Press Release :Ecully, 20th January 2023 – 8:00 am

2022 revenues up 73% to €7.4 million

“2022 financial year represents a size change for Spineway, which has achieved proforma revenues of nearly €10 million**, exceeding the Group’s highest historical level.

In addition to a commercial performance, this exercise confirms the relevance of our mixed growth strategy combining organic growth and targeted acquisitions.

The synergies implemented through the acquisition of Distimp in 2021 and Spine Innovations in 2022 are reflected in our sales by significantly strengthening our key geographic positions and our premium product lines.

Our objective of improving our results and returning to profitability is reinforced. Our Group benefits from a senior team and a strengthened premium product portfolio to meet challenges, particularly regulatory ones.

A pipeline of R&D projects reinforces our vision of great innovation opportunities and confirms our desire to position ourselves as a reference player in the spine sector. These investments, which will lead to additional future growth, and staff reinforcement will mechanically weigh on the Group’s results.”

Stéphane Le Roux, CEO of Spineway

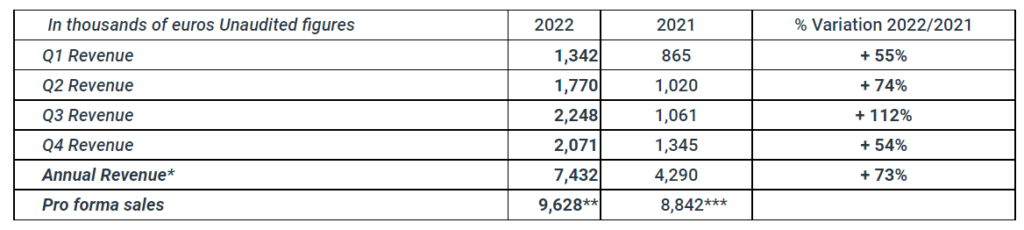

* 2022 revenues include the share of revenues linked to Spine Innovations since its integration on July 21, 2022, i.e. €1.7m.

** Proforma 2022 revenues include, for comparison, Spine Innovations from January 1, 2022.

*** Proforma 2021 revenues include, for comparison, Distimp and Spine Innovations from January 1, 2021 (acquired on June 25, 2021, and July 21, 2022).

Spineway has achieved a good year in 2022 with annual revenues of €7.4 million, up 73% compared to 2021. This significant improvement in the Group’s revenues is driven by the full-year sales contribution of the Distimp ranges and the integration of Spine Innovations sales in the second half of 2022.

In 2022, Europe will be the Group’s leading distribution area (€2,906 K and 39% of sales). The zone benefits from commercial synergies due to the development of the German and French markets (turnover multiplied by 2.6). This European market is driven by the tripling of sales of Distimp’s Premium ranges and the 42% contribution to sales of Spine Innovations in this region.

Latin America remains a major zone for the Group and accounts for 34% of Group sales (€2,548 K, up 28%).

In addition, the other geographical areas also showed good dynamics over the year: the Middle East shows significant growth and Asia is driven by the integration of Spine Innovations, particularly in the Australian market.

As of December 31, 2022, the Group had a solid cash position of approximately €5.5 million to support its organic development.

In line with its development plan, Spineway has strengthened its geographical positions in strategic countries and expanded its product lines with higher added value. On a growth trajectory, the Group will continue in 2023 to deploy its recent acquisitions. With its strengthened team to face future challenges, the Group is investing in an R&D program to realize its strong innovation potential in the medium and long term and confirms its strategy to position itself as a leading international player in the spine sector.

Upcoming: February 9, 2023 – Annual results 2022

SPINEWAY IS ELIGIBLE FOR PEA-SME (EQUITY SAVINGS PLANS FOR SMES)

Find out all about Spineway at www.spineway.com.

This press release has been prepared in both English and French. In case of discrepancies, the French version shall prevail.

Spineway designs, manufactures and markets innovative implants and surgical instruments for treating severe disorders of the spinal column.

Spineway has an international network of over 50 independent distributors and 90% of its revenue comes from exports.

Spineway, which is eligible for investment through FCPIs (French unit trusts specializing in innovation), has received the OSEO Excellence award since 2011 and has won the Deloitte Fast 50 award (2011). Rhône Alpes INPI Patent Innovation award (2013) – INPI Talent award (2015).

ISIN: FR001400BVK2 – ALSPW