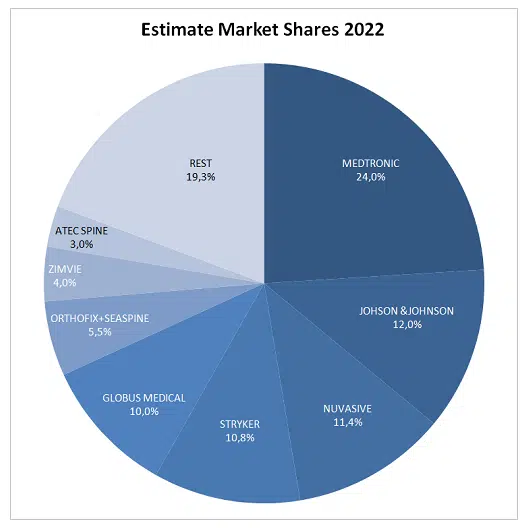

The spinal surgery device market is undergoing an unprecedented transformation. In recent years, several leading companies have executed strategic moves that have reshaped the competitive landscape. Globus Medical acquired NuVasive, consolidating its presence in minimally invasive spine solutions; Stryker decided to sell its Spine division to Viscogliosi Brothers, while Zimmer Biomet (now Zimvie) also transferred its spine unit to H.I.G. Capital (Highridge Medical). In less than two years, four of the top five market players have undergone significant structural changes—a phenomenon reflecting both industry consolidation and the pursuit of specialization and technological differentiation. One only needs to look at how the spine market was in 2022 (Chart).

These moves not only alter market shares but also redefine each player’s innovation, investment, and expansion strategies, creating opportunities for new companies focused on advanced technologies and integrated surgical solutions to emerge as relevant competitors. In this context, Highridge Medical stands out as a strategic player, pursuing selective acquisitions that expand its portfolio and strengthen its presence in a highly competitive and constantly evolving market.

What is Highridge’s Portfolio Today?

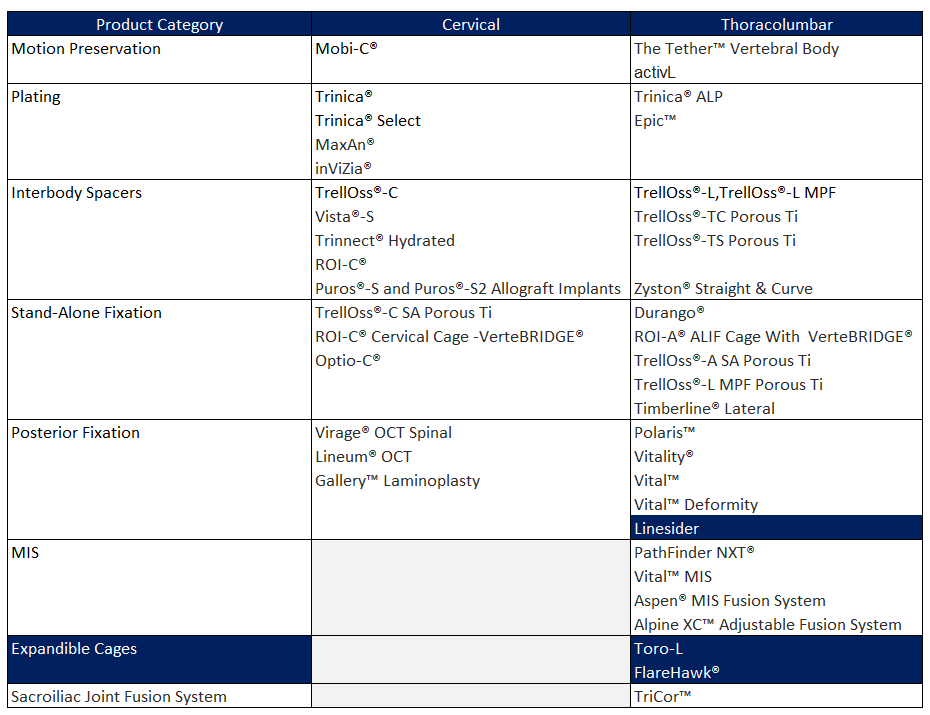

Highridge Medical has consolidated itself as an emerging and solid competitor with a broad and highly specialized portfolio, built upon the integration of technologies and products inherited from four companies with strong legacies in the spine industry: Biomet renowned for their long-standing expertise in fixation systems, surgical instrumentation, and spinal solutions; Lanx for minimally invasive implants; and LDR, a pioneer in cervical disc arthroplasty and motion-preserving technologies. This combined heritage has enabled Highridge to develop a comprehensive offering that spans from the cervical to the thoracolumbar spine, covering minimally invasive surgery (MIS), motion-preserving devices, and advanced biologics.

Today, Highridge’s portfolio is both extensive and diverse, but several standout products illustrate its focus on innovation and clinical outcomes:

- Mobi-C® and ROI-C®: Cervical artificial discs designed to preserve natural mobility, a direct legacy from LDR and global references in motion preservation.

