This week, we’ve reported several developments related to cervical disc prostheses. Yesterday, we covered the launch and presentation of a new cervical disc prosthesis by a French company at the EuroSpine congress. We also reported on a new distribution agreement for disc prostheses in Australia. In addition, Centinel Spine® received two-level FDA approval for its prodisc® C Vivo and prodisc® C SK Match-the-Disc™ cervical total disc replacement devices — a significant milestone in the U.S. market.At the same time, we’re seeing continued progress and expansion of other devices in Europe, such as the MOVE-C, which keeps securing new agreements across different countries and increasing its market penetration.

As we mentioned a few months ago, this market continues to show a clear growth trend. For this reason, we’ve updated our previous article, which provides an overview of the cervical disc prosthesis market and its main competitors. For those interested, you can also check out our article on the prostheses that have disappeared over the years.

THE MARKET

The global cervical disc prosthesis market is growing steadily, driven by an aging population, rising diagnoses of degenerative cervical conditions, and increasing demand for motion-preserving alternatives to fusion surgery. In 2024, it generated about $2.48 billion worldwide, becoming a preferred option for selected patients due to benefits like restored mobility, reduced pain, and lower adjacent segment degeneration.

By 2030, the market is projected to reach $4.5–$5 billion, with a CAGR of 7–9%, supported by demographic trends, advances in viscoelastic and 3D-printed designs, and demand for minimally invasive procedures.

However, the market’s trajectory will depend on evolving regulatory requirements, the availability of long-term clinical evidence, and the need to demonstrate cost-effectiveness within healthcare systems. Companies that successfully combine technological innovation, robust clinical data, and adaptable commercial strategies will be best positioned to lead in this competitive and evolving sector.

STUDIES

This growing trend is supported with the positive conclusions from several long terms studies as for example the following:

- Long-term Evaluation of Cervical Disc Arthroplasty with the Mobi-C© Cervical Disc: A Randomized, Prospective, Multicenter Clinical Trial with Seven-Year Follow-up: https://www.ijssurgery.com/content/ijss/11/4/31.full.pdf

- Ten-Year Outcomes of 1- & 2-Level Mobi-C Patients: https://highridgemedical.com/wp-content/uploads/HM0092-REV-A-GLBL-Mobi-C-10yr-Summary.pdf

- Long-Term Clinical Experience with Selectively Constrained SECURE-C Cervical Artificial Disc for 1-Level Cervical Disc Disease: Results from Seven-Year Follow-Up of a Prospective, Randomized, Controlled Investigational Device Exemption Clinical Trial.https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6159663/

- New study first presented at the annual meeting of the International Society for the Advancement of Spinal Surgery (3-5 April 2019, Anaheim, CA). Jack E. Zigler, MD (Texas Health Center for Diagnostics and Surgery, Texas Back Institute, Plano, TX) reported results that “strongly support” the safety of Centinel Spine’s prodisc® C Cervical Total Disc Replacement System. In the study of 504 consecutive patients, Zigler and colleagues found no secondary surgery requirements for device failure and a relatively low reoperation rate of 5.5%—including the learning curve for every participating surgeon. The study encompassed results, specifically reoperation rates, for all consecutive patients receiving a prodisc C over a fifteen-year timeframe at a single center. https://centinelspine.press/2019/05/02/study-strongly-supporting-the-safety-of-centinel-spines-prodisc-c-cervical-total-disc-replacement-system-presented-at-isass/

- The MOVE-C Cervical Artificial Disc – Design, Materials, Mechanical Safety

- Freedom® Cervical Disc: Clinical experience and two-year follow-up with a one-piece viscoelastic cervical total disc replacement

- Cervical disc arthroplasty: What we know in 2020 and a literature review

MARKET MILESTONES

Also, recently the cervical artificial disc market has been moving with several milestones in the last years:

- Dec. 22, 2017– Centinel Spine, LLC (CS) announced the acquisition of the worldwide assets of the prodisc® Total Disc Replacement portfolio from DePuy Synthes Products, Inc. The prodisc® portfolio included prodisc® C and prodisc® L in the United States and prodisc® VIVO, prodisc® NOVA, prodisc® C, prodisc® L, and prodisc® O, along with DISCOVER™ Cervical outside the United States.

