Endoscopic spinal surgery is becoming an important alternative to traditional open spine surgery by offering less invasive options with faster recovery and fewer complications. This technique uses very small incisions, usually under an inch, along with specialized tubular retractors and a high-definition endoscope to provide surgeons with a clear, magnified view of the spine. Unlike traditional surgery, which relies on directly seeing the area, endoscopic surgery uses the camera’s indirect visualization, allowing for less tissue damage and better precision. There are two main approaches: uniportal, which uses one small incision for both the camera and instruments, and biportal, which uses two small incisions—one for the camera and another for surgical tools. Both techniques continue to improve and expand the possibilities of minimally invasive spine surgery.

Additionally, different endoscopic methods target specific areas of the spine.:

- The transforaminal approach is popular for procedures like discectomy, allowing precise access through a small anatomical window called Kambin’s triangle. It works well for treating nerve compression in the foramen and for some revision surgeries, though it’s less effective for central spinal stenosis.

- The interlaminar technique, on the other hand, offers a view similar to traditional open surgery, which makes it easier for many surgeons to adopt. It helps preserve important structures like bone and facet joints and is currently the fastest-growing method in endoscopic spine surgery.

- Minimally invasive lumbar fusion techniques, such as MIS-TLIF, use tubular retractors to stabilize the spine with minimal tissue damage, making them especially suitable for elderly or fragile patients.

- In the cervical spine, endoscopic procedures are gaining popularity for treating degenerative conditions, offering outcomes similar to open surgery but with less bleeding and shorter hospital stays. While thoracic spine endoscopy is still in early stages due to the region’s complexity, emerging techniques like uniportal endoscopy are showing promising results and may expand treatment options in the near future.

- Market trends highlight that:

- Transforaminal procedures currently dominate in volume and usage.

- Interlaminar procedures are growing at the highest rate, driven by their versatility and strong clinical results.

- Asia-Pacific is becoming a key growth region due to increased adoption and training, while North America maintains its leadership in innovation and market presence.

Is the Market Growing?

- According to Research and Markets, the global spine endoscopy market was valued at US $5.17 billion in 2023, is estimated to reach US $5.59 billion in 2024, and is projected to grow to US $9.02 billion by 2030, with a compound annual growth rate (CAGR) of 8.26%.

- These figures are consistent with data from 360iResearch (February 2025), which values the market at US $5.59 billion in 2024, expects it to reach US $6.05 billion in 2025, and also forecasts a target of US $9.02 billion by 2030, at a CAGR of 8.28% between 2025 and 2030.

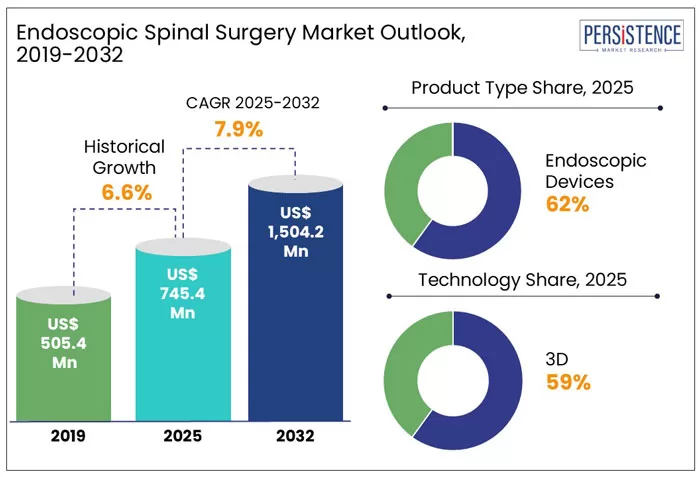

- Meanwhile, Persistence Market Research provides a more conservative outlook, estimating the market at US $745.4 million in 2025, with projected growth to US $1.50 billion by 2032, representing a CAGR of 7.9%. In terms of techniques, transforaminal endoscopic procedures led in revenue in 2021, but interlaminar approaches are currently seeing the fastest growth, driven by their clinical advantages over traditional surgery. Notably, 80% to 90% of patients report significant pain relief and improved mobility after endoscopic procedures, reinforcing the positive outlook for this sector in the years ahead.

In summary, the spine endoscopy market is projected to expand rapidly in the coming years, with most estimates converging around US $9 billion by 2030, reflecting a consistent CAGR of 7–8% across multiple reputable sources.

Why the Spine Endoscopy Market is growing ?

The rise of spinal endoscopy is not just a passing trend—it’s a response to deeper changes in demographics, technology, and healthcare priorities. Several factors are contributing to its growing adoption in hospitals and surgical centers around the world.

