- SMAIO first-half 2023 sales at €4.0m, excluding intra-group (1) transactions, up a sustained +203% thanks to NuVasive milestone payment of $3m (~€2.8m)

- Further improvement in margin on “non-group” implant sales to 67% vs. 63% in 2022 and 55% in 2021

- Solid cash position of €7.3m at June 30, 2023, excluding €1.5m non-dilutive financing obtained from SMAIO’s longstanding banking partners

Lyon, October 18, 2023 – 6pm CEST – SMAIO (Software, Machines and Adaptative Implants in Orthopaedics – Euronext Growth Paris, ISIN Code: FR0014005I80 / Mnemonic: ALSMA), a French player specialized in complex spine surgery with a comprehensive offer including software, adaptative implants and related services, today published its first-half 2023 (2) results, approved by the Board of Directors on October 17, 2023.

Philippe ROUSSOULY, Chairman and CEO of SMAIO, comments: “In the first half of 2023, we have efficiently deployed our strategic plan in the United States, leveraging our collaboration with NuVasive and training local prescribing surgeons to enable the spread of our i-kontrol offering. At the same time, we have improved our profitability indicators, with margins on implant sales reaching 67% thanks to the optimization of our purchasing conditions. Finally, we have pursued a targeted R&D policy which has enabled us to preserve our cash position in preparation for our commercial expansion. Building on these achievements, we look forward to the coming half-years with confidence, as we continue to implement our strategic plan, which will focus primarily on increasing our sales and boosting our profitability.”

SMAIO USA, a wholly owned subsidiary of SMAIO, was incorporated at the end of 2022 to expand into the strategic US market. Not exceeding any of the 3 thresholds set by art. R233-17 of the French Commercial Code, and as the SMAIO USA subsidiary does not make a material contribution to Group earnings, SMAIO has not produced consolidated financial statements for the first half of 2023.

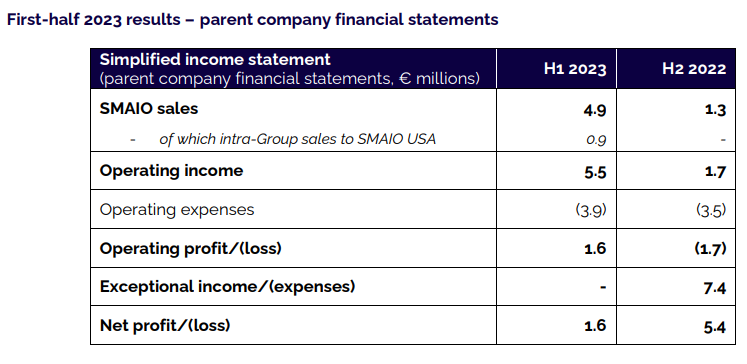

Considering intra-Group sales of implants, instruments and services of €0.9m to the SMAIO USA subsidiary, SMAIO sales totaled €4.9 million.

Strong sales growth was driven by international business, which accounted for 88% of total sales to June 30, 2023, and mainly includes a $3 million (around €2.8 million) payment from NuVasive (3) following FDA 510(k) certification of a customized version of its surgical planning software.

Restated for intra-group transactions with its US subsidiary, SMAIO sales for the 1st half of 2023 came to €4.0 million, up +203% on the first half of 2022, as published on July 18, 2023.

Half-year sales of the Kheiron system, comprising custom-made implants and rods, remained stable compared to the same period in 2022, with good growth in Spain and Sweden. The ramp-up of the Kheiron system should be supported by the opening of the US market in the second half of 2023, with several US centers finalizing registration procedures for SMAIO implantable devices.

The software segment is expected to grow in the coming halves thanks to the partnership and licensing agreement signed with NuVasive. Under this agreement, SMAIO, through its US subsidiary SMAIO USA, will be able to offer its planning services to NuVasive customers and generate additional recurring revenues from late 2023 / early 2024, depending on the registration times required in the targeted US hospitals.

The margin on implant sales, restated for intra-group operations with its subsidiary SMAIO USA, improved significantly to 67% in the first half of 2023, compared with 63% in the first half of 2022 and 55% in 2021. This margin should increase automatically as the US subsidiary gains strength in a highly profitable market.

Other operating expenses rose mainly because of the Company’s sustained efforts to promote its various solutions to surgeons via training courses in Europe and the United States. Depreciation, amortization and provisions remained stable at €0.6 million.

In view of the above, SMAIO’s operating income for the first half of 2023 is a profit of €1.6 million (€0.9 million restated for intra-group transactions with its subsidiary SMAIO USA), compared with a loss of €1.8 million for the first half of 2022.