- March.15,2018–Orthofix International N.V. (NASDAQ:OFIX), announced that it has entered into a definitive agreement to acquire Spinal Kinetics Inc., a privately held developer and manufacturer of artificial cervical and lumbar discs.

- Feb. 7, 2019– Orthofix Medical Inc. (NASDAQ:OFIX), a global medical device company focused on musculoskeletal products and therapies, announced U.S. Food and Drug Administration (FDA) approval of the M6-C™ artificial cervical disc for patients suffering from cervical disc degeneration. The M6-C artificial cervical disc was developed by Spinal Kinetics, a company acquired by Orthofix in April 2018.

- Feb. 24, 2021–Nuvasive acquired Simplify Medical, a privately held company and developer of the Simplify® Cervical Artificial Disc (Simplify Disc) for cervical total disc replacement (cTDR).

- May 2023: Orthofix launches the M6-C™ Cervical Disc in international markets.

- December 2023: Orthofix announces discontinuation of the M6-C™ Cervical Disc.

- January 2024: NuVasive reports positive clinical data from the post-market study of the Simplify® Cervical Artificial Disc.

- March 2024: Spineart secures FDA approval for the Baguera C® Cervical Disc.

KEY DRIVERS OF THE MARKET

Growing aging population driving the expansion of degenerative spinal diseases and disorders, with global prevalence of degenerative disc disease expected to increase significantly as the population aged 65+ is projected to double by 2050.

Advantages over traditional spinal fusion procedures: Spinal fusion remains the gold standard for treating degenerative disc disease, offering deformity correction and stabilization. However, complications such as adjacent segment disease, loss of mobility, and the need for revision surgery have increased interest in motion-preserving alternatives like artificial disc replacement (ADR). Used in both the cervical and lumbar spine, ADR employs advanced materials such as metal-on-polymer and ceramic-on-ceramic bearings to restore natural biomechanics. Cervical ADR currently dominates due to proven long-term clinical effectiveness and rising demand for two-level procedures, while lumbar ADR adoption remains limited by stricter patient selection and higher complication risks.

FDA approvals and improving reimbursement schemes: North America leads the global ADR market, driven by favorable reimbursement policies and new FDA approvals for two-level cervical systems. Rapid growth is also anticipated in South America as companies expand and patients seek modern treatments, though pricing pressures persist. In Asia-Pacific, the Middle East, and Africa, reliance on out-of-pocket payments limits access, while Europe faces cost constraints that slow adoption. Despite economic constraints in Europe and other regional challenges, global ADR markets are expected to achieve medium to high growth. This outlook is supported by strong clinical evidence from over 10 years of follow-up studies confirming the long-term safety and efficacy of ADR procedures, alongside technological innovations such as patient-specific implants, advanced surgical instrumentation, and AI-assisted planning. Increasing demand for motion-preserving and minimally invasive treatments—driven by benefits like preserved spinal motion, reduced reoperation rates, and faster recovery—is accelerating adoption among patients and physicians. While spinal fusion remains the dominant segment, ADR and other non-fusion technologies hold significant potential to become the new gold standard, particularly among younger, more active patients.

COMPETITION

The global cervical disc replacement market has historically been dominated by companies whose implants were approved by the FDA for use in the United States. Manufacturers without FDA clearance have typically had lower market penetration.

