Last week Zimmer Biomet announced its intention to spin off its Spine and dental businesses. According to Bryan Hanson, CEO of the company, the goal is to focus on high-growth and priority areas such as knees, hips, S.E.T. and CMFT, prioritize resources and simplify their operating models.

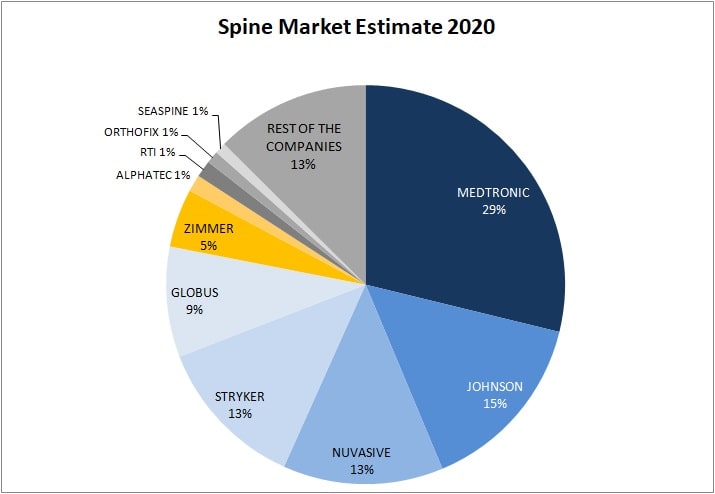

From our point of view, this strategic action of focusing on the markets where Zimmer is a winner also represents putting aside the businesses where they fail to compete successfully. We already commented last year in an article about the Spinal market 2020 that “Zimmer has not yet found their way in the spinal business. Maybe their channel is more focused on Knee and Hip. Although in the last years the bought Biomet and LDR, their sales are still very below what it is expected from a big company as Zimmer Biomet. Will they acquire in 2020 a spine company (Nuvasive, Globus...) to boost growth and prevent from stay behind competitors? …“.

Without a doubt, Zimmer has chosen to retire from the Spinal market. In the medium term they will probably sell that business to a large spine company attracted to gain a larger market share. In the past, we thought that Zimmer would acquire a company like Globus Medical or Nuvasive. Now it is rather the other way around.

What could happen now? This spin off probably represents a medium-term sale. Who could buy it? The candidates must be interested in growing in the spine market, and above all have the financial strength to do so. Who could be the possible candidates?

Zimmer’s spine sales represent approximately 5% of the market. The candidates could be several:

Globus Medical: With a 9% market share, it would be placed at 14%. It would go from being the fifth in the market to the third after Medtronic and Johnson&Johnson. However, it would really only bring him market share since the products would not add anything to his vast and high-quality portfolio. On the other hand, it would be an acquisition with a very high cost. From a strategic point of view it probably does not fit with the Globus mentality of growth based on technology and high quality products. Although everything can happen…

Stryker: With a strategy also based on acquisitions this would be a way to rank second in the market behind Medtronic. It is true that with the acquisition of K2M, its product portfolio is very broad and that of Zimmer contributes little (except for Tethering or disc prostheses). However, Stryker is always looking for winning positions in competing markets and therefore cannot be ruled out.

Nuvasive: It is unlikely since our impression is that they expect to be acquired rather than to buy other companies. It is true that with Zimmer, they would be the second in the market and therefore it could be more attractive to potential buyers.

Smith&Nephew: Finally, another option would be to have it acquired by a large company that wants to enter the spine market with a representative market share. Smith&Nephew could be a candidate although we do not know if this would be a strategic move that could interest them.

Conclusion: Some of the options that we have discussed could happen or simply continue as an independent company for many years. We will see what happens and we hope to tell it to you!