Our confidence in Globus Medical, in David Paul, Keith Pfeil, and the entire management team remains absolute. It is true that some months ago we were concerned to see the share price fall after the acquisition of Nevro, a transaction that raised short-term doubts for many investors.

However, as experienced investors know, what truly matters is that companies have strong long-term projects and leadership teams capable of executing them. This philosophy fits perfectly with Globus’s current position.

The company’s third-quarter 2025 results confirm this strength: a solid business, expanding margins, and a management team that continues to demonstrate strategic vision and consistent execution.

Yesterday, we were eager to see Globus’s results and how the market would react. The stock closed the regular session at $61.71, nearly unchanged from previous days. But in after-hours trading, following the release of results, shares jumped 24.37% to $76.75, driven by outstanding operational performance and an upward revision of full-year guidance.

These results consolidate Globus as one of the global leaders in spine, orthopedics, and neurosurgical technology.

Results well above expectations

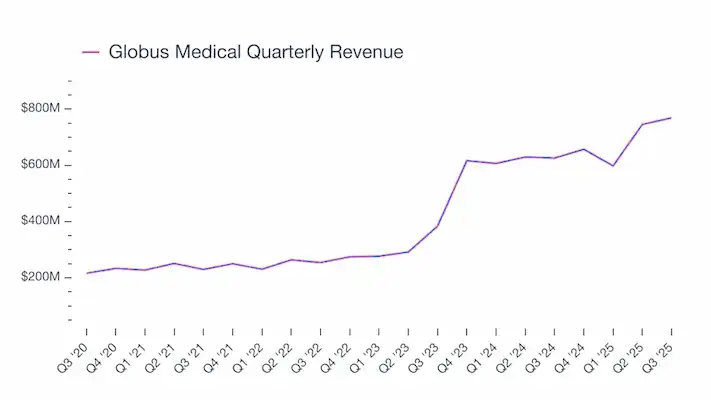

Globus Medical delivered results well above market forecasts, posting revenue of $769 million, up 22.9% year-on-year and 4.7% above analyst estimates of $734.8 million. Adjusted earnings per share (EPS) reached $1.18, exceeding the consensus by 53.4%, while adjusted EBITDA rose to $252.6 million, with a 32.8% margin.The operating margin expanded significantly to 17.9%, compared with 7.7% in the same quarter last year, showing a major improvement in both efficiency and profitability. Free cash flow margin also increased to 27.8%.

Following these results, Globus President and CEO Keith Pfeil commented: “We are pleased with the strength of our results and the continued progress across the company.”And indeed, the numbers justify his optimism.

The impact of Nevro and organic growth

Looking deeper into the figures, a significant portion of growth came from the integration of Nevro, which added incremental volume in the neuromodulation segment.

However, even excluding this acquisition, organic growth remains strong, reflecting the continued success of the company’s core spine business and the positive reception of its navigation and robotic surgery technologies.

This is important, as it shows that Globus’s growth does not rely solely on acquisitions, but rather on its continuous innovation and increasing commercial strength in key markets.

The integration of NuVasive also stands out as one of the fastest and most effective in the sector.

What to expect for late 2025 and 2026

Following these results, the company raised its full-year guidance. Globus now expects $2.88 billion in revenue (up from $2.85 billion previously) and an adjusted EPS of $3.80, representing a 20.6% increase compared to its prior estimate.

This upward revision reinforces market confidence in Globus’s ability to sustain its growth pace. Over the past five years, sales have grown at a compound annual rate of 29.3%, and in the last two years, the growth rate has accelerated to 50.3% annually, reflecting strong demand for the company’s advanced medical technologies.

Looking ahead, analysts expect revenue to grow about 10% over the next 12 months. While this implies some moderation compared to previous years, it still positions Globus well above the industry average.

Is Globus catching up to Medtronic?

The main question now in the spine market is whether Globus Medical is about to catch up — or has already caught up — to Medtronic (NYSE: MDT).

In recent quarters, Medtronic has become more aggressive, especially in the United States, strengthening its commercial network and actively defending its leadership position in spine.

However, Globus is closing the gap quickly, thanks to its strategic focus, strong execution, and continued innovation.In fact, some market indicators suggest that Globus may already have reached Medtronic in certain product segments, something that would have seemed unlikely only a few years ago.

We continue to closely monitor this direct competition between the two industry leaders and expect to update our market share estimates next week, incorporating the impact of this strong Q3 and the evolving competitive dynamics reshaping the sector.

Conclusion

Globus Medical delivered an exceptional quarter, with broad improvements in sales, margins, and outlook.The integration of Nevro added further momentum, but organic growth remains robust, confirming the company’s healthy fundamentals.

Globus’s ability to combine organic expansion, operational efficiency, and strategic acquisitions places it in a strong position within the medical technology sector.

The 24% surge in its share price following the results reflects market confidence that the positive momentum will continue in the coming quarters.

###