- TrellOss®-L and TrellOss®-C: Porous interbody cages engineered to promote osteointegration, combining Zimmer Biomet’s expertise in biomaterials with advanced anatomical design.

- Vital™ and Vitality®: Spinal fixation systems originating from Lanx, designed to address both complex deformities and MIS procedures.

- TrellOss®-L MPF: A lateral fusion system with porous titanium, meeting the growing demand for less invasive surgical approaches.

- Alpine XC™: An adjustable fusion system that provides surgeons with enhanced flexibility to adapt to patient-specific anatomy.

- PrimaGen Advanced™: A next-generation biologic solution to support bone consolidation and fusion.

While these products represent the most emblematic and clinically impactful solutions, Highridge’s portfolio goes far beyond this list, including multiple fixation systems, complementary instrumentation, and MIS solutions inherited from Biomet, Zimmer, and Lanx. This breadth, combined with continuous innovation, positions Highridge as a comprehensive provider capable of addressing virtually every surgical need in spine care and as a differentiated competitor against established leaders in the industry.

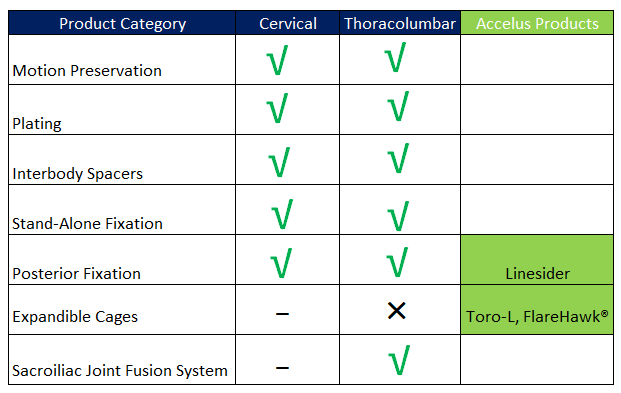

Complementing the Portfolio: What Did Highridge Acquire from Accelus?

The recent acquisition of FlareHawk®, Toro™, and LineSider® systems from Accelus complements Highridge’s existing portfolio by covering key areas that strengthen its value proposition:

- FlareHawk®: Expandable interbody fusion system with minimal insertion profile and controlled multiplanar expansion. This system complements the TrellOss® interbody cages, offering an expandable alternative that better fits patient anatomy and enhances initial stability, broadening the range of solutions for MIS and lateral fusion procedures.

- Toro™: Multidirectional expandable cage with advanced instrumentation for greater versatility. Integrated into the existing portfolio, Toro™ allows surgeons to perform complex procedures with enhanced control and adaptability, reinforcing Highridge’s ability to provide personalized interbody fusion solutions.

- LineSider®: Modular pedicle screw system ensuring precision and efficiency in implant placement. This system complements the Vital™ and Vitality™ fixation systems, improving implant stability and intraoperative efficiency, especially in MIS and complex deformity procedures.

- A key differentiator in its portfolio is the incorporation of Adaptive Geometry®, a technology that allows implants to dynamically adapt to a patient’s anatomy and specific surgical needs. This design optimizes load distribution and implant stability, reducing bone stress and enhancing osteointegration. Additionally, Adaptive Geometry® enables precise intraoperative adjustments, increasing procedural versatility and improving clinical outcomes, particularly in minimally invasive surgery and interbody fusion. Thanks to this technology, Highridge offers personalized solutions that combine innovation, safety, and surgical efficiency.

Together, these systems not only expand Highridge’s surgical options but also strengthen its comprehensive offering, providing surgeons with more versatile and complete solutions for all types of spinal procedures.

Why Did Highridge Make This Move?

Highridge Medical combines organic development with strategic acquisitions to consolidate its position in the spinal surgery market. Backed by H.I.G. Capital, the company is well-positioned—at least in terms of product portfolio—to compete with giants such as Medtronic, Johnson & Johnson (DePuy Synthes), Globus Medical, and Viscogliosi Brothers, offering differentiated products aligned with current trends: motion preservation, minimally invasive surgery, and advanced biologics.

With this move, Highridge strategically strengthens its portfolio in expandable interbody cages, addressing a key segment of the rapidly growing minimally invasive spine market. Products like FlareHawk® and Toro™ offer surgeons versatile, patient-specific solutions that enhance stability, optimize anatomical fit, and simplify procedures. By integrating these technologies, Highridge not only broadens its offering but also positions itself as a leader in high-growth, innovation-driven spine surgery trends, including the expanding field of endoscopic spinal procedures.

Why Did Accelus Make This Move?

For Accelus, divesting FlareHawk®, Toro™, and LineSider® aligns with a strategy to streamline its portfolio and focus resources on its core areas of growth—particularly innovative expandable implant technologies and enabling platforms for minimally invasive procedures. By transferring these systems to Highridge, Accelus can sharpen its innovation pipeline, reduce overlap, and concentrate investment in solutions where it seeks to build clear competitive differentiation. At the same time, the move ensures that these products remain in the hands of a company committed to advancing them, while Accelus accelerates its own strategic priorities.

####