Lyon (France), April 11, 2023 – 6 pm CEST – SMAIO (Software, Machines and Adaptative Implants in Orthopaedics – Euronext Growth Paris ISIN: FR0014005I80 / Ticker: ALSMA), a French player specialized in complex spine surgery with a global offer comprising software, today published its 2022 annual results1 approved by the Board of Directors on April 11, 2023.

Philippe ROUSSOULY, Chairman and CEO of SMAIO, said: “The year 2022 has allowed SMAIO to consolidate its foundations which should enable it to achieve its main objectives for 2023: to develop its surgical planning software solutions in new countries and above all to accelerate the penetration of the North American market, the leading spine market in the world. Indeed, we have strengthened our presence there during 2022 by obtaining two 510(k) registrations and by conducting educational programs and first surgeries. In addition, since our IPO, which helped strengthen our financial structure, we continue to work closely with our partner and shareholder NuVasive, a U.S. leader in spine technology innovations. Our goal is to achieve, during the first half of 2023, an initial milestone of $3 million from this collaboration, as well as recurring revenues from imaging analysis services performed by SMAIO operators for NuVasive customers. As a result, we look forward to 2023 with confidence as we focus on ramping up our international development strategy, particularly in the U.S.”

Annual results 2022

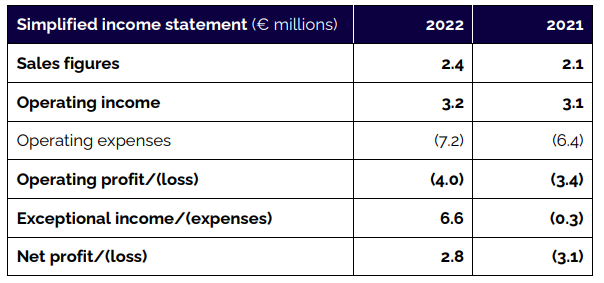

Sales amounted to €2.4 million in 2022, up +15% on the previous year. This growth is mainly driven by international operations, in particular by the ramping up of historical distribution contracts in Spain and Scandinavia, by new agreements signed in Greece and the Baltic States, and by the first surgeries performed in the United States.

As in 2021, sales of implants and rods accounted for 95% of SMAIO’s activity and the software segment, with the Keops platform, represents the balance. As a reminder, the latter segment is expected to grow in the coming months, driven in particular by the FDA 510(k) clearance for the Balance Analyzer 3D software and the partnership and licensing agreement with NuVasive2 .

The margin on cost of sales improved significantly, rising from 55% in 2021 to 63% in 2022. This is a direct consequence of the better purchasing conditions negotiated in 2021 and also of the growth in international sales in high value-added markets.

Other operating expenses increased mainly due to the amortization of new instrument kits loaned out or given to hospitals on consignment, the amortization of R&D costs reflecting the innovation momentum, the depreciation of inventories, and the commercial resources for the deployment of the Kheiron system. Depreciation, amortization and operating provisions amounted to €1.5 million, compared with €1.1 million in 2021. This change is explained by the continued increase in the base of R&D costs, a growing volume of instrument kits amortized over 5 years, and the recognition of the risk of obsolescence on implants.

Taking into account the above-mentioned factors, 2022 operating income is down to €(4.0) million compared with €(3.4) million in 2021.

The exceptional result amounts to €6.6 million and results almost entirely from the dropping of the current account held by Japanese group Otsuka – SMAIO’s former core shareholder – in favor of the Company for €7.4 million, as well as the merger loss of the company Sylorus Robotics for a value of €(0.6) million.

After taking into account a research tax credit of €0.3 million, net income for 2022 is a profit of €2.8 million compared with a loss of €(3.1) million for the same period in 2021.

Solid financial structure

Cash and cash equivalents at December 31, 2022 amounted to €5.69 million, compared with €0.57 million at December 31, 2021. This increase is explained by the integration of the net proceeds of €7.5 million from the capital increase carried out at the time of SMAIO’s IPO on Euronext Growth in April 2022. This level of cash enables the company to cover the financing needs related to the developments presented to the financial community at the time of this capital increase.

Shareholders’ equity stood at €9.75 million at December 31, 2022, compared with €(0.62) million at December 31, 2021.

As a reminder, on February 1, 2022, Otsuka announced that it was discontinuing its orthopedic business and decided to transfer its shares to the Vice President of Operations of SMAIO, as well as its current account, to SMAIO’s sole other shareholder, Sylorus Scientific3. It also decided to entirely cancel SMAIO’s current account debt, thereby completely deleveraging the company.

2022 highlights: structural steps achieved to accelerate penetration of the US market

- Partnership with NuVasive

As part of the partnership, NuVasive has committed to invest a total of $10 million (€9 million4) in the Company, of which $5 million (approximately €4.5 million4) has already been invested at the time of SMAIO’s IPO in early April 2022, with the balance consisting of milestone payments to be made once the Company has obtained FDA 510(k) clearance for two software solutions interfacing with the US group’s technology platforms.

