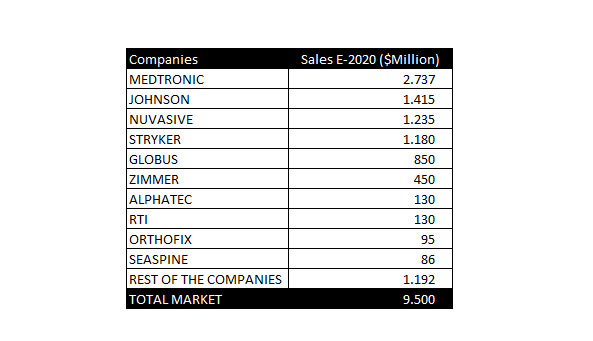

The Spine market accounts in 2020 for $9,5 billion worldwide, with an estimated increase of 2,5% vs. 2019. Analysts are forecasting a range of 1% to 2,5% growth for this market in the next few years because of price pressures and stricter insurance companies policies.

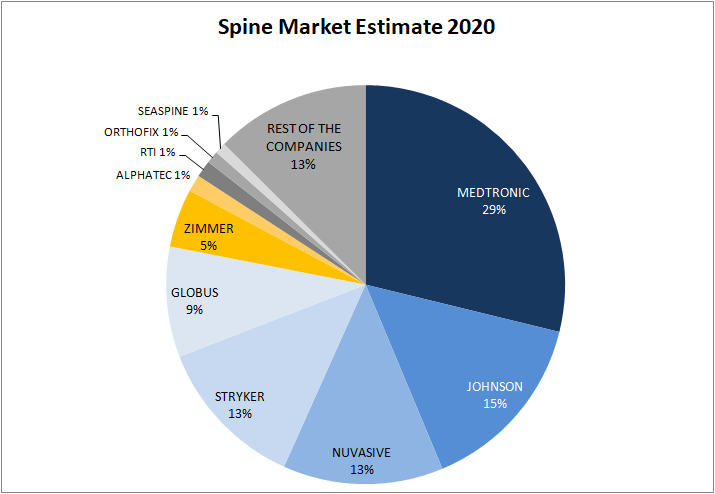

Our estimate of the 10 top spine players’ market share in 2020 is the following:

Medtronic: They will keep their leader position with an estimated growth of 3,1% mainly due to the support of the technology used in spine surgeries, including robotics (Mazor acquisition) navigation, imaging, and powered surgical. Also, sales growth will come from the acquired Titan Spine as well as from the new product launches including: T2 StratosphereTM, InfinityTM OCT, and Prestige LPTM systems.

DePuy Synthes (Johnson&Johnson): We expect a minimum growth of 1% after many years with sales decreasing. For the moment they lack technology as robotics as a source for growth. Recently they acquired the remaining stake in Verb Surgical Inc. to strengthen its digital surgery portfolio with robotics and data science expertise but we do not expect any spine robot launched in 2020. The newly launched products as the SYMPHONY Occipito-Cervico-Thoracic (OCT) System and the CONDUIT Interbody Platform (EIT acquisition) will contribute to the spine sales growth this year.

NuVasive: The company estimates full year 2020 revenue growth to be in the range of 4.0% to 6.0%. We think that Nuvasive Culture, Strategy and Products will make them grow up to $1235 million this year.According to their long-term strategy they expect their growth to be based on existing leadership position in the lateral market segment to drive increased adoption of less invasive surgery with innovative and enabling technologies ( Pulse® , LessRay Global Alignment (iGA) technology,Neuromonitoring) and from the open spine surgery market segments where the Company is under represented, including cervical and deformity.

Stryker: 2019 was a very successful year in Spine with a 31,1% growth ($1085 million) due mainly to the acquisition of K2M. We expect a growth range between 8-10%. Their range of Spine products in addition with the support of technology as SpineMap Go and the Mobius Imaging (acquired in 2019) should build up a growth to $1180 million.

