Endoscopic spinal surgery serves as an alternative to traditional open spine procedures, providing comparable or superior outcomes. This method employs micro-incisions, typically less than an inch in size, along with specialized tubular systems and an endoscope to observe internal structures. By utilizing indirect visualization, this technique has surpassed traditional approaches, which rely on direct observation of organs, enabling surgeons to attain clearer images during the operation. Moreover, it facilitates minimally invasive procedures, leading to quicker recovery and diminished postoperative discomfort.

Endoscopic spinal surgery represents a groundbreaking approach for treating various spinal conditions, providing patients with less invasive options and speedier recoveries compared to traditional open procedures. Here’s a breakdown of the different techniques:

- Transforaminal: This method is crucial in endoscopic spinal surgery, particularly for procedures like discectomy. Surgeons navigate an endoscope to the Kambin’s triangle under fluoroscopic guidance, ensuring precise positioning. While it shows promise for revision surgeries and effectively treats foraminal stenosis, its effectiveness for central stenosis remains limited.

- Interlaminar: With a visualization similar to traditional open surgery, the interlaminar approach has broadened the scope of Endoscopic Spinal Surgery. By using endoscopes, surgeons can better preserve bone anatomy and facet joints, yielding results comparable to or superior to conventional methods.

- Lumbar Fusion: Minimally Invasive Lumbar Interbody Fusion (MIS-TLIF) procedures using tubular retractors have gained popularity for their minimal disruption and swift recovery. Endoscopic lumbar interbody fusion, especially beneficial for elderly or severely ill patients, is gaining traction despite limitations in severe cases.

- Cervical Spine: Endoscopic techniques are increasingly utilized in degenerative diseases of the cervical spine, offering comparable results to traditional surgeries with advantages such as reduced blood loss and shorter hospital stays. Recent advancements, including endoscopic laminectomy, challenge previous assumptions.

- Thoracic Spine: While research on thoracic spine conditions lags due to their rarity, endoscopic approaches hold promise. However, complexities in thoracic spine anatomy pose challenges, limiting widespread adoption. Nonetheless, emerging techniques like uniportal endoscopy (UBE) show potential for future developments.

Is the market growing?

There is a rise in adoption of minimally invasive surgeries around the globe, owing to the advantages such less pain associated with procedure, shorter hospital stays, faster recovery and greater patient compliance. This, advantages of endoscopic spinal surgery over the traditional surgery, rises its demand in the healthcare sector.

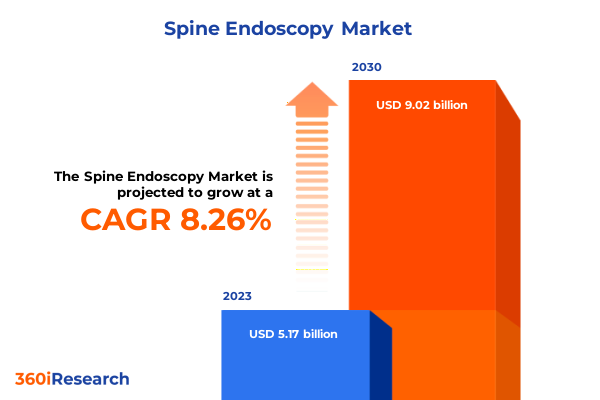

The global spine endoscopy market, according to 360iresearch is valued at US$ 5,7 billion in 2023 and is estimated to reach a value of US$ 9,02 billion by 2030, with a CAGR of 8.2% through the next decade.

In terms of revenue, transforaminal endoscopic procedures dominated in 2021. However, interlaminar endoscopic procedures are experiencing the fastest growth, driven by their advantages over traditional methods. With 80 to 90% of patients reporting reduced pain and improved mobility post-surgery, the future of endoscopic spinal surgery looks promising.

Which are the main competitors? https://thespinemarketgroup.com/category/endoscopy-spine/

Others:

- Spinendos: Until 2020, Spinendos, a German company with expertise in spinal endoscopy, was also in the market. In 2021, Double Medical Technology acquired it with the aim of promoting its development and expanding its portfolio, especially in MIS surgery. However, little has been heard since then about Spinendos’ products, as Double Medical does not include them in its current portfolio according to its website.

All video parts, images and documents related to the products are of the sole property of the different companies.All the information is for Educational purpose only! No copyright infringement intended.We encourage you to contact us if you have any comment, suggestion or if you want us to include/remove your videos, images or brochures. Please contact us: [email protected]

Image Frontpage: RIWOSpine