After considering tax income of €0.1 million, SMAIO’s net profit for the first half of 2023 stood at €1.6 million, compared with a profit of €5.4 million for the first half of 2022, the latter having benefited from exceptional income of €7.4 million linked to the abandonment of the current account held by the Japanese group Otsuka – SMAIO’s historical shareholder – to the Company’s benefit.

Solid financial structure

Cash position at June 30, 2023 stood at €7.3 million, compared with €5.7 million at December 31, 2022. This increase was due to good control over cash burn levels, the payment relating to the milestone achieved with NuVasive and the receipt of the €1 million Bpifrance Innovation R&D loan that includes a 3-year grace period.

SMAIO continued to optimize its financial structure with two loans from a banking pool comprising BNP Paribas and Société Générale, for a total of €1.5 million and a 4-year maturity. The two loans were drawn down on September 1st and October 1st, 2023 respectively.

Considering intra-group transactions with its subsidiary SMAIO USA, the Company’s shareholders’ equity stood at €11.4 million at June 30, 2023 (€10.7 million restated for intra-group transactions), compared with €9.7 million at December 31, 2022.

Strategy and outlook: implementation of growth plan and development in the United States

The Company is continuing to implement its strategic plan presented at the time of the IPO in April 2022, and will focus on:

- pursuing its efforts to develop custom planning software for NuVasive;

- accelerating the marketing of the i-kontrol solution in Europe, Australia and the United States through its American subsidiary;

- maintaining the development of innovative R&D projects aimed at improving the accuracy, speed and reliability of spine surgery, such as morphologically adapted guides 3D-printed from scans of the vertebrae to be operated on, enabling implants to be accurately positioned in the pedicles, or morphologically adapted trackers allowing vertebrae to be detected in space in order to steer them or guide a robotic arm.

About SMAIO

A precursor in the use of clinical data and imaging of the spine, SMAIO designs global solutions for spine surgery specialists. The Company has recognized expertise thanks to KEOPS, its Big Data management software that has become a global reference with more than 100,000 patient cases documented.

SMAIO offers spine surgeons a comprehensive platform, I-Kontrol, incorporating planning, implants and related services, enabling them to treat spinal pathologies in a safe, effective and lasting way.

SMAIO is positioned at the forefront of innovation with the ambition of providing surgeons with the first active robotic solution enabling a high level of performance and repeatability to be achieved.

Based in Lyon, France, SMAIO benefits from the skill and expertise of more than 30 highly specialized staff.

For further information, please visit our website: www.smaio.com

1 SMAIO sales came to €4.9m, including intra-group transactions with its subsidiary SMAIO USA..2 Data not audited. The half-yearly financial report on SMAIO’s parent company financial statements is available, in French, on the Company’s website (www.smaio-finance.com) and on the Euronext website (www.euronext.com).3 On February 9, 2023, Globus Medical, a U.S.-based company that manufactures and markets a full range of spinal devices and implants, signed an agreement to acquire NuVasive in an all-stock transaction valued at approximately $3.1 billion. As of the date of the publication of the half-year financial report and the information available to SMAIO, NuVasive owns 15.55% of the Company’s share capital. To the best of the Company’s knowledge, this transaction does not impact the commercial agreement between SMAIO and NuVasive.

Source: https://www.smaio-finance.com/images/PDF/PR_SMAIO_HYR-2023_18-10-2023.pdf

Contacts

SMAIO

Philippe Roussouly

Chief Executive Officer

Renaut Fritsch

Chief Financial Officer

[email protected]

NewCap

Dusan Oresansky/Quentin Massé

Investor Relations

[email protected]

Tel.: +33 (0)1 44 71 94 92

NewCap

Arthur Rouillé

Media Relations

[email protected]

Tel.: +33 (0)1 44 71 94 98

Listing market: Euronext Growth Paris

ISIN: FR0014005I80

Ticker: ALSMA

Disclaimer

This press release contains non-factual elements, including, but not limited to, certain statements regarding future results and other future events. These statements are based on the current vision and assumptions of the management of the Company. They incorporate known and unknown risks and uncertainties that could result in significant differences in results, profitability and expected events. In addition, SMAIO, its shareholders and its affiliates, directors, officers, counsels and employees have not verified the accuracy of, and make no representations or warranties about, statistical information or forecast information contained within this news release and that originates or is derived from third party sources or industry publications; these statistical data and forecast information are only used in this press release for information purposes. Finally, this press release may be drafted in French and in English. In the event of differences between the two texts, the French version will prevail.