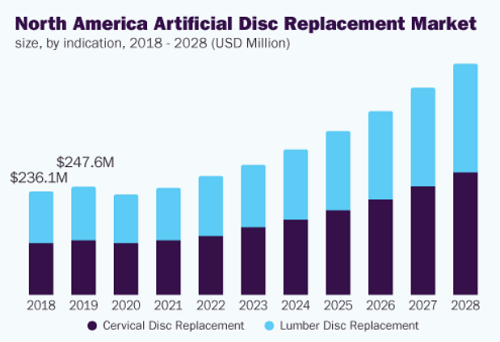

The global artificial disc replacement market size was valued at USD 471.0 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2021 to 2028.

Why is this Market Growing?

Increasing patient population of lower back pain across the world is the major factor that is expected to drive growth of the market. Moreover, patients who does not get relief form non-surgical treatment methods are recommended to adopt lumbar disc replacement by doctors. In 2019, according to the AME journal prevalence of lumbar spinal stenosis (LSS) is around 200,000 adult patients in the U.S, and it is expected to reach around 64 million by the year 2025.

Which Lumbar Disc Replacement Devices are FDA Approved?

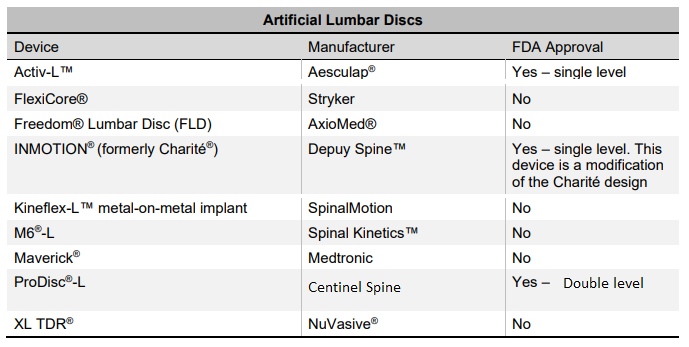

Furthermore, the lumbar disc replacement device market is very niche and consolidated market. Moreover the U.S Food and Drug Administration (FDA) have approved only three lumbar total disc replacement devices. There are several other lumbar disc that have been developed by companies without the U.S. FDA approval. SB Charite III lumbar disc was the first lumbar disc approved by the U.S FDA in 2004. Later, this lumbar disc was discontinued from the market because the advanced version of INMOTION is launched in the market. The Activ-L, INMOTION (formerly Charite) and ProDisc – L are three lumbar disc available in the market, which are approved by the U.S Food and Drug Administration. Moreover, companies are focused on developing new products to offer various treatment options for spine related patients.

In addition, manufacturers are focusing on acquisition strategies to strengthen their product portfolios, which is expected to drive global lumbar disc replacement devices market growth. For instance, Centinel Spine in October 2017, entered into an asset purchase agreement to acquire ProDisc Total Disc Replacement portfolio from DePuy Synthes.

Which are the main competitors?

The leading players in the global ADL market today are Centinel Spine (Prodisc-L), Braun Aesculap (Actif L), Axiomed and Orthofix (M6-L ) although not all of them are FDA approved. Please visit the ADL section to learn more about Lumbar discs :https://thespinemarketgroup.com/category/adl/ :

Devices that compete in the International Market (2023):

- ProDisc Lumbar (Centinel Spine)

- activL Artificial Disc (Braun Aesculap)

- BAGUERA®L (Spineart)

- LP-ESP disc prosthesis (Spine Innovations)

- M6-L artificial lumbar disc (Orthofix)

- Freedom® Lumbar Disc (Axiomed)

- ORBIT™-R (Globus Medical)

- Aditus Lumbar Disc Prosthesis (Aditus Medical)

- Mobidisc® L Lumbar Disc Prosthesis (Highridgemedical)

Devices OUT of the market (2023):

- InOrbit™ (Globus Medical): OUT of the market

- Kineflex Prosthetic Disc (Southern Medical): OUT of the market

- Cadisc™-L (Rainier): OUT of the Market

- CHARITÉ™ Artificial Disc (Depuy Synthes): OUT of the market

- Flexicore (Stryker): OUT of the Market

- INMOTION® (formerly Charité®) (Johnson&Johnson): OUT of the market

- Maverick (Medtronic): OUT of the market and with not much information available.

- TRIUMPH® (Globus Medical): OUT of the Market

- XL TDR® (Nuvasive): OUT of the market and with not much information available.The XL TDR from NuVasive was an investigational intervertebral disc replacement which was implanted using a lateral approach to the lumbar spine. The device had CoCrMo endplates and a ball and socket articulation.

Key Takeaways of the Global Lumbar Disc Replacement Device Market:

- The global lumbar disc replacement device market is expected to exhibit a CAGR of 13.5% over the forecast period (2020-2027), owing to increasing spine related health issues globally

- Among material, metal-on-biopolymer segment is expected to hold dominant position in the global lumbar disc replacement device market, owing to increasing focus of key market players to develop advanced devices for the treatment of spine related problems.

###

We have updated this list with the Brochures, Surgical Techniques, and Videos available. We hope you find it useful and we appreciate and welcome any suggestions or comments. We may have missed some of the information or it may be inaccurate. In that case, we apologize for this. Please contact us and let us know.

All video parts, images, and documents related to the products are the sole property of the different companies. All the information is for Educational purposes only! No copyright infringement intended. We encourage you to contact us if you have any comments or suggestions or if you want us to include/remove your videos, images, or brochures. Please contact us at: [email protected]

If we can get patients data, contradictions of devices in tabular it would be nice and helpful.