- Two 510(k) clearences to accelerate development in the United States

In June 2022, SMAIO announced the granting of two FDA 510(k) clearances for key components of its i-Kontrol platform: the Balance Analyzer 3D surgery planning software and the K-rod patient-specific union rod. With these clearances, SMAIO is able to offer its i-Kontrol solution in North American medical centers.

- Success of the Sagittal Alignment Academy educational programs

During the second half of 2022, SMAIO successfully held three “Sagittal Alignment Academy” sessions for European (Copenhagen for Northern Europe and Madrid for Southern Europe, in September) and North American (Dallas, USA, in November) spine surgeons. Bringing together several dozen surgeons, these programs aim to accelerate the international distribution of SMAIO’s technology.

Strategy and outlook: focus on US development, internationalization and innovation

In line with the roadmap deployed since its IPO, SMAIO’s priority in 2023 will be to ensure:

1. the ramping up of the partnership with NuVasive, focused on the development of a customized version of the i-plan platform for NuVasive, entitling SMAIO to a first milestone payment of $3 million. In parallel, the Company aims to develop an image analysis service for NuVasive customers.

2. marketing the i-Kontrol solution in Europe, the United States and Australia. To do so, the company will rely on its own sales force, its partner NuVasive in the United States, and a network of distributors and agents.

3. the development of innovative R&D projects designed to improve the precision, speed and reliability of spine surgery, with morphologically adapted guides manufactured 3D-printed from scans of the vertebrae to be operated on, enabling implants to be accurately positioned in the pedicles, or morphologically adapted trackers enabling the detection of vertebrae in space in order to navigate them or to guide a robotic arm.

About SMAIO

A precursor in the use of clinical data and imaging of the spine, SMAIO designs global solutions for spine surgery specialists. The Company has recognized expertise thanks to KEOPS, its Big Data management software that has become a global reference with more than 100,000 patient cases documented.

SMAIO offers spine surgeons a comprehensive platform, I-Kontrol, incorporating planning, implants and related services, enabling them to treat spinal pathologies in a safe, effective and lasting way.

SMAIO is positioned at the forefront of innovation with the ambition of providing surgeons with the first active robotic solution enabling a high level of performance and repeatability to be achieved.

Based in Lyon, France, SMAIO benefits from the skill and expertise of more than 30 highly specialized staff.

For further information, please visit our website: www.smaio.com

1 Audit procedures have been carried out on annual accounts. The management report, the corporate governance report, the annual financial statements and the auditor’s report on these annual financial statements will be posted on the Company’s website (www.smaio-finance.com) and on the Euronext website (www.euronext.com).

2 On February 9, 2023, Globus Medical, a U.S.-based company that manufactures and markets a full range of spinal devices and implants, signed an agreement to acquire NuVasive in an all-stock transaction valued at approximately $3.1 billion. As of the date of the publication of the annual financial report and the information available to SMAIO, NuVasive owns 15.55% of the Company’s share capital. To the best of the Company’s knowledge, this transaction does not impact the commercial agreement between SMAIO and NuVasive.

3 Sylorus Scientific SA is 80% owned by Philippe Roussouly, CEO of SMAIO, and by Pierre Roussouly (Philippe’s father) for the balance.

4 Based on an indicative exchange rate of 1 euro for 1.10 dollar

Next financial events:

- Annual General Meeting: June 20, 2023

- H1 2023 sales: July 18, 2023 (after market)

- H1 2023 results: October 18, 2023 (after market)

Listing market: Euronext Growth Paris

ISIN: FR0014005I80

Mnemonic: ALSMA

Contacts

SMAIO

Philippe Roussouly

Chief Executive Officer

Renaut Fritsch

Chief Financial Officer

[email protected]

NewCap

Dusan Oresansky/Quentin Massé

Investor Relations

[email protected]

Tel.: +33 (0)1 44 71 94 92

NewCap

Arthur Rouillé

Media Relations

[email protected]

Tel.: +33 (0)1 44 71 94 98

Disclaimer

This press release contains non-factual elements, including, but not limited to, certain statements regarding future results and other future events. These statements are based on the current vision and assumptions of the management of the Company. They incorporate known and unknown risks and uncertainties that could result in significant differences in results, profitability and expected events. In addition, SMAIO, its shareholders and its affiliates, directors, officers, counsels and employees have not verified the accuracy of, and make no representations or warranties about, statistical information or forecast information contained within this news release and that originates or is derived from third party sources or industry publications; these statistical data and forecast information are only used in this press release for information purposes. Finally, this press release may be drafted in French and in English. In the event of differences between the two texts, the French version will prevail.

SOURCE: https://www.smaio-finance.com/images/PDF/PR_SMAIO_FYR-2022_EN.pdf; https://www.smaio-finance.com/index.php/en/press-releases