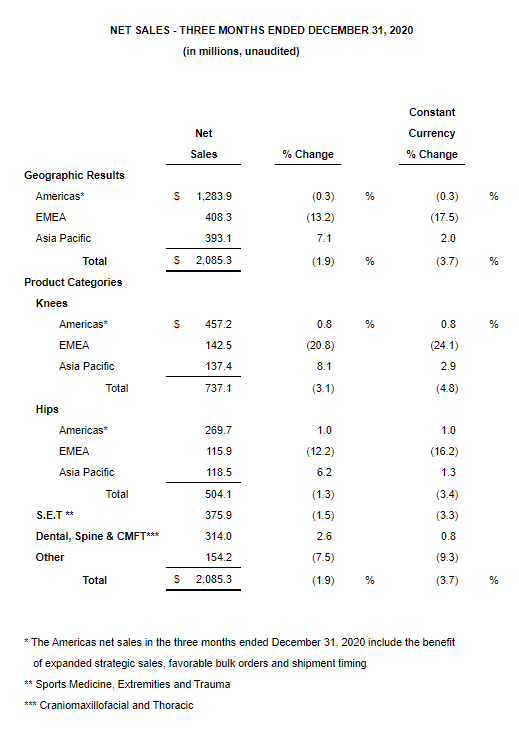

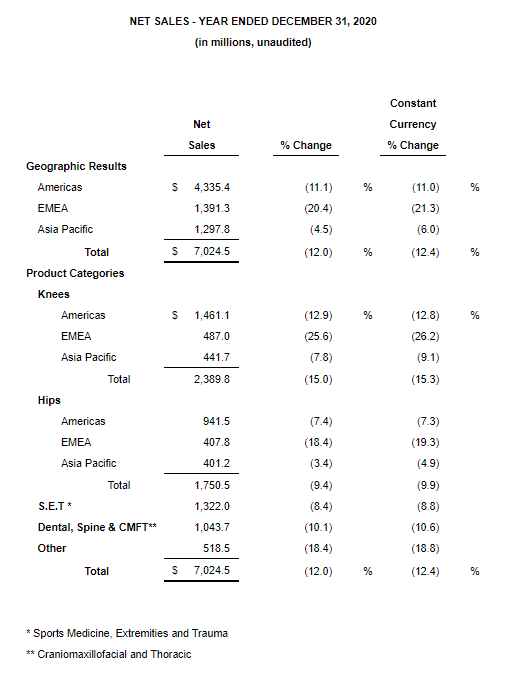

WARSAW, Ind., Feb. 5, 2021 /PRNewswire/ — Zimmer Biomet Holdings, Inc. (NYSE and SIX: ZBH) today reported financial results for the quarter and year ended December 31, 2020. The Company reported fourth quarter net sales of $2.085 billion, a decrease of 1.9% from the prior year period, and a decrease of 3.7% on a constant currency basis. Net sales for the full year were $7.025 billion, a decrease of 12.0% from the prior year, and a decrease of 12.4% on a constant currency basis. Net earnings for the fourth quarter were $333.7 million, or $440.7 million on an adjusted basis, and for the full year net loss was $138.9 million and net earnings on an adjusted basis were $1,181.6 million.

Diluted earnings per share were $1.59 for the fourth quarter, an increase of 3.2% over the prior year period. Adjusted diluted earnings per share were $2.11 for the fourth quarter, a decrease of 8.3% from the prior year period. Full-year diluted loss per share was $0.67 and full-year adjusted diluted earnings per share were $5.67, a decrease of 28.0% from the prior year.

“The fourth quarter saw continued pressure from COVID and its impact on the recovery of elective procedures, yet our core business remained strong as did our operational execution to close out 2020,” said Bryan Hanson, President and CEO of Zimmer Biomet. “Against that backdrop, we continue the transformation of our business in order to drive growth and increase shareholder value, as underscored by today’s announcement that we intend to spin off our Spine and Dental businesses. This transaction will position us to prioritize resources, simplify our operating models and deliver greater value through two independent publicly traded companies. Our team remains confident and focused as we continue to deliver on our mission and serve patients, providers and our customers.”

Please see the attached schedules accompanying this press release for additional details on performance in the quarter and full-year 2020, including sales by Zimmer Biomet’s three geographies and five product categories.

Recent Highlights

Aligned with Zimmer Biomet’s active portfolio management strategy and the ongoing transformation of the business, key recent highlights include:

- Acquisition of A&E Medical Corp., a privately-held company that manufactures and sells innovative and differentiated products in the sternal closure market; expanded Zimmer Biomet’s sternal closure portfolio to be one of the most comprehensive in a space growing at a high single digit percentage rate annually; revenues are recorded in the Company’s Dental, Spine and CMFT segment.

