The lumbar prosthesis market, specifically lumbar total disc replacement (TDR), is experiencing significant expansion, countering the perception that it is a technique with limited or declining adoption. According to independent data from iData Research, the number of TDR procedures in the U.S. grew at a compound annual growth rate of 23% between 2018 and 2024. This growth is even more pronounced in internal data from Centinel Spine, which reports a 26% annual increase in implant volumes, along with a 20% annual growth in the number of surgeons using its technology. This trend can be attributed to a combination of factors, including advances in implant design, improved clinical outcomes, the search for alternatives to spinal fusion, and greater training and confidence among healthcare professionals. Altogether, these developments suggest that lumbar disc replacement is becoming an increasingly accepted therapeutic option with strong growth potential in the treatment of degenerative spinal disorders.

1.-Why is the LDR Market Growing?

One of the main drivers of growth in the lumbar disc replacement (LDR) market is the rising global prevalence of lower back pain, which continues to be one of the leading causes of disability worldwide. As the number of patients affected increases, so does the demand for effective surgical alternatives when conservative treatments fail. Lumbar disc replacement is gaining ground as a motion-preserving solution compared to traditional spinal fusion. Patients and surgeons alike are showing growing interest in procedures that offer faster recovery times, reduced adjacent segment degeneration, and improved long-term mobility.

According to the AME Journal, approximately 200,000 adults in the U.S. were affected by lumbar spinal stenosis (LSS) in 2019. Although some projections have suggested figures as high as 64 million by 2025, these likely refer to the global prevalence of chronic low back pain rather than LSS specifically. Combined with technological advancements in implant design, improved clinical outcomes, and greater familiarity among spine specialists, these demographic and clinical trends are fueling the strong momentum behind lumbar total disc replacement worldwide.

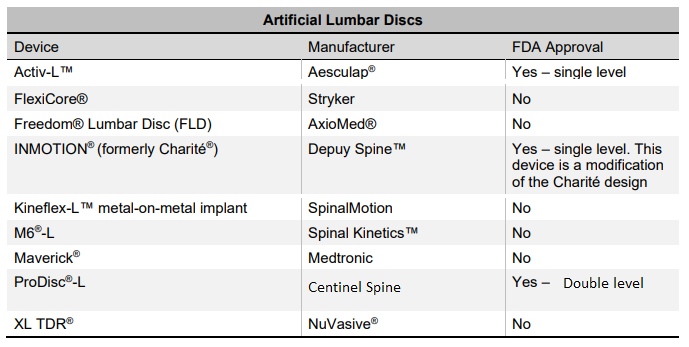

2.-Which Lumbar Disc Replacement Devices are FDA Approved in 2025?

The lumbar disc replacement device market is a very niche and consolidated segment. To date, the U.S. Food and Drug Administration (FDA) has approved only three lumbar total disc replacement devices. Several other lumbar discs have been developed without FDA approval. The SB Charite III was the first lumbar disc approved by the FDA in 2004, but it was later discontinued following the introduction of its advanced successor, the INMOTION device. However, INMOTION has also been discontinued. Currently, only two FDA-approved lumbar disc replacements actively compete in the U.S. market: Activ-L and ProDisc-L. Among these, ProDisc-L is regarded as the most comprehensive option, owing to its extensive clinical history, demonstrated long-term outcomes, and design that closely replicates the natural biomechanics of the lumbar spine.

3.-Which are the main competitors worldwide?

The leading players in the global lumbar artificial disc (LAD) market today include Centinel Spine (ProDisc-L), Braun Aesculap (Activ-L), Axiomed, Spineart, Highridge Medical, and Globus Medical, although not all of these devices have received FDA approval. It is also important to note that the M6 device from Orthofix, which was once popular outside the U.S., has recently been discontinued. For more detailed information about lumbar discs, including models that are no longer available on the market, please visit the ADL section: https://thespinemarketgroup.com/category/adl/

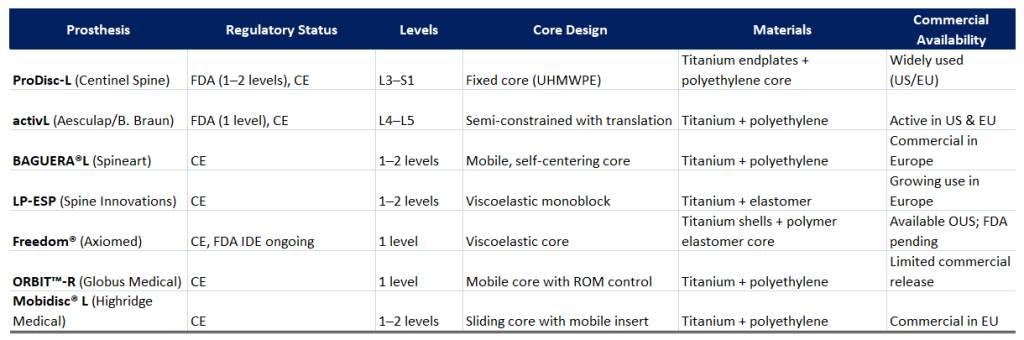

Devices that compete in the International Market (2025):

- ProDisc Lumbar (Centinel Spine)

- activL Artificial Disc (Braun Aesculap)

- BAGUERA®L (Spineart)

- LP-ESP disc prosthesis (Spine Innovations)

- Freedom® Lumbar Disc (Axiomed)

- ORBIT™-R (Globus Medical)

- Mobidisc® L Lumbar Disc Prosthesis (Highridgemedical)

4.-Choosing the Right Materials in Lumbar Disc Prostheses: Key to Success

Why the material matters? The materials used in lumbar disc replacement devices play a fundamental role in their clinical performance, longevity, and patient safety. They directly influence the device’s biocompatibility, wear resistance, bone integration, and potential for long-term complications. An ideal material must minimize risks such as inflammatory reactions, corrosion, or the generation of wear particles that could accelerate device failure.

