Press release Ecully, September 7, 2022 – 8 pm

Half-year results 2022

Initial benefits of redeployment

- Acceleration of activity driven by Distimp sales and contributions

- Good operating performance orientation

- Strong cash position of €15.3 million allowing

- No additional issuance of Convertible Bonds until the end of 2022

- The continuation of the Group’s growth strategy

Growth ambition and strategy confirmed

- Following the acquisition of Distimp in June 2021, acquisition of Spine Innovations in July 2022

- Continued construction of a European player in spine care

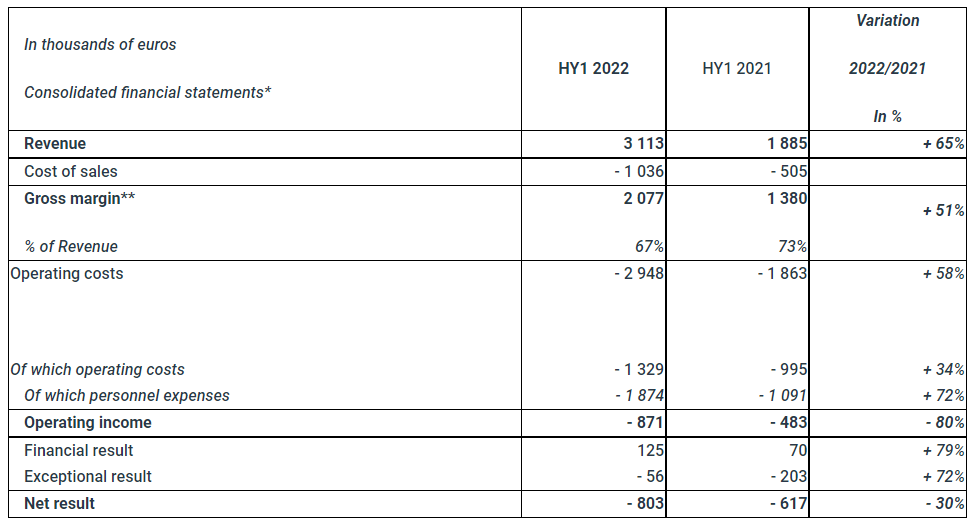

* Unaudited figures

** Accounting gross margin including inventory adjustments. Adjusted from this impact, the gross margin related to pure sales is of 2,244 k€, i.e. a rate of 72% at the end of June 2022, stable compared to the end of June 2021 (1,339 k€ and 71%). The margin on sales thus increased in value by 68%.

The Board of Directors of Spineway, at a meeting held on September 7, 2022, chaired by Stéphane Le Roux, approved the half-year results as of June 30, 2022.

In the context of a still fragile and non-homogenous recovery in its areas of operation, Spineway achieved revenues of €3.1 million in the first half of 2022, up 65% compared to the first half of 2021. This increase is driven by the strong performance of sales in Latin America (+72% to €1.5M), the synergies implemented with Distimp, notably in France, which brought the turnover of the European zone to €0.9M (+106% compared to HF1 2021) and the solid results in the Middle East (€0.4M, up 96%)

Improved gross margin on sales by 68% and controlled expenses

This growth in activity is accompanied by a 68% increase in gross margin on sales** to €2.2 million at the end of June 2022 compared to €1.3 million last year.

During the period, operating costs were kept under control despite the reinforcement of the teams necessary for the development and transformation of R&D projects and the growth of the Group. Thus, the number of employees has increased by 29% since June 2021. The management team has been reinforced by four new top-level experts: a Director of Sales for France and French-speaking Africa, a Scientific Director, an R&D Director and a Marketing and International Sales Director.

Operating costs amounted to €1.3 million, i.e. 43% of sales compared to 53% last year, even though the Group continued to incur regulatory expenses, particularly in studies and clinical tests to prepare the changeover linked to the new CE/MDR regulations.

The operating profit for the first half of 2022 is thus – 0.9 M€ compared to – 0.5 M€ at the end of June 2021.

Also benefiting from the improvement in the financial profit (+ 78%) and the exceptional result (+72%), the net result was -0.8 M€ versus -0.6 M€ last year. It now represents 26% of the turnover compared with 33% last year and has thus increased by 7 points.

