LYON, France–(BUSINESS WIRE)–SMAIO (Software, Machines and Adaptative Implants in Orthopaedics – Euronext Growth Paris ISIN: FR0014005I80 / Ticker: ALSMA, eligible for PEA-PME equity savings plans) (Paris:ALSMA), a French player specialized in complex spine surgery with a global offer comprising software, adaptative implants and related services, today published its 2021 annual results1, approved by the Board of Directors on April 29, 2022, and confirmed its 2022 outlook.

Philippe ROUSSOULY, CEO of SMAIO, commented: “On behalf of the entire SMAIO team, I would again like to thank all the shareholders, including our partner NuVasive, who contributed to the success of our IPO on the Euronext Growth market. The funds raised through this operation will help us effectively deploy our unique and global solution in spine surgery, i-kontrol, which combines precise planning, customized execution and analytic monitoring of patient data over time. In 2022, we are intending to significantly accelerate our commercial development, notably in North America thanks to NuVasive’s support, and to make full use of the immense potential of our KEOPS database and our tailor-made surgical technologies in order to pave the way for the gradual automation of spine surgery procedures”.

2021 annual results

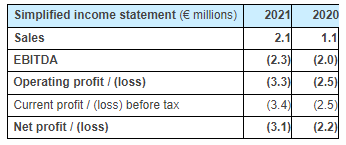

Annual sales totaled €2.1 million in 2021, an increase of +73% compared with the previous year (€1.2 million) that had been affected by the spread of the Covid-19 pandemic. Although the public health situation improved in 2021, the Company continued to suffer the consequences of the crisis with the impossibility of accessing certain key markets such as the United States and United Kingdom, travel restrictions having only been lifted at the end of the year. Sales therefore remained concentrated in France (60% of activity), although the first export distribution contracts signed in 2020 have begun to bear fruit, underpinned at the end of 2021 by a distribution agreement for the Australian market.

From the second half of 2021, the Company began to market its patient-specific K-rods with around a hundred surgical procedures performed, primarily in France. Marketing authorization requests were filed with the FDA to obtain approval to market these tailor-made implants in the United States, a market that strongly values technological innovations.

The margin on implant sales improved from 53% in 2020 to 55% in 2021, thanks to better procurement conditions negotiated in 2021 with a second qualified subcontractor. Nevertheless, sales via distributors, which now account for close to 40% of total sales and generate lower margins than direct sales, weighed on the general improvement in margins, which should see a significant increase once the Company is in a position to develop its sales in the United States.

Other operating expenses, primarily comprising external costs and wages and social security contributions, increased in line with the development of sales activity, the intensification of R&D efforts, legal restructuring operations undertaken prior to the IPO and staff taken on in the second half of 2020 and the first half of 2021. The total payroll increased by approximately 27% on the previous year, but its proportion of total operating expenses fell (to 44% in 2021 from 49% in 2020).

Depreciation and provisions totaled €1.1 million, versus €0.6 million the previous year. This increase was a result of the rise in R&D spending and thus the amortization of corresponding capitalized costs, the supplying to health facilities of a growing volume of sets of instruments amortized over 5 years and the taking into account of the low consumption level of inventories of implants of extreme sizes.

Incorporating the elements detailed above, the 2021 operating loss was €3.3 million, compared with a loss of €2.5 million in 2020, the increase in operating expenses primarily associated with the increase in the payroll and with development projects not yet being sufficiently offset by the mark-ups generated by the growth in sales.

Strengthened financial structure

SMAIO’s cash and cash equivalents (€574 thousand at end-2021) were strengthened at the end of the first quarter of 2022 by the €8 million in net proceeds generated by the capital increase undertaken at the time of the Company’s IPO on the Euronext Growth market in Paris. SMAIO’s current cash position will allow it to finance the Company’s development in accordance with the strategy presented at the time of its IPO.

Implementation of the value-creating partnership with NuVasive

Sharing a similar vision of the importance of spinal realignment planning and implant placement to achieve favorable, repeatable and long-lasting results, in the first quarter of 2022 NuVasive, a global leader in spine technology innovation, and SMAIO signed a partnership and licensing agreement to further develop SMAIO’s surgical planning solutions and to support the innovation pipeline and commercialization efforts.

