The COVID-19 has been caused measurable impact on the global economy and, in turn, on the Spinal Fusion market. Quarantines, traveling constraints, and social distancing measures on a broad-scale drive a steep decline in business and consumer spending until the end of Q2. All the companies have taken mesures to protect the healths of their employes as well as taken temporary actions to reduce operating expenses.

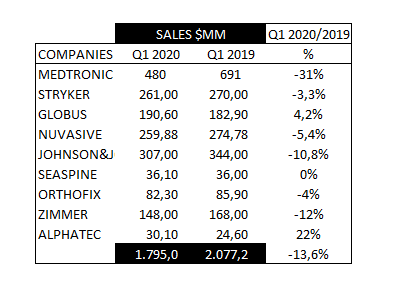

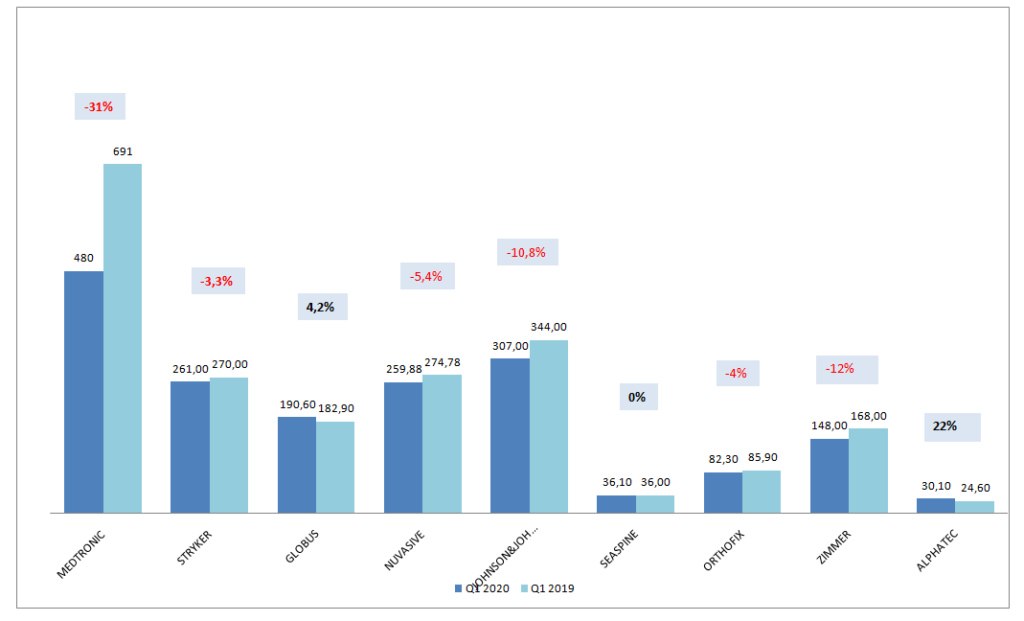

The average loss of the 9 main Spine companies in this Q1 (Medtronic Q4) has been 13,6% accounting for 282$MM.We have updated the information including Zimmer Biomet* (Estimated Spine Sales) and Alphatec Spine information.

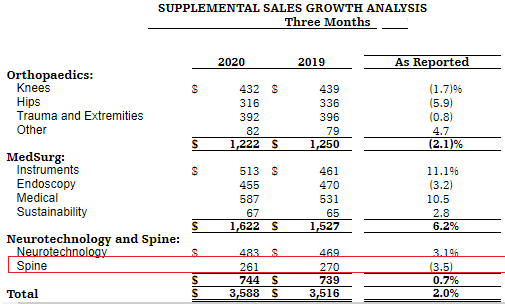

STRYKER

Consolidated net sales were significantly negatively impacted by the global response to the COVID-19 pandemic, resulting in lower than previously expected unit volume growth rates across all segments.

Consolidated net sales of $3.6 billion increased 2.0% in the quarter and 2.9% in constant currency. Organic net sales increased 2.4% in the quarter including 2.8% from increased unit volume partially offset by 0.4% from lower prices.

Neurotechnology and Spine net sales of $0.7 billion increased 0.7% in the quarter and 1.5% in constant currency. Organic net sales increased 0.3% in the quarter from increased unit volume.

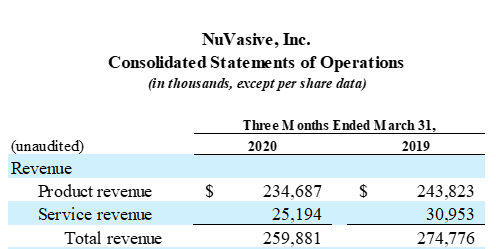

NuVasive reported first quarter 2020 total revenue of $259.9 million, a -5.4% decrease compared to $274.8 million for the first quarter 2019. On a constant currency basis, first quarter 2020 total revenue decreased -5.1% compared to the same period last year.

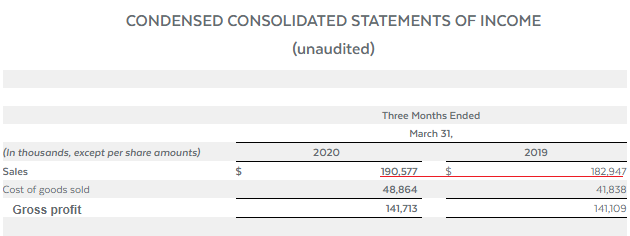

GLOBUS MEDICAL

Worldwide sales for the first quarter were $190.6 million, an increase of 4.2% over the first quarter of 2019 on an as-reported basis and 4.4% on a constant currency basis. We estimate the negative sales impact of COVID-19 to be approximately $20 million in the quarter. First quarter sales in the U.S., including robotics, increased by 7.4% compared to the first quarter of 2019. International sales decreased by 9.3% over the first quarter of 2019 on an as-reported basis and 8.3% on a constant currency basis.

