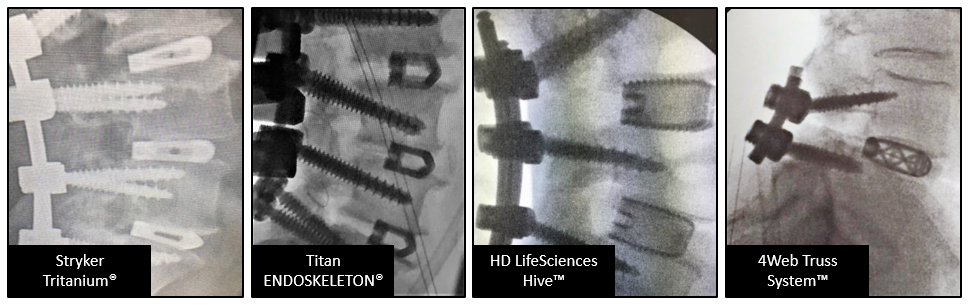

Early in 2018, MedTech Strategies conducted a survey to find out if titanium based interbody fusion devices produced with modern 3D printed technology could offer the radiographic visualization surgeons demand. A short online survey was conducted with 24 US based orthopedic surgeons to examine their input on this question. Surgeons were asked to choose their preferred commercially available 3D printed devices, based on visualization, in the following radiographic images. See Figure 1. The devices provided were:

• Stryker Tritanium®

• Titan ENDOSKELETON®

• HD LifeSciences™ Hive™

• 4Web Truss System™

Figure 1: Radiographic images from tested devices

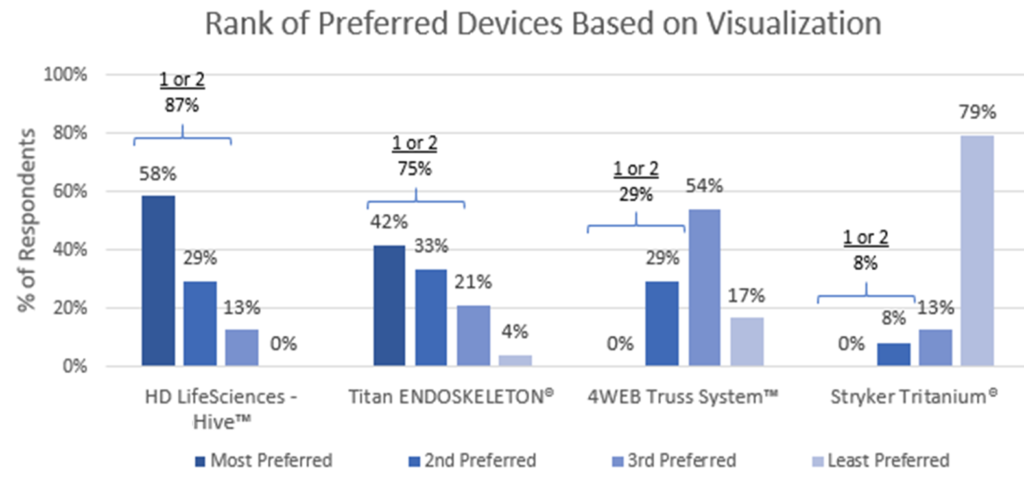

Interestingly, the most preferred device was HD LifeSciences Hive®. 58% of surgeons indicated that it was the most preferred device presented and 87% ranked it as first or second choice. Of the four devices presented, the Hive device was the only one of the four never ranked last by any surgeon. See Figure 2.

Figure 2: Rank of Preferred Devices Based on Visualization

Respondents indicated that of the four options, the HD device had the best visualization overall and was the “easiest to see through.” When asked to provide the material or brand/manufacturer of the HD LifeSciences device, one respondent indicated that it looked like a device made from PEEK which further demonstrates the radiolucent qualities of the Hive structure.

Other reasons for choosing the HD LifeSciences device included visualization of bony healing, assumed best evaluation of a solid interbody fusion by CT scan and most open space within the implant.

The second most preferred device was the Titan ENDOSKELETON with the 4Web Truss System and the Stryker Tritanium to follow. A high of 79% of respondents placed the Tritanium device as the least preferred device.

As with all new interbody fusion device technology, understanding the drivers for choice and importance of aspects like visualization are important. Companies like HD LifeSciences have found a way to incorporate the benefits of improved manufacturing of titanium with the preferred visualization surgeons are demanding.

About Ilsa Webeck

Ilsa Webeck is the founder and lead principal consultant of MedTech Strategies LLC, a boutique strategic marketing firm focused on understanding customer needs to build for growth. In her 20+ years in healthcare business strategy she has contributed to the success of emerging ventures and market leaders by uncovering value for new technologies. Ilsa holds a BA in Biology from Dartmouth College and an MBA from the Tuck School of Business. She is an invited lecturer at the Boston Biomedical Innovation Center, Harvard University Office of Technology Development and mentor for MassChallenge.