Among the leading players, Medtronic holds a significant share with its long-standing Prestige LP. The Mobi-C, currently under Highridge, was previously part of Zimmer, Biomet, and originally developed by LDR. The ProDisc line, with a long history dating back to Spine Solutions and later Synthes and DePuy-Synthes, is now marketed by Centinel Spine and also benefits from FDA approval. Globus Medical, despite not prioritizing this segment, has achieved strong market presence thanks to FDA clearance and robust distribution. NuVasive—now part of Globus—acquired the PCM disc in the early 2000s and more recently the Simplify disc, both backed by extensive clinical experience. Lastly, one of the top-selling, if not the best-selling, devices has been the M6 from Orthofix, which has just been discontinued—a decision that has taken many by surprise.

Therefore, having FDA approval and being able to sell in the U.S. remains a key factor for achieving significant global market share. Many other companies with highly innovative products have instead chosen to focus on markets such as Europe, leaving the U.S. and FDA approval outside their immediate strategic priorities.

Major Market Leaders:

- Mobi C (Highridge Medical) – FDA Approved (1-level & 2-level).First cervical disc approved for both 1 and 2-level indications (2013)

- Prestige LP (MEDTRONIC) – FDA Approved (1-level & 2-level). Market leader, widely covered by insurance

- SECURE C3/C/CR Series (GLOBUS MEDICAL) – FDA Approved (1-level)

- PCM Cervical Disc (NUVASIVE) – FDA Approved (1-level)

- Simplify Cervical Disc (NUVASIVE) – FDA Approved (1-level & 2-level).Recently approved for 2-level procedures (2021)

- PRODISC C Total Disc Replacement (CENTINEL SPINE) – FDA Approved (1-level).Original PRODISC technology

Featured:

- PRODISC C Total Disc Replacement: (Centinel Spine): FDA Approved (1-level).FDA approved July 2022

- PRODISC C Nova (Centinel Spine): FDA Approved (1-level).FDA approved July 2022

- PRODISC C Vivo (Centinel Spine): FDA Approved (1-level).FDA approved July 2022

- MOVE-C® (NG Medical): Not FDA Approved

- d-motion (NORMMED): Not FDA Approved

- d-active (NORMMED): Not FDA Approved

- d-flex Titanium (NORMMED): Not FDA Approved

Others:

- Activ C (BRAUN AESCULAP).Not FDA Approved

- Baguera C (SPINEART).Not FDA Approved

- C DISC (COUSIN SURGERY).Not FDA Approved.

- DYNALIS-C® (NEUROFRANCE).Not FDA Approved.

- ESP Cervical Disc (Spineway).Not FDA Approved

- Freedom® (AXIOMED). Not FDA Approved

- LorX® Cervical Disc Prosthesis. Not FDA Approved

- PROCORAL™ (PRODORTH)- Not FDA Approved

- ROTAIO® (SIGNUS) – Not FDA Approved

- RHINE Cervical Disc System (Stryker) – Not FDA Approved. Despite Stryker backing, not approved in US