The Group remains committed to an objective of revenue growth and reorganization aimed at a return to operating profitability while going on with costs’ control.

Strengthened equity and solid cash position of €15.3 million at the end of June

In the first half of 2022, the conversion of convertible or exchangeable bonds into new or existing ordinary shares linked to the contract with Negma GROUP LTD generated a capital increase of €0.6 million through the creation of 6,213,624,332 shares and an issue premium of €1.1 million. The purpose of this contract is to finance the Group’s acquisition and partnership plan, to support its strategy and also to support cash requirements related to current operations, particularly in connection with the current pandemic. As of June 30, 2022, €11.5 million of additional financing remained under this contract, which has provided €22.6 million in cash since its conclusion.

With a strong cash position of more than €15 million as of June 30, 2022, the Group has decided to suspend the issuance of new tranches of convertible bonds until the end of 20221. The Group’s financial structure remains sound with a net cash position of €10.9 million and shareholders’ equity of €21.5 million as of June 30, 2022.

The company is studying financing solutions that are more favorable to its development, its shareholders, and the support of its future projects.

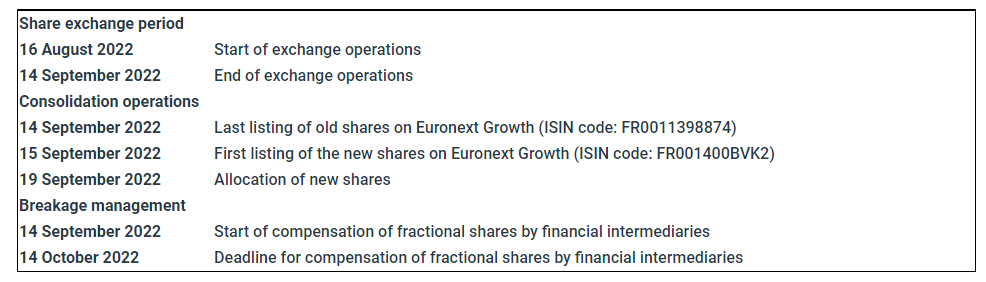

Shares Consolidating to reduce volatility

In order to support its growth and value creation strategy, since August 16, Spineway has initiated a reverse stock split based on 1 new share for 40,000 shares. This consolidation, which will be effective on September 15, has the dual objective of limiting share price volatility and reducing speculation on the share price.

Ambition confirmed

The strengthening of the Group’s cash position and shareholders’ equity will enable it to pursue its growth plan.

As such, in July 2022, Spineway acquired Spine Innovations, a French company specializing in intervertebral disc prostheses for the cervical and lumbar spine. Spine Innovations has a team of 13 people and markets its products mainly in France, Europe, and Australia. For the fiscal year 2020/2021, the company generated sales of €4.2 million, 76% of which were generated internationally. In line with its growth strategy, this new acquisition will enable Spineway to add a new segment to its product offering, strengthen its positions in France and internationally, and expand its teams. This acquisition will contribute to the Group’s revenues from the second half of 2022.

This new acquisition confirms the Group’s strategy of positioning itself as a leading European player in the field of spinal implants, in particular by expanding its range of innovative Premium products, through targeted external growth.

Upcoming:

September 28, 2022: Lyon Pôle Bourse Forum at the Palais du Commerce in Lyon

September 20, 2022: Closing of the Consolidation Transaction

October 14, 2022: Third quarter revenues

SPINEWAY IS ELIGIBLE FOR THE PEA-PME (EQUITY SAVINGS PLANS FOR SMES)

Find out all about Spineway at www.spineway.com

This press release has been prepared in both English and French. In case of discrepancies, the French version shall prevail.

Spineway designs, manufactures and markets innovative implants and surgical instruments for treating severe disorders of the spinal column.

Spineway has an international network of over 50 independent distributors and 90% of its revenue comes from exports.

Spineway, which is eligible for investment through FCPIs (French unit trusts specializing in innovation), has received the OSEO Excellence award since 2011 and has won the Deloitte Fast 50 award (2011). Rhône Alpes INPI Patent Innovation award (2013) – INPI Talent award (2015).

ISIN: FR0011398874 – ALSPW

1 To date, 760 bonds remain to be converted on the previously raised tranches