- In November 2023, entered into a new four-year financing agreement with borrowing capacity of up to $150 million

- Net sales of $184.0 million, an increase of 61% on a reported basis and an increase of 8% on a pro forma basis when normalizing for a one-time stocking order that occurred in the third quarter of 2022 for SeaSpine

- Bone Growth Therapies growth of 15%, marking three consecutive quarters with double-digit net sales increases, with growth coming from both spine and fracture portfolios

- U.S. spinal implants, biologics, and enabling technologies sales growth of 7% on a pro forma basis over prior year

- Global Orthopedics net sales increase of 7% on a reported basis over prior year, with 14% growth in the US

- Adjusted EBITDA of $13.5 million, or 7.3% of sales, representing 36% sequential growth over the second quarter of 2023

LEWISVILLE, Texas–(BUSINESS WIRE)–Orthofix Medical Inc. (NASDAQ:OFIX) today reported its financial results for the quarter ended September 30, 2023. Net sales were $184.0 million, earnings per share (“EPS”) was $(0.77), and adjusted EPS was $0.07.

“Orthofix has performed well and operated smoothly following the announcement of our management transition. The Company saw very strong growth across multiple business segments and product lines. Our complementary portfolio is driving even further incremental cross selling opportunities,” said Catherine Burzik, Chair of the Board and Interim Chief Executive Officer of Orthofix. “Sales momentum is strong, and we are laser focused on driving shareholder value via profitable growth and merger synergy realization. We expect the company to deliver much higher adjusted profits next year and to exit 2024 cash-flow positive. I am highly confident in the future of the company.”

Financial Results Overview

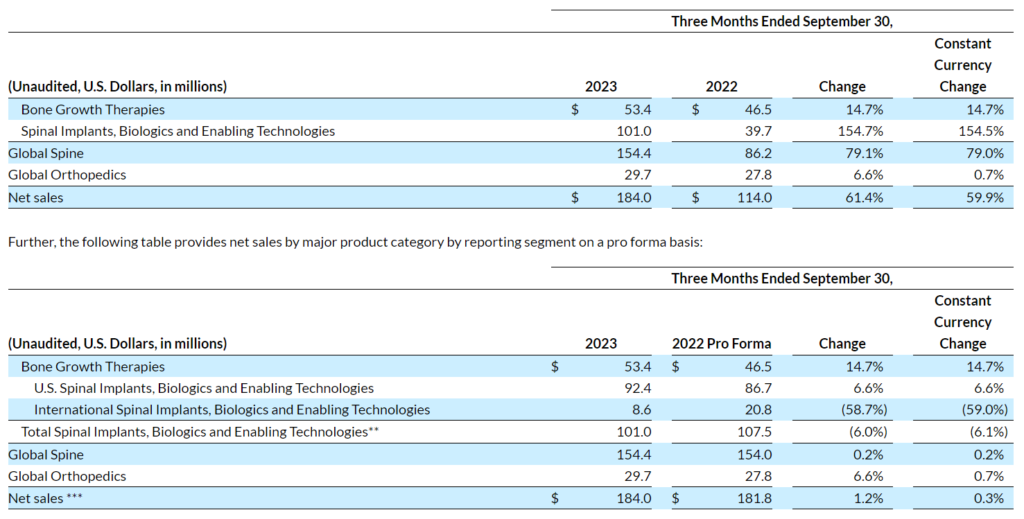

The following table provides net sales by major product category by reporting segment as reported:

** Pro forma net sales for 2022 for Spinal Implants, Biologics, and Enabling Technologies include the impact of final Spinal Implant stocking orders to European distributors prior to SeaSpine’s exit from that market. Excluding the impact of these transactions, net sales growth for this product category was 5.8% on a pro forma reported basis and pro forma constant currency basis.

*** Pro forma net sales for 2022 include the impact of final Spinal Implant stocking orders to European distributors prior to SeaSpine’s exit from that market. Excluding the impact of these transactions, net sales growth was 8.4% on a pro forma reported basis and 7.4% on a pro forma constant currency basis.

Gross profit increased $36.3 million to $119.8 million. Gross margin decreased to 65.1% compared to 73.2% in the prior year period. Adjusted gross profit increased $46.7 million to $130.7 million. Adjusted gross margin was 71.0% compared to 73.6% in the prior year period.

Net loss was $(28.9) million, or $(0.77) per share, compared to net loss of $(10.7) million, or $(0.53) per share in the prior year period. Adjusted net income was $2.7 million, or $0.07 per share, compared to adjusted net income of $6.1 million, or $0.30 per share, in the prior year period.

Adjusted EBITDA was $13.5 million, or 7.3% of net sales, compared to $14.3 million, or 12.5% of net sales, in the prior year period.

Liquidity

As of September 30, 2023, cash totaled $33.7 million, compared to $50.7 million as of December 31, 2022. As of September 30, 2023, the Company had $70.0 million in borrowings outstanding under its five year $175 million secured revolving credit facility. The Company subsequently borrowed an additional $9.0 million in October 2023. On a year-to-date basis through September 30, 2023, cash flow from operations decreased $25.2 million to $(39.1) million, while free cash flow decreased $54.9 million to $(86.1) million.

