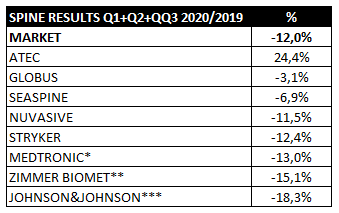

This year 2020 is being tough for everyone. Most companies are experiencing significant sales drops. The Spine market in 2020 has fallen an average of 12% due to the COVID-19. Most of the leading companies are publishing negative results as Medtronic (-13%), Johnson & Johnson (-18,3%), Stryker (-12,4%), Nuvasive (-11,5%), and Zimmer Biomet (-15,1%).

However, not all spine companies are suffering in the same way. After analyzing the data of the key players, in the first nine months (Q1, Q2, Q3) we have noticed that there are three companies that are holding up better than the rest.

Who are they and what are the reasons for this to happen?

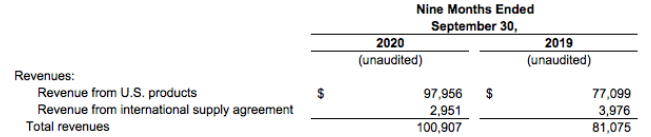

1.- ALPHATEC SPINE:+24,4%

Alphatec Spine is certainly emerging again. In this Covid year, their sales results are quite successful. Its growth in these 9 months has been 24%, largely driven by the excellent results of Q3 with 43% growth compared to the previous year.

What have Alphatec done to achieve growth?

- Increased U.S. revenue per case by 13% year-over-year, driven by strong performance in the lateral interbody fusion and AlphaInformatiX product categorie

- Continued sales network transformation, resulting in 47% year-over-year revenue growth from strategic distribution;

- Increased revenue per surgeon by 20% year-over-year;

- Closed a follow-on equity offering that generated net proceeds of $107.7 million to support continued growth-related investments and expand the institutional shareholder base;

- Launched the Sigma TLIF Access System and the InVictus MIS Modular Pedicle Screw System that fully integrate with SafeOp Neural InformatiX, the SingleStep system and IdentiTi TLIF implants to enable a comprehensive MIS TLIF approach

- Launched the InVictus MIS Tower Fixation System, allowing for less disruptive treatment of more complex pathologies

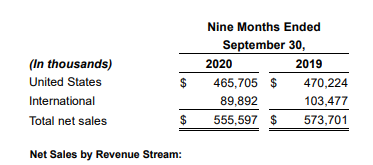

2.- GLOBUS MEDICAL: -3,1%

In the nine months of 2020 they have decreased by only 3% compared to the results of the same period of 2019. This result is very positive considering the impact of Covid of an average of 12%. Its most direct competitors have fallen between 11, 5% and 18%. In order to cover the important gap generated by the COVID, this third quarter has been essential, which has grown by 10% compared to the previous year.

How have they achieved it?

The sale of the Robot Excelsius GPS has been one of the drivers in addition to competitive recruiting. According to their CEO Dave Demski, “Competitive recruiting and onboarding, pull through from a growing base of robotic installations, and impressive uptake from new product introductions were all strong contributors to growth. While Enabling Technologies revenue was down compared to last year’s outstanding third quarter, we are encouraged by the health of the pipeline as we exited the quarter”

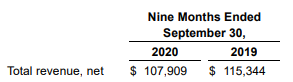

3.- SEASPINE: -7%

Seaspine has decreased by 7% in the three quarters of the year with a revenue of 107.9 M compared to the 115 of 2019. In this last quarter they have grown by 10% and have managed the negative data of COVID.

How have they achieved it?

They have achieved the results thanks to the extension of its distribution network and the launch of new products. This year alone, they have made the following 8 launches:

- Full Launch of Mariner® Midline Posterior Fixation System

- Full Launch of Mariner® MIS and Mariner Outrigger™ Spinal Fixation Systems

- Full Launch of the Shoreline RT® Cervical Interbody Implant System

- Limited Launch of Explorer™ TO Expandable Interbody Device

- Limited Launch of its Admiral™ ACP System

- Limited Launch of Meridian™ ALIF System with Reef™ A Interbody

- Limited Launch of WaveForm C 3D-Printed Interbody Implant System

- Limited Launches of NorthStar™ OCT and Cervical Facet Fusion™ Systems

***

*Medtronic: SPINEMarketGroup Sales Growth Estimation. Restorative Therapies Group was reorganized into Cranial and Spinal technologies coming both sales figures together.

** Zimmer Biomet: SPINEMarketGroup Sales Growth Estimation because Spine sales are presented with Dental CMF resuls.

*** Johnson&Johnson :SPINEMarketGroup Sales Growth Estimation because Spine sales are mixed with SPORT and Other.