In this article, we want to present our growth forecasts for the main spine companies in 2021. Please, bear in mind that it is a first estimate made by us and that it may not be fulfilled. Companies remain subject to the potential and uncertain impact of the ongoing COVID-19 pandemic. Hospitals may experience a surge in COVID-19 cases and defer elective procedures so that results may be adversely affected. The information comes in some cases from the companies themselves, but in others, it is an assessment that we make taking into account trends and available information.

The Spine Market

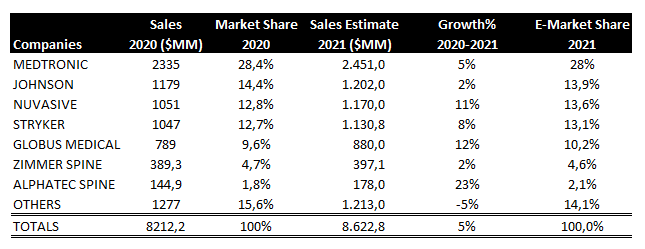

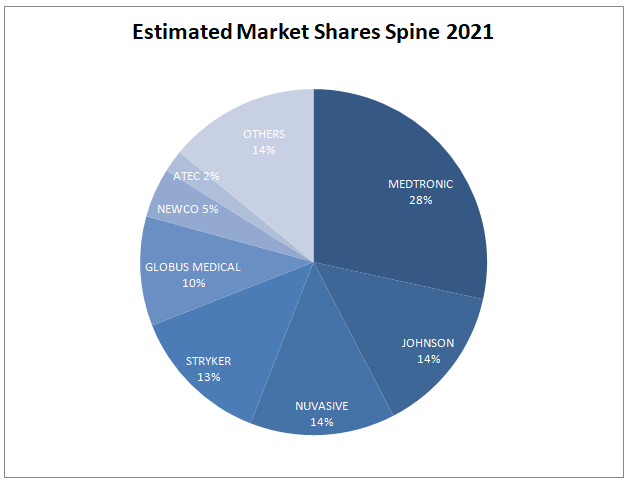

Although due to the influence of COVID-19 it is very difficult to estimate the market growth, we consider that in 2021 the spine will increase about 5% reaching $8.623 MM.

Our Estimates are the following:

First Estimation Market Shares Spine Market 2021

MEDTRONIC (SPINE)

Medtronic CEO Geoffrey Martha said in the Medtronic’s fiscal year 2021 second quarter earnings video webcast that in 2021 they would maintain their market share with a slight increase in the U.S. A major source of growth, (double-digit) would come from the titanium cages that came from their acquisition of Titan Spine last year, which is now in their organic results. He also commented on the importance of his spinal robot as a source of growth with the following words: “In Spinal Robotics, while large capital equipment purchases continue to be pressured as a result of COVID, we estimate that we sold over one and a half times the robots than Globus did. We continue to grow our share in the spine robot market, which is a good leading indicator of our future spine implant sales. Additionally, we’re expanding the capabilities of our Mazor X robot. We received approval earlier this month for navigated interbody cages, as well as our Midas Rex high-speed power drills“.Our estimated in Spine for Medtronic is closed to 5% so that as their CEO said, it will keep their market share of 28%.

JOHNSON&JOHNSON (SPINE)

According to the presentation done by its CEO Alex Gorsky last November, they suffered in 2020 a decline driven by the negative impact of COVID-19 due to patients deferring their procedures until COVID.

They estimate to grow in 2021 significantly in their Division of Medical Devices. However, in its spine business, we estimate a single-digit growth of between 2-3% adjusting its market share to 13.9%.

STRYKER

Stryker in their company-wide outlook 2021, estimates that as they recover from the pandemic, they expect 2021 organic net sales growth to be in the range of 8% to 10% from 2019. . Our estimate is for an 8% growth over the 2020 figure.

NUVASIVE

In the case of Nuvasive, we do not have any estimate or outlook for 2021 from the Company. Our estimate for 2021 is 1170MM, which represents a growth of 11% and an increase in market share of 0.6%, reaching 13.6%.

GLOBUS MEDICAL

The Company announced full-year 2021 guidance with expected net sales of $880 million.

ZIMMER BIOMET (NEWCO)

Zimmer Biomet a few weeks ago did a spin-off of its spine and dental businesses. From now on, it will be a new company called NewCo. It is very difficult to make an adequate estimate of its performance after this change in which it is very difficult to quantify its effects on results. Nevertheless, we risk estimating a modest 2% growth due to the COVID recovery.

ALPHATEC SPINE

According to their company 2021 Outlook, they expect total revenue for the fiscal year ended December 31, 2021, to approximate $178 million, which includes U.S. revenue of approximately $176 million. Revenue guidance reflects expected driven by continued launches of novel procedures and products and growing traction of the procedures and products released in 2020.