Subsequent to the quarter, on November 6, 2023, the Company entered into a Financing Agreement (the “Financing Agreement”) with Blue Torch Finance LLC, as administrative agent and collateral agent, and certain lenders party thereto. The Financing Agreement provides for a $100 million senior secured term loan, a $25 million senior secured delayed draw term loan facility, and a $25 million senior secured revolving credit facility, each of which mature on November 6, 2027. In connection with entering into the Financing Agreement, the Company repaid in full amounts outstanding and terminated all commitments under the Company’s prior $175 million senior secured revolving credit facility. For additional discussion of the Financing Agreement, see the Company’s Current Report on Form 8-K as filed with the SEC on November 8, 2023.

Business Outlook

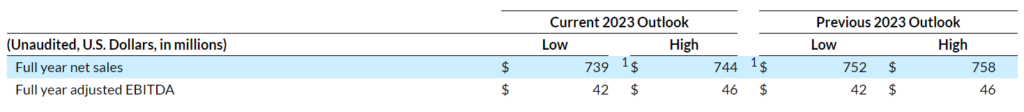

As of the date hereof, the Company expects the following financial results for the year ended December 31, 2023. These expectations are based on the current foreign currency exchange rates and do not take into account any additional potential exchange rate changes that may occur this year.

1 Represents a year-over-year increase of 60.4% to 61.5% on a reported basis and an increase of 5.4% to 6.2% on a pro forma basis.

The Company is unable to provide expectations of GAAP income (loss) before income taxes, the closest comparable GAAP measures to Adjusted EBITDA (which is a non-GAAP measure), on a forward-looking basis because the Company is unable to predict without unreasonable efforts the ultimate outcome of matters (including acquisition-related expenses, accounting fair value adjustments, and other such items) that will determine the quantitative amount of the items excluded in calculating Adjusted EBITDA, which items are further described in the reconciliation tables and related descriptions below. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with GAAP.

Conference Call

Orthofix will host a conference call today at 4:30 PM Eastern time to discuss the Company’s financial results for the third quarter of 2023. Interested parties may access the conference call by dialing (888) 330-2508 in the U.S. and Canada, and (240) 789-2735 in all other locations, and referencing the access code 9556380. A replay of the call will be available for three weeks by dialing (800) 770-2030 in the U.S. and Canada, and (647) 362-9199 in all other locations, and entering the access code 9556380. A webcast of the conference call may be accessed at ir.Orthofix.com.

About Orthofix

The newly merged Orthofix-SeaSpine organization is a leading global spine and orthopedics company with a comprehensive portfolio of biologics, innovative spinal hardware, bone growth therapies, specialized orthopedic solutions and a leading surgical navigation system. Its products are distributed in approximately 68 countries worldwide. The Company intends to announce a new name for the Orthofix-SeaSpine organization in the future, but in the interim will continue to operate under the Orthofix name.

The Company is headquartered in Lewisville, Texas, and has primary offices in Carlsbad, California, with a focus on spinal product innovation and surgeon education, and Verona, Italy, with an emphasis on product innovation, production, and medical education for Orthopedics. The Orthofix-SeaSpine organization’s global R&D, commercial and manufacturing footprint also includes facilities and offices in Irvine, California; Toronto, Canada; Sunnyvale, California; Wayne, Pennsylvania; Olive Branch, Mississippi; Maidenhead, United Kingdom; Munich, Germany; Paris, France; and Sao Paulo, Brazil. For more information, please visit www.orthofix.com.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, relating to our business and financial outlook, which are based on our current beliefs, assumptions, expectations, estimates, forecasts and projections. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” or “continue” or other comparable terminology. Forward-looking statements in this communication include the Company’s expectations regarding net sales and adjusted EBITDA for the year ended December 31, 2023. Forward-looking statements are not guarantees of our future performance, are based on our current expectations and assumptions regarding our business, the economy and other future conditions, and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, including the risks described in Part I, Item 1A under the heading Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”), and in Part II, Item 1A under the heading Risk Factors in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. Factors that could cause future results to differ from those expressed by forward-looking statements include, but are not limited to, (i) our ability to maintain operations to support our customers and patients in the near-term and to capitalize on future growth opportunities, (ii) risks associated with acceptance of surgical products and procedures by surgeons and hospitals, (iii) development and acceptance of new products or product enhancements, (iv) clinical and statistical verification of the benefits achieved via the use of our products, (v) our ability to adequately manage inventory, (vi) our ability to recruit and retain management and key personnel, (vii) global economic instability and potential supply chain disruption caused by Russia’s invasion of Ukraine and resulting sanctions, and (viii) the other risks and uncertainties more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”). As a result of these various risks, our actual outcomes and results may differ materially from those expressed in these forward-looking statements.

This list of risks, uncertainties, and other factors is not complete. We discuss some of these matters more fully, as well as certain risk factors that could affect our business, financial condition, results of operations, and prospects, in reports we file from time-to-time with the SEC, which are available to read at www.sec.gov. Any or all forward-looking statements that we make may turn out to be wrong (due to inaccurate assumptions that we make or otherwise), and our actual outcomes and results may differ materially from those expressed in these forward-looking statements. You should not place undue reliance on any of these forward-looking statements. Further, any forward-looking statement speaks only as of the date hereof, unless it is specifically otherwise stated to be made as of a different date. We undertake no obligation to update, and expressly disclaim any duty to update, our forward-looking statements, whether as a result of circumstances or events that arise after the date hereof, new information, or otherwise, except as required by law.