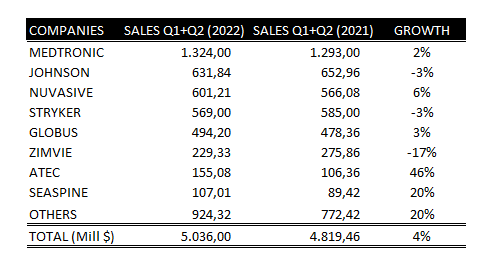

Most companies have already published their semi-annual results (Q1+Q2) in August. With these data, we can present today the market shares at this time. Also, we can see the companies that are growing in 2022.

What have we seen in the first half of 2022?

- The spine leading companies (Medtronic, Johnson&Johnson, Nuvasive, Stryker, Globus Medical, Zimvie, Seaspine, and ATEC Spine) have grown by 1,6%.

- The rest of the companies have increased sales by 20% in this period.

- Of the leading companies, Medtronic, Nuvasive, Globus Medical, Seaspine, and ATEC are growing so far in 2022.

- Johnson&Johnson, Stryker and Zimvie have decreased in this first semester.

Market Shares

Regarding market shares, with the data for the first semester, we can see some changes compared to those at the end of 2021.

- Medtronic: Although they have grown in Spine, we estimate that it has lost 1% of its share. At the end of 2021, he was the leader with 27%. Now, he is still the leader but with 26%.

- Johnson&Johnson/Globus Medical/ Seaspine: They remain stable in their 2021 quotas despite their growth and, in the case of Johnson&Johnson, their drop in sales.

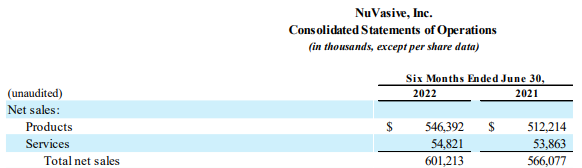

- Nuvasive/Stryker: By the end of 2021, we estimated Nuvasive had lost their third position to Stryker after the acquisition of K2M. However, Nuvasive´s growth and the negative result of Stryker in spine sales have reversed the situation.

- Zimvie: Their start as an independent company has not been as good as expected. However, it maintains the market share it had when it was at Zimmer (5%).

- ATEC Spine: Its growth of 45% this semester has given it a 1% increase in market share in such a way that it surpasses Seaspine and ranks seventh in the market with 3%.

- OTHERS: After the big spine companies, the rest have grown by 20% with a volume of almost $1bn in the first half. It has become clear that even though the spine market is stable in terms of market leaders, many companies are pushing new ideas and developments and taking share from the big ones.

Results:

Medtronic*

We estimate that Medtronic may have grown by 2% in this period according to the data provided by the company that I include below:

- (Q4 2022): Fourth quarter revenue in Spine & Biologics was flat year-over-year, with low-single-digit growth in Core Spine and a decline in Biologics.

- (Q1 2023): Spine & Biologics decreased mid-single digits, with mid-teens declines in Biologics.

*Spine sales data are always our estimates since the published results go together with those of Cranial. Medtronic data of the February-July period (Q4+Q1) is the one that corresponds to the January-June (Q1+Q2) of the rest of the companies.

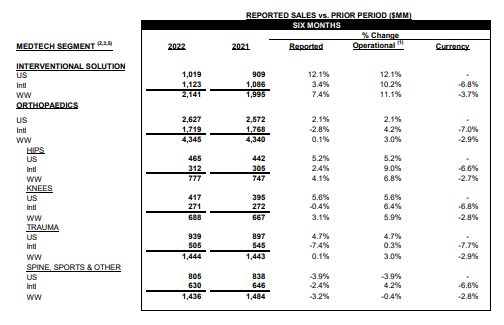

Johnson&Johnson

In spine, we estimate a decrease of 3% based on the data included below:

Spine sales data are always our estimates since the published results go together with Sports&Others.

Nuvasive

Nuvasive has grown 6% in these first six months of 2022. This increase is driven by the 2021 commercial launches of the Simplify Cervical Disc and the Pulse platform, as well as higher procedure volume in the U.S. and strong international performance.