- Synergy Cervical Disc.(Synergy Disc). Not FDA Approved

- Triadyme C Cervical Disc. (Dymicron).Not FDA Approved

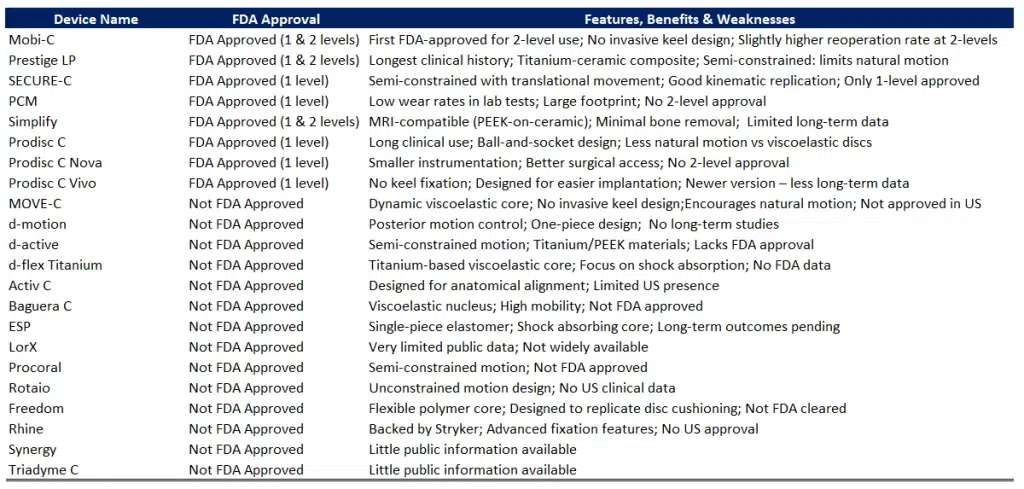

We have prepared the following chart featuring the main cervical disc prostheses on the market, highlighting their key strengths and weaknesses, as well as whether or not they are approved by the FDA:

- Almas (NOVASPINE): Not FDA Approved.

- Biolign Disc (ELITE SURGICAL): Not FDA Approved.

- Crea Spine Cervical disc prosthesis (BTB MEDICAL).Not FDA Approved.

- Dolphin Cervical Mobile Disc with Silicon Elastomer (ARTROFIKS).Not FDA Approved.

- Neosys Cervical Prosthesis (NEOSYS): Not FDA Approved

- Phoenix Cervical Disc (SOUTHERN MEDICAL): Not FDA Approved

- RMDYNX Cervical Mobile Prosthesis (ARTFX): Not FDA Approved

- Shark Mobile Prosthesis (ARTROFIKS): Not FDA Approved

- Smart Mobile Prosthesis with Polyethylene (ARTROFIKS): Not FDA Approved

- Viking Spine Ceramic (VIKING SPINE): Not FDA Approved

- Viking Spine Titanium (VIKING SPINE): Not FDA Approved

***We may have missed some of the information or it may be inaccurate. In that case, we apologize for this. Please contact us, let us know and we will correct it. Also comments are welcome and do not hesitate to contact us by mail (spinemarketgroup@gmail.com) if you have any issue related with this topic.

RESOURCES:

List of most of the Devices: Artificial Cervical Discs

VIDEOS Available: Playlist Cervical Disc Systems

- Alphatec Spine (Scientx): Discocerv

- AxioMed Viscoelastic Disc Replacement Revolution

- B.Braun Aesculap: Activ C

- Biomech PAONAN: UFO cervical dynamic intervertebral spacer

- Centinel Spine: Prodisc C Vivo Total Disc Replacement Overview and Surgical Technique Animation

- Centinel Spine: Why prodisc C?

- FH Orthopedics: CP ESP

- Globus Medical: SECURE C

- Globus Medical: Secure-C

- Kisco International: PHYSIODISC

- MEDICREA: GRANVIA C

- Medtronic: BRYAN Cervical Disc Implant Features

- Medtronic: PRESTIGE LP Cervical Disc Procedure Animation

- NEURO FRANCE Implants: DYNALIS C

- NEURO FRANCE: DYNALIS C

- NGMedical: MOVE®-C

- NuVasive: PCM Animation

- Nuvasive: Simplify Disc procedure

- Orthofix: M6 C Artificial Disc Design

- Prodorth: Spine Disc Prosthesis

- SIGNUS Medizintechnik: ROTAIO Cervical disc prosthesis

- Simplify Medical: Simplify Disc in Motion

- Spineart: BAGUERA C

- Synergy Disc Replacement: Synergy Disc

- Viking Spine: Cervical disk ceramic

- Viking Spine: MOTIS 5 Motion Cervical Disc Prosthesis

- Zimmer Biomet: Mobi C Product Animation

- ZimVie: Mobi C

###

We have updated this list with the Brochures, Surgical Techniques, and Videos available. We hope you find it useful and we appreciate and welcome any suggestions or comments.

All video parts, images, and documents related to the products are the sole property of the different companies. All the information is for Educational purposes only! No copyright infringement intended. We encourage you to contact us if you have any comments or suggestions or if you want us to include/remove your videos, images, or brochures. Please contact us at: spinemarketgroup@gmail.com