A few months ago, we received numerous inquiries from our readers asking whether Globus Medical had finally surpassed Medtronic as the global leader in spinal technologies. Rather than speculate, we opted to wait for a clean, data-driven comparison between both companies’ most recent results. Although Medtronic operates on a fiscal calendar and Globus reports on a standard one, Medtronic’s Q4 FY2025 aligns closely with Globus’s Q1 2025, offering an ideal point of reference.

Medtronic’s Position: Still Leading, But for How Long?

In Q4 FY2025, Medtronic reported $1.342 billion in revenue from its Cranial & Spinal Technologies (CST) division, reflecting 4.4% organic growth. This performance was primarily driven by its spinal portfolio, with particular strength in capital equipment and implant pull-through associated with the AiBLE™ surgical ecosystem—a platform integrating spine implants with navigation, imaging, and robotics.

Although Medtronic does not break out spine revenues separately from CST, historical investor communications consistently suggest that around 60% of CST revenue comes from spinal products. The remaining 40% is typically attributed to cranial technologies, including neuro-oncology and surgical navigation.

Applying the conservative estimate of 60%, Medtronic’s spine revenue in Q4 FY2025 is likely around $805 million. This estimate aligns with company commentary that spine was the principal growth driver within CST, implying spine-specific organic growth of approximately 6–8% during the quarter.

Globus Medical: Catching Up Fast

By contrast, Globus Medical, whose product portfolio is almost entirely focused on spine, reported $616.5 million in revenue for Q1 2025. This marks a strong year-over-year increase, fueled by continued adoption of the ExcelsiusGPS robotic platform and ongoing momentum from the NuVasive acquisition, completed in 2023.While Medtronic still leads in absolute revenue terms, the gap is narrowing. Globus is scaling quickly and executing with precision.

The key question is no longer if it will catch up, but when.

When could that happen?

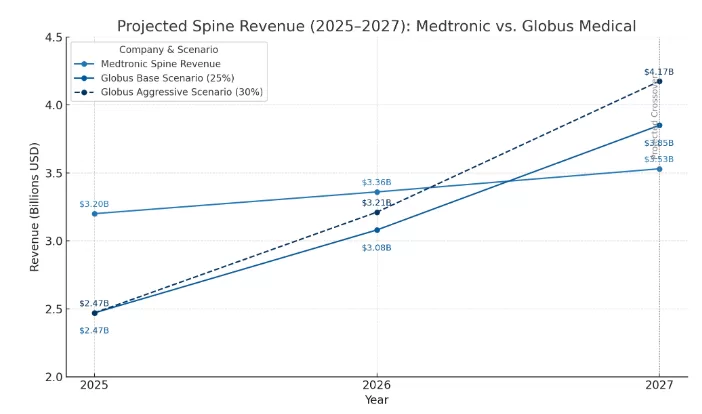

Globus Medical is gaining ground rapidly, leveraging sharp execution, innovation in surgical robotics, and strategic M&A.If current trends persist, we expect a changing of the guard by 2027, or potentially as early as 2026 under more aggressive assumptions.Ultimately, the future of spine market leadership will be determined not just by scale, but by innovation, particularly in enabling technologies like robotics.

What Could Change the Trajectory?

Several factors could accelerate or delay this leadership shift:

- Faster Global Adoption: If Globus accelerates adoption of ExcelsiusGPS across international markets, its growth could outpace projections.

- Medtronic Deceleration: A slowdown in Medtronic’s spine growth to 3% or below would narrow the revenue gap sooner.

- Innovation Cycles: If Medtronic launches a next-generation AiBLE™ 2.0 platform with significant clinical or economic advantages, it could preserve its lead and slow Globus’s advance.

###

Header Image: Freepik: https://www.freepik.com/