- Launch of a large-scale, multimedia, direct-to-patient campaign, “Don’t Let Pain Gain on You”, in the U.S., focused on education and support for patients around elective procedures like joint replacement surgery, especially during the COVID pandemic.

- Partnership with Hospital for Special Surgery (HSS) to advance innovation on the mymobility® with Apple Watch® remote care management system that will enable patients and practices around the world to leverage HSS’ expertise in orthopedic patient care through Zimmer Biomet’s platform.

- Formal launch of the Zimmer Biomet Foundation, a philanthropic 501(c)(3) organization that further strengthens the Company’s ongoing commitment to empowering diverse and underserved communities, supporting STEM education, enabling community health and providing disaster relief; launch included announcement of a partnership with the National Association for the Advancement of Colored People (NAACP) Empowerment Programs, Inc., with a commitment of $2 million over the next three years to support partnered efforts with NAACP to end racial injustice and advance diversity and equality.

- In conjunction with Q4 earnings, announcement of the intention to pursue a plan to spin off the Company’s Spine and Dental businesses to form a new and independent, publicly traded company (“NewCo”); planned transaction will enhance the focus of both Zimmer Biomet and NewCo to meet the needs of patients and customers and achieve faster growth and greater value for all stakeholders.

Geographic and Product Category Sales

The following sales tables provide results by geography and product category for the three-month period and year ended December 31, 2020, as well as the percentage change compared to the prior year periods, on both a reported basis and a constant currency basis.

Cash Flow and Balance Sheet

Cash provided by operating activities for the fourth quarter was $425.1 million and free cash flow was $328.5 million. At December 31, 2020, the Company had $802.1 million in cash and cash equivalents on the balance sheet. In the fourth quarter, the Company paid $49.8 million in dividends and declared a dividend of $0.24 per share. Cash provided by operating activities for the full year was $1.205 billion and free cash flow was $795.3 million. In the full year, the Company paid $198.5 million in dividends and declared dividends of $0.96 per share. As previously announced, Zimmer Biomet refinanced $1.5 billion in debt that came due April 1, 2020, renegotiated the terms of its $1.5 billion revolver and secured an additional $1.0 billion credit facility. No borrowings are outstanding under these credit facilities.

Financial Guidance

There continues to be uncertainty around the ongoing impact of COVID-19. Therefore, the Company is currently unable to quantify the expected impact on its results of operations, financial condition and cash flows, which could be material, for full year 2021 and is not providing financial guidance at this time.

Conference Call

The Company will conduct its fourth quarter and full-year 2020 investor conference call today, February 5, 2021, at 8:30 a.m. ET. The audio webcast can be accessed via Zimmer Biomet’s Investor Relations website at https://investor.zimmerbiomet.com. It will be archived for replay following the conference call.

About the Company

Founded in 1927 and headquartered in Warsaw, Indiana, Zimmer Biomet is a global leader in musculoskeletal healthcare. We design, manufacture and market orthopedic reconstructive products; sports medicine, biologics, extremities and trauma products; office based technologies; spine, craniomaxillofacial and thoracic products; dental implants; and related surgical products.

We collaborate with healthcare professionals around the globe to advance the pace of innovation. Our products and solutions help treat patients suffering from disorders of, or injuries to, bones, joints or supporting soft tissues. Together with healthcare professionals, we help millions of people live better lives.

We have operations in more than 25 countries around the world and sell products in more than 100 countries. For more information, visit www.zimmerbiomet.com or follow Zimmer Biomet on Twitter at www.twitter.com/zimmerbiomet.

Website Information

We routinely post important information for investors on our website, www.zimmerbiomet.com, in the “Investor Relations” section. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website or any other website referenced herein is not incorporated by reference into, and is not a part of, this document.

Note on Non-GAAP Financial Measures

This press release includes non-GAAP financial measures that differ from financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may not be comparable to similar measures reported by other companies and should be considered in addition to, and not as a substitute for, or superior to, other measures prepared in accordance with GAAP.

Sales change information for the three-month period and the year ended December 31, 2020 is presented on a GAAP (reported) basis and on a constant currency basis. Constant currency percentage changes exclude the effects of foreign currency exchange rates. They are calculated by translating current and prior-period sales at the same predetermined exchange rate. The translated results are then used to determine year-over-year percentage increases or decreases.