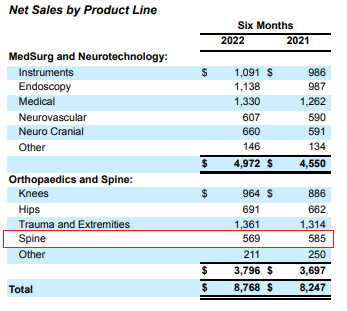

Stryker

Their Spine sales have fallen by 3% this semester. In addition, they have lost 1% of market share in favor of Nuvasive.

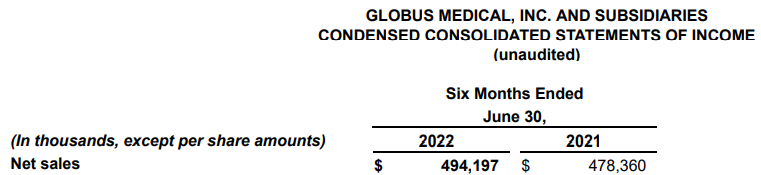

Globus Medical

Driven by an increase in robotic systems demand, and the initial roll-out of the highly anticipated Excelsius3DTM imaging system, Globus Medical has grown 3% in the half year with 5% growth in the second quarter.

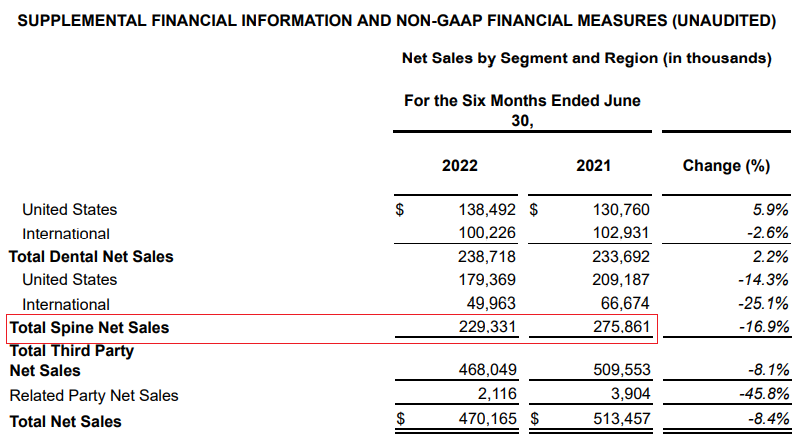

Zimvie

In this semester, sales of Zimvie in Spine have fallen by 16,9%. Regarding initiatives to return to growth, Vafa Jamali, President and Chief Executive Officer of ZimVie commented: “Within spine, we received a major positive insurance policy decision from Anthem Blue Cross Blue Shield for The Tether™, a device for treatment of pediatric scoliosis, expanding insurance coverage for up to 30 million lives,” “We are also tracking to our plan to

improve the short- and long-term operational efficiency of our newly independent company.”

SeaSpine

It has grown by 20%, due to the launch of new products (It has been the company that has had the most launches in 2022!) and attracting and onboarding distributors from their larger competitors

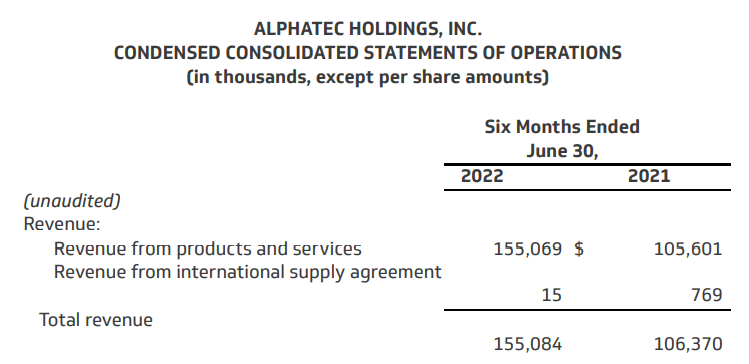

ATEC Spine

Of the leading companies, it is the one that has grown the most in spine with 46%.