- The impact of aging populations

Back pain and degenerative spine conditions are among the most common health issues in people over 50. As the global population ages, more patients are seeking solutions that allow them to stay active without undergoing traditional open surgery. Endoscopic techniques offer precisely that—minimally invasive options with quicker recovery times. - Technology is catching up with clinical needs

The tools available today are far superior to those from just a few years ago. Endoscopes now offer sharper visualization, better ergonomics, and more versatile working channels. Combined with improvements in imaging, navigation, and energy systems, surgeons have more confidence and control during procedures, even in complex cases. - Consistent clinical results and patient benefits

One of the strongest arguments for endoscopic surgery is the patient experience. Reduced pain, same-day discharge, faster return to daily life, and fewer complications make it an attractive option. Clinical studies increasingly support these outcomes, making it easier for hospitals and clinicians to trust and adopt these techniques. - Investment and innovation are accelerating

Medical device manufacturers are investing heavily in endoscopic platforms—especially in biportal techniques and smart visualization systems. This investment is pushing the market forward, making systems more accessible and specialized, and broadening the range of procedures that can be done endoscopically. - A better fit for modern healthcare systems

Healthcare today is under pressure to deliver results efficiently. Endoscopic spine surgery fits well into outpatient settings and ambulatory surgical centers (ASCs), where lower cost, faster turnover, and patient comfort are essential. It’s a solution that aligns with where healthcare is heading.

Which are the main competitors?

https://thespinemarketgroup.com/category/endoscopy-spine/

Others:

- Spinendos: Until 2020, Spinendos, a German company with expertise in spinal endoscopy, was also in the market. In 2021, Double Medical Technology acquired it with the aim of promoting its development and expanding its portfolio, especially in MIS surgery. However, little has been heard since then about Spinendos’ products, as Double Medical does not include them in its current portfolio according to its website.

Emerging Chinese manufacturers

Several emerging Chinese manufacturers offer both uniportal and biportal spinal endoscopy systems, aiming to provide cost-effective and technologically advanced solutions for minimally invasive spinal surgery. Companies like Kangdu Medical, TMT Medical (Tianjin Tianming), Shenzhen Futulight Medical, and Beijing Fule Science & Technology develop endoscopic towers, surgical instruments, and visualization systems tailored for various spinal procedures.

These manufacturers emphasize competitive pricing (often 30-50% lower than Western equivalents like Joimax or Karl Storz) and incorporate features such as HD/4K optics, integrated LED light sources, and all-in-one systems. However, accessing detailed and reliable information about their products and certifications remains challenging, as their websites are often primarily in Chinese, with limited English content and navigation difficulties.

While some claim CE Mark or ISO 13485 compliance, verifying these certifications—or confirming FDA approvals—requires direct contact or checking regulatory databases like EUDAMED. Additionally, technical documentation, post-sales support, and clinical validation (e.g., published case studies) are less accessible compared to established Western brands. At least from my experience, it is hard to gather comprehensive data or verify international regulatory approvals, which makes direct comparison with established Western manufacturers more complex.

Which to Choose If You’re Just Getting Started?

When evaluating potential partners for launching a spinal endoscopy program, it’s essential to consider not only the technology, but also the long-term value and support that each manufacturer can offer. To identify the top three options, we applied a set of practical and strategic criteria: proven experience in the market, the maturity and completeness of their endoscopic solutions (for both uniportal and biportal techniques), and the presence of CE, FDA, or equivalent certifications ensuring global market readiness. Beyond that, we gave special attention to the availability of structured training, clinical support, and service infrastructure, all of which are critical for successful adoption and scalability. We also evaluated the quality of the visualization systems, instrumentation ergonomics, and the overall adaptability of each platform to different surgical indications. Finally, cost-effectiveness played a key role, especially for hospitals or institutions planning to implement spinal endoscopy for the first time.

It’s important to note that all the companies included in this analysis offer high-quality solutions and solid value in their own right. The following selection reflects our professional recommendation and opinion based on the criteria above—but every option presented here deserves strong consideration depending on your specific goals, clinical setup, and resources.

Based on these criteria, Joimax, RIWOspine, and Unintech clearly stand out as the strongest candidates.

- Joimax has been a global pioneer in endoscopic spine surgery for over two decades, offering one of the most comprehensive and clinically validated platforms for both uniportal and biportal approaches. Their systems are backed by a global presence, robust regulatory approvals (including CE and FDA), and an outstanding international training network. For institutions seeking a strategic, long-term partner with a premium offering and strong educational support, Joimax sets the standard.

- RIWOspine, with its heritage of precision German engineering, is particularly recognized for the quality and reliability of its biportal systems. Their instrumentation and endoscopic towers are built for surgical accuracy and efficiency, and their presence in Europe is well established. For hospitals that value technological sophistication and localized support, RIWOspine offers a premium solution focused on clinical outcomes.

- Unintech, based in Germany, has built a strong reputation in uniportal endoscopy and has recently expanded into biportal techniques. Their modular product approach offers flexibility and cost control, making them especially attractive for centers aiming to establish a high-quality endoscopic practice without overcommitting financially at the outset. Their European base and growing reputation in minimally invasive spine procedures make them a strong contender for institutions seeking both quality and value.

Conclusion: These three manufacturers combine clinical depth, technical innovation, and solid support infrastructure. Depending on the strategic priorities—whether excellence in training, biportal expertise, or cost-effective modularity—each offers a compelling path forward for starting or expanding a spinal endoscopy program.

###

All video parts, images and documents related to the products are of the sole property of the different companies.All the information is for Educational purpose only! No copyright infringement intended.We encourage you to contact us if you have any comment, suggestion or if you want us to include/remove your videos, images or brochures. Please contact us: spinemarketgroup@gmail.com

Image Frontpage: RIWOSpine