Net earnings (loss) and diluted earnings (loss) per share for the three-month period and the year ended December 31, 2020 are presented on a GAAP (reported) basis and on an adjusted basis. Adjusted earnings and adjusted diluted earnings per share exclude the effects of certain items, which are detailed in the reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures presented later in this press release.

Free cash flow is an additional non-GAAP measure that is presented in this press release. Free cash flow is computed by deducting additions to instruments and other property, plant and equipment from net cash provided by operating activities.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in this press release. This press release also contains supplemental reconciliations of additional non-GAAP financial measures that the Company presents in other contexts. These additional non-GAAP financial measures are computed from the most directly comparable GAAP financial measure as indicated in the applicable reconciliation.

Management uses non-GAAP financial measures internally to evaluate the performance of the business. Additionally, management believes these non-GAAP measures provide meaningful incremental information to investors to consider when evaluating the performance of the Company. Management believes these measures offer the ability to make period-to-period comparisons that are not impacted by certain items that can cause dramatic changes in reported income but that do not impact the fundamentals of our operations. The non-GAAP measures enable the evaluation of operating results and trend analysis by allowing a reader to better identify operating trends that may otherwise be masked or distorted by these types of items that are excluded from the non-GAAP measures. In addition, constant currency sales changes, adjusted operating profit, adjusted diluted earnings per share and free cash flow are used as performance metrics in our incentive compensation programs.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the impact of the COVID-19 pandemic on our business, and any statements about our forecasts, expectations, plans, intentions, strategies or prospects. All statements other than statements of historical or current fact are, or may be deemed to be, forward-looking statements. Such statements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual outcomes and results to differ materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to: the effects of the COVID-19 global pandemic and other adverse public health developments on the global economy, our business and operations and the business and operations of our suppliers and customers, including the deferral of elective procedures and our ability to collect accounts receivable; the risks and uncertainties related to our ability to successfully execute our restructuring plans; the success of our quality and operational excellence initiatives, including ongoing quality remediation efforts at our Warsaw North Campus facility; the ability to remediate matters identified in inspectional observations or warning letters issued by the U.S. Food and Drug Administration (FDA), while continuing to satisfy the demand for our products; compliance with the Deferred Prosecution Agreement entered into in January 2017; the impact of substantial indebtedness on our ability to service our debt obligations and/or refinance amounts outstanding under our debt obligations at maturity on terms favorable to us, or at all; the ability to retain the independent agents and distributors who market our products; dependence on a limited number of suppliers for key raw materials and outsourced activities; the possibility that the anticipated synergies and other benefits from mergers and acquisitions will not be realized, or will not be realized within the expected time periods; the risks and uncertainties related to our ability to successfully integrate the operations, products, employees and distributors of acquired companies; the effect of the potential disruption of management’s attention from ongoing business operations due to integration matters related to mergers and acquisitions; the effect of mergers and acquisitions on our relationships with customers, suppliers and lenders and on our operating results and businesses generally; challenges relating to changes in and compliance with governmental laws and regulations affecting our U.S. and international businesses, including regulations of the FDA and foreign government regulators, such as more stringent requirements for regulatory clearance of products; the outcome of government investigations; competition; pricing pressures; changes in customer demand for our products and services caused by demographic changes or other factors; the impact of healthcare reform measures; reductions in reimbursement levels by third-party payors and cost containment efforts of healthcare purchasing organizations; dependence on new product development, technological advances and innovation; shifts in the product category or regional sales mix of our products and services; supply and prices of raw materials and products; control of costs and expenses; the ability to obtain and maintain adequate intellectual property protection; breaches or failures of our information technology systems or products, including by cyberattack, unauthorized access or theft; the ability to form and implement alliances; changes in tax obligations arising from tax reform measures, including European Union rules on state aid, or examinations by tax authorities; product liability, intellectual property and commercial litigation losses; changes in general industry and market conditions, including domestic and international growth rates; changes in general domestic and international economic conditions, including interest rate and currency exchange rate fluctuations; and the impact of the ongoing financial and political uncertainty on countries in the Euro zone on the ability to collect accounts receivable in affected countries. A further list and description of these risks and uncertainties and other factors can be found in our Annual Report on Form 10-K for the year ended December 31, 2019, including in the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and our subsequent filings with the Securities and Exchange Commission (SEC). Copies of these filings are available online at www.sec.gov, www.zimmerbiomet.com or on request from us. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our filings with the SEC. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers of this press release are cautioned not to rely on these forward-looking statements since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary note is applicable to all forward-looking statements contained in this press release.