ProDisc-L as an example: ProDisc-L illustrates a well-established material combination designed for both performance and durability:

- Composition: The endplates are made of cobalt-chromium-molybdenum (CoCrMo) alloy, known for its high mechanical strength and excellent biocompatibility.

- Core: The core is constructed from ultra-high molecular weight polyethylene (UHMWPE), a material widely used in joint arthroplasty due to its low friction, wear resistance, and mechanical reliability.

- Advantages: This pairing offers a robust, load-bearing surface with a smooth articulating interface that mimics natural disc motion without generating significant wear or debris.

- Considerations: Although CoCrMo is generally safe and durable, there is a theoretical concern over long-term metal ion release; however, clinical studies have shown this is rare and usually well tolerated.

Comparison with newer designs: Some next-generation lumbar disc implants are exploring alternative materials to enhance performance:

- Ceramic components or advanced composites may improve long-term biocompatibility but often introduce challenges such as increased cost, brittleness, or more complex manufacturing processes.

- Viscoelastic polymers are being used to simulate natural shock absorption while improving wear characteristics.

- Titanium coatings or porous titanium endplates can enhance osseointegration and reduce the risk of implant migration.

5.-Design Matters: How Lumbar Disc Types Shape Outcomes

The internal design—or core design—of a lumbar artificial disc plays a critical role in determining how closely the device mimics the natural biomechanics of the lumbar spine, its durability, and overall clinical performance. There are several main types of designs, each with distinct implications for motion preservation, implant longevity, and surgical technique.

- Fixed core designs feature a rigid internal structure between the metal endplates that does not allow internal motion. While they provide high stability, they significantly limit the range of motion and function more like a partial fusion. An early example is the SB Charite III, which initially had a more fixed behavior.

- Mobile core designs, such as the ProDisc-L, include a polyethylene core that can move slightly between the endplates. This allows for a range of motion that better replicates the natural disc, improves load distribution, and may reduce stress on adjacent segments. ProDisc-L is also classified as semi-constrained, meaning it uses a ball-and-socket structure that enables motion (flexion, extension, lateral bending, and rotation) within predefined limits, striking a balance between mobility and stability to avoid over-motion that could compromise surrounding structures.

- Lastly, viscoelastic core designs use specialized polymers to replicate the shock-absorbing properties and elastic behavior of a healthy disc. These offer a more physiological motion profile but may face challenges related to long-term durability and surgical complexity. A well-known example of this design is the M6-L from Orthofix, which was recently discontinued despite its popularity outside the U.S.

Together, these design variations reflect different philosophies on how best to preserve function while ensuring mechanical safety and clinical effectiveness in lumbar disc arthroplasty.

6.-Comparison table between different devices

7.- Which are the top three lumbar prostheses and what are the reasons?

ProDisc-L stands out as the most established, versatile, and clinically validated lumbar disc replacement available today.

Its broad FDA approval (including 2-level use), long-term data, and global presence make it the top choice for both surgeons and patients.

1.-Best Overall: ProDisc-L (Centinel Spine)

- The only device FDA-approved for both one and two levels (L3–S1), making it the most versatile option for U.S. surgeons.

- Proven fixed core design with UHMWPE (ultra-high molecular weight polyethylene) that offers excellent long-term wear resistance.

- Extensive clinical track record with over 20 years of data and widespread global use:

- Widely available and commonly used in both the U.S. and Europe, providing a high level of surgeon experience and standardization.

2.-Second Best: activL (Aesculap/B. Braun)

- FDA-approved for one level (L4–L5).

- Features a semi-constrained design with translational motion, aiming to mimic natural spinal kinematics more closely than fixed-core devices.

- Actively marketed and implanted in both the U.S. and Europe.

- Slight disadvantage: only approved for one level and lacks the long-term follow-up seen with ProDisc-L.

3.-Third Best: BAGUERA®L (Spineart)

- Uses a mobile, self-centering core, designed to better replicate physiological disc behavior.

- Growing usage and positive reception in European markets.

- Drawback: No FDA approval yet, so not available in the U.S.

- Less long-term data available compared to ProDisc or activL.

Other Notable Mentions:

- LP-ESP and Freedom: Viscoelastic designs with potential benefits in shock absorption, but limited by lack of full FDA approval or limited commercial release.

- ORBIT™-R and Mobidisc® L: Innovative concepts with sliding or ROM-controlled cores, yet with narrower availability and smaller clinical footprints so far.

###

Disclaimer

This article reflects only our personal opinion based on the information available at the time of writing. We may have missed some information or some details might be inaccurate. If so, we apologize and kindly ask you to contact us so we can correct it.Comments and suggestions are always welcome. Please feel free to reach out to us at spinemarketgroup@gmail.com if you have any questions or concerns related to this topic.

All video clips, images, and documents related to the products are the sole property of their respective companies. All information is provided for educational purposes only. No copyright infringement is intended.We encourage you to contact us if you wish to share feedback, request inclusion or removal of videos, images, or brochures.