As part of this collaboration, NuVasive has pledged to invest a total of $10 million (€9m2) in the Company, of which $5 million (approximately €4.5 million) has already been invested within the framework of SMAIO’s IPO in early April. The balance will consist of milestone payments made when the Company receives FDA 510(k) clearance for two software solutions interfacing with the American group’s technological platforms.

NuVasive has exclusivity regarding the planning tool development partnerships implemented by SMAIO for a three-year period from the date on which the second software solution is approved.

Moreover, within the framework of this partnership, the Company will put in place an image analysis and planning assistance service for NuVasive’s clients, which will be billed and will thus generate recurring payments proportional to the number of analyses performed.

Strategy and outlook

In 2022, and in accordance with the strategy announced at the time of its IPO, the Company will pursue three key objectives:

1. The implementation and ramping up of the partnership with NuVasive, focusing on the development of a customized version of the i-plan platform for NuVasive (including the KEOPS, Balance Analyzer 3D and SPIDER Plan software and related services) and, at the same time, an image analysis service offer.

2. The development of the i-kontrol solution’s marketing activity in Europe, the United States and Australia. To achieve this, the Company will build on its own sales force, its partner NuVasive for the commercialization of its surgery planning services in the United States and a network of distributors and agents in Europe, Australia and the United States.

3. The development of innovative R&D projects aimed at improving the accuracy, speed and reliability of spine surgery, with morphologically adapted guides 3D-printed from scans of the vertebrae to be operated upon enabling implants to be accurately positioned in the pedicles, or morphologically adapted trackers allowing vertebrae to be detected in space in order to steer them or guide a robotic arm.

Upcoming financial events:

- Shareholders’ AGM: June 20, 2022

- Publication of H1 2022 sales: July 12, 2022, after market

About SMAIO

A precursor in the use of clinical data and imaging of the spine, SMAIO designs global solutions for spine surgery specialists. The Company has recognized expertise thanks to KEOPS, its Big Data management software that has become a global reference with more than 100,000 patient cases documented.

SMAIO offers spine surgeons a comprehensive platform, I-Kontrol, incorporating planning, implants and related services, enabling them to treat spinal pathologies in a safe, effective and lasting way.

SMAIO is positioned at the forefront of innovation with the ambition of providing surgeons with the first active robotic solution enabling a high level of performance and repeatability to be systematically achieved.

Based in Lyon, France, SMAIO benefits from the skill and expertise of more than 30 highly specialized staff.

For further information, please visit our website: www.smaio.com

Listing market: Euronext Growth Paris

ISIN: FR0014005I80

Mnemonic: ALSMA

Disclaimer

This press release contains non-factual elements, including, but not limited to, certain statements regarding future results and other future events. These statements are based on the current vision and assumptions of the management of the Company. They incorporate known and unknown risks and uncertainties that could result in significant differences in results, profitability and expected events. In addition, SMAIO, its shareholders and its affiliates, directors, officers, counsels and employees have not verified the accuracy of, and make no representations or warranties about, statistical information or forecast information contained within this news release and that originates or is derived from third party sources or industry publications; these statistical data and forecast information are only used in this press release for information purposes. Finally, this press release may be drafted in French and in English. In the event of differences between the two texts, the French version will prevail.

1 Audit procedures have been carried out on annual accounts. The management report, the corporate governance report, the annual financial statements and the auditor’s report on these annual financial statements were posted on 29 April 2022 on the Company’s website (www.smaio-finance.com) and on the Euronext website (www.euronext.com).

2 Based on an indicative exchange rate of 1 euro for 1.10 dollars

Contacts

SMAIO

Philippe Roussouly

Chief Executive Officer

Fabrice Kilfiger

Chief Financial Officer

[email protected]

NewCap

Dusan Oresansky/Quentin Massé

Investor Relations

[email protected]

Tel.: +33 (0)1 44 71 94 92

NewCap

Nicolas Merigeau

Media Relations

[email protected]

Tel.: +33 (0)1 44 71 94 98