Japan, with more than 127 million people, is a relevant market for spinal implants. In addition, with a population that is increasingly aging, overweight, and with a very high life expectancy, the demand is rising. The degenerative spine and osteoporotic fractures are the pathologies that drive the growth of this market, which can be around a CAGR of 7% in the period 2023-2028. But, despite being a large market and of great interest to US companies, it has significant barriers to entry. The complex and costly regulatory system, and the language issues, make it difficult for foreign companies to penetrate their spine market.

Which are the Competitors?

The leading companies in the spine market in Japan are mainly Stryker, ZimVie, Medtronic, Globus Medical Inc., and NuVasive. Additionally, there are also some local players as the following (Please visit our Japan section):

1.- Ammtec

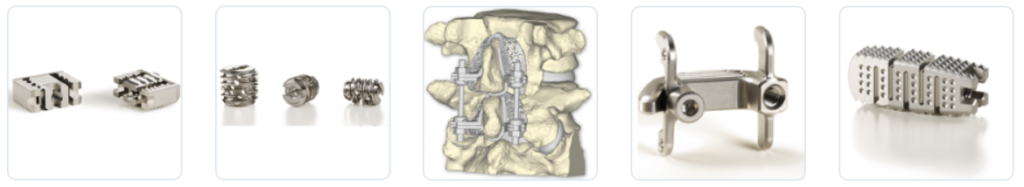

Ammtec was set up in 1997 by the founding members of Surgical Dynamics Japan (founded in 1992). At this time they launched a lumbar fusion cage as the first fixation cage for spinal surgery in Japan. Following the foundation of Ammtec, they expanded their portfolio with cervical fusion cages. Since then, they have attained a solid reputation as the pioneer in cage fixation for spinal surgery in Japan. Currently, Ammtec provides the spinal fusion cage “m-cage” series as the flagship product line. Additionally, their product portfolio includes laminoplasty plates, titanium PLIF/TLIF cages, the SWIFT interspinous device, and the TM fixation system.

Since its foundation in 1997, Ammtec gradually shifted its function from a trading company to manufacturing its own products. In 2011, they acquired ISO13485, which allows them to present our unique products to the foreign spine market.Please for more information visit: https://ammtec.co.jp/product-information/

2.-Japan Medical Dynamic Marketing

Headquartered in Shinjuku-ku, Tokyo, Japan Medical Dynamic Marketing, was founded in 1973. The company develops and markets domestic medical products and services. Its products include trauma devices, joint prostheses, spinal fixation devices, and artificial bone fillers. The company serves the needs of medical professionals and major hospitals throughout Japan. It supports about 3,100 hospitals.

In 2012, they launched the Vusion OS Interbody Cage, a product manufactured by our U.S. subsidiary ODEV.

In 2014, they entered the major spinal fusion device market by adding the Pagoda Spinal System and IBIS Spinal System to their lineup. Up to now, they have been adding products to their spine portfolio according to the changes in surgical procedures. In 2018, they started selling vertebroplasty through a new business alliance, and in 2019 they launched laminoplasty plates.

Please for more information visit: https://www.jmdm.co.jp/en/

3.- Teijin Nakashima Medical