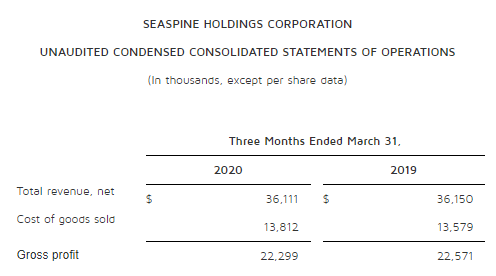

SEASPINE

Revenue for the first quarter of 2020 was $36.1 million, flat compared to the first quarter of 2019. U.S. Spinal Implants revenue was $14.5 million, a 3% decrease compared to the same period of the prior year. The decrease was driven by lower procedure volumes and unit pricing, somewhat offset by a procedural mix shift to more thoracolumbar procedures, which typically generate more revenue per case compared to other procedures. U.S. Orthobiologics revenue was $17.3 million, a 2% increase compared to the same period of the prior year. The increase was driven by growth in recently launched products.

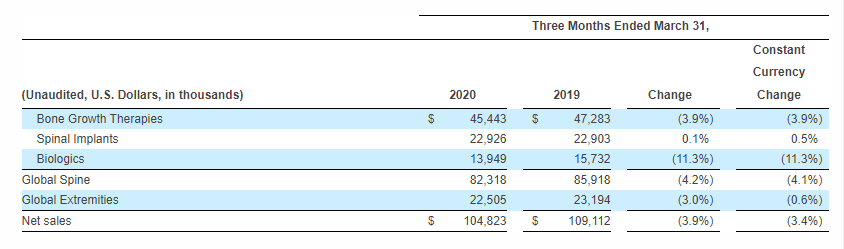

ORTHOFIX

Orthofix Medical Inc. (NASDAQ:OFIX) reported its financial results for the first quarter ended March 31, 2020. Net sales were $104.8 million, diluted earnings per share (“EPS”) was $1.32 and adjusted EPS was $0.09.

MEDTRONIC:

Spine fourth quarter revenue of $480 million decreased 31 percent as reported and 32 percent on an organic basis. Core Spine declined in the high-twenties, both in the U.S. and globally. Sales of bone morphogenetic protein (BMP) declined in the high-thirties.

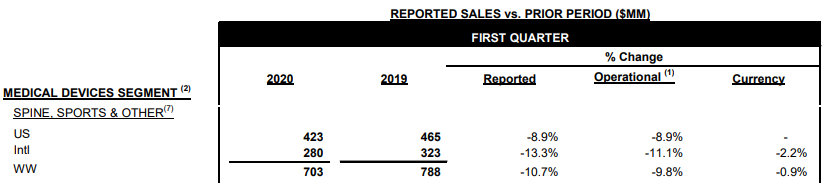

JOHNSON&JOHNSON

SPINE, SPORTS&OTHER worldwide operational sales, declined 10,7% driven by the estimated net negative impact of the COVID-19 pandemic and the associated deferral of medical procedures. Our Spine estimates for Q1 2020 is 307$MM.

ZIMMER BIOMET

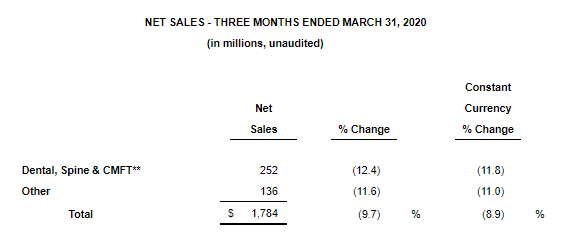

Zimmer Biomet Holdings, Inc. reported first quarter net sales of $1.784 billion, a decrease of 9.7% from the prior year period, and a decrease of 8.9% on a constant currency basis – both consistent with the preliminary results disclosed in the Company’s press release on April 6, 2020. Net loss for the first quarter was $509 million, including goodwill impairment. Net earnings on an adjusted basis were $354 million. We have estimated the Spine Sales considering that represents 58% of the Dental, Spine and CMF Business.

ALPHATEC SPINE

Alphatec Holdings, Inc. (“ATEC” or the “Company”) (Nasdaq: ATEC), announced the following financial results for the quarter ended March 31, 2020, and recent corporate highlights:

First Quarter 2020 Financial Results

- Total revenue of $30.1 million; U.S. revenue of $29.1 million, up 27% year over year;

- U.S. gross margin of 72.1%; and

- Cash and cash equivalents of $27.5 million as of March 31, 2020; pro forma cash of $47.5 million, including recent draw against credit facility.

Recent Corporate Highlights

- Increased contribution from new products to 56% of Q1 2020 U.S. revenue up from 22% in Q1 2019 and 48% in Q4 2019;

- Grew Q1 2020 revenue per case by 15% over Q1 2019;

- Continued progress transforming the sales network with Q1 2020 U.S. revenue growth from strategic distribution up 34% compared to Q1 2019 and significant sales talent additions in key geographies;

- Completed three FDA 510K new product regulatory submissions; and

- Secured an additional $35 million capital commitment from Squadron Capital.

It’s overpriced anyway.