Globus Medical: The company established full year 2020 guidance of $850 million in sales that represents 8% growth compared to 2019. Our expectation are aligned with their outlook for 2020. Their strategy is still focused on growing spine sales with the support of robotics and the expandable technology. State-of the art and differentiated products, very complete portfolio, Excelsius GPS (best robot) and great company culture.

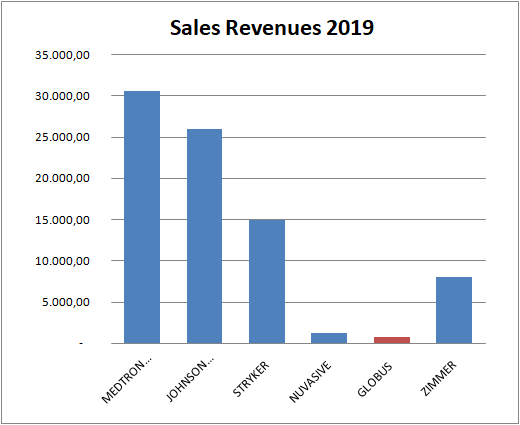

Our Comment: From our point of view, Globus Medical is a very profitable and competitive company in Spine but when considered in the Orthopedic or the Medical Devices market, is relatively an small company as seen in the following chart 1 (more or less happens with Nuvasive,but less profitable…).

Sooner or later, Globus will have to make acquisitions to gain “weight” in the Orthopedic market or it will be acquired by a big company with an urgent need to grow in the spine market. Zimmer Biomet maybe…?

Zimmer Biomet

We expect a minimum growth this year (+2,5%) although they have quite a complete portfolio. They have recently launched the TrellOss titanium 3D-printed interbody filling gaps in their product offering. They do not expect to launch the ROSA Spine in 2020.

Our Comment: Zimmer has not yet found their way in the spinal business. Maybe their channel is more focused on Knee and Hip or their product and acquisitions strategy. Although in the last years the bought Biomet and LDR, their sales are still very below what it is expected from a big company as Zimmer Biomet. Will they acquire in 2020 a spine company (Nuvasive, Globus…) to boost growth and prevent from stay behind competitors?

Alphatec

Alphatec´s Revenue guidance for 2020 reflects sales growth of 15%-18% compared to 2019, driven by 8 to 10 anticipated new product launches and the continued traction of new products released in 2019, including the SafeOp Neural InformatiX SystemTM, which is designed to seamlessly integrate critical neural information into ATEC procedural solutions.

Seaspine

SeaSpine expects full-year 2020 total revenue to be in the range of $177 to $181 million, reflecting growth of approximately 12% to 14% over full-year 2019. SeaSpine has more than 20 development projects underway.

Our Comment:We expect in the Spine products (excluding Biologics) a 2020 full year revenue of $86 billions with a growth of 12,7% compared with 2019 revenue.

RTI

Last month, RTI’s approved to sell its OEM business to a leading European private equity firm and to become a pure-play company for spinal implants.The spine business generated revenue of about $118 million in 2019. Management expects double-digit product introductions and to launch at least 10 new products in 2020 and 2021.

Orthofix

We expect a minimum growth this year (+2,5%) due to new product launches that may happen since we missed any new spine products in 2019. Last year the Company appointed Jon Serbousek as new company CEO and also named a new president of Global Spine Business (Kevin Kenny).

Others: According to our estimates, there are more than 400 spinal companies worldwide. The 10 top players account for the 90% of the market while the rest 390 companies represent 10% of the spine implants global sales. To know more about those companies, please visit:https://thespinemarketgroup.com/category/spine-companies/

Disclosure: We expresses our own opinions. We are not receiving any compensation from any of those companies. We have no business relationship and no stock from them.

IMPORTANT: If you use this data, we would appreciate if you please include the Source as: thespinemarketgroup.com