Is the past always better than the present? We love to reminisce about the good old days. . . When prices were high and the spine market was stable, growing and very profitable. Ten years ago, we did not have to deal with the pricing or with insurance companies pushing back harder than ever on spinal fusions, making it more difficult to gain approval for surgical procedures.

But was the past better for all the companies?

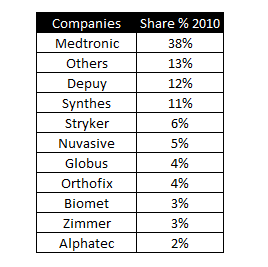

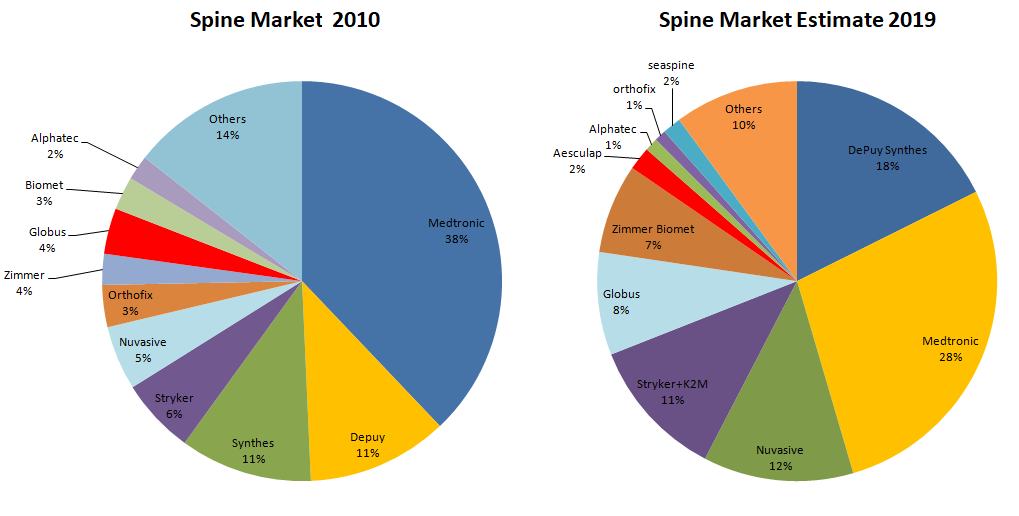

For Medtronic, definitively yes! In 1998 they acquired Sofamor Danek and become the market leader. In those times, with the market growing strongly, they launched innovative products as Sextant (2002) and the Bryan cervical disc prothesis (2003).In 2010, Medtronic was the market leader with 38% of market share with the rest of the key players quite far: The second competitor Johnson&Johnson (Depuy) only had 11% of market share Synthes had 10%, Stryker 6% and the rest of players were below 5%.

Today, things have changed and Medtronic is still the leader but with a market share decreased from 38% to 28%. Other important companies such as Depuy with Synthes, Zimmer with Biomet (that have already acquired LDR) or now Stryker with K2M have looked for acquisitions as a way of acquiring market share. Nuvasive or Globus Medical have nevertheless opted for the development and promotion of innovative products and techniques.

How the Future looks like?

- Commoditization: Products and technologies will become more and more similar (Me-too products) and with increased price pressure.The big companies will seek differentiation through technology such as robotics and navigation. The business will not be the implants but the global offers that include technological solutions that provide added value in safety and efficacy.

- The Spine Market will decline over the next years.

Where Growth will come from? Big Fish eats small fish!

- Since the market will have a low growth rate, there will be a growing trend for consolidation among companies.In 2018, a number of notable acquisitions played out.Learn about acquisitions in 2018 in: https://thespinemarketgroup.com/category/acquisitions/

- Nuvasive and Globus Medical will be purchased or will have to buy companies considering that they are only focused on the spinal market. The rest of its competitors ( Medtronic, DePuy Synthes, Stryker, Zimmer Biomet)are larger and more diversified in other markets.We will see it very soon!

- Zimmer Biomet: Although Zimmer bought Biomet and LDR they are in the same position they were 10 years ago. They are still number 6 in the market (with more market share of course!). If they want to grow they will have to do what Stryker has done with K2M. They will have to buy a big Spinal player as Nuvasive or Globus Medical?

- Small Companies: Will have many problems to grow. Since the margins go down, probably most of the investors will be increasingly moving out of Spine.Many existing smaller spine companies are already bankrupt or will be acquired.

SO, Is the past of the spinal market better than the present? YES it is , at least for most of the companies. It is true, that were there are problems, there are challenges and some companies will become stronger. But in thismature market where growth comes from stealing or bying market share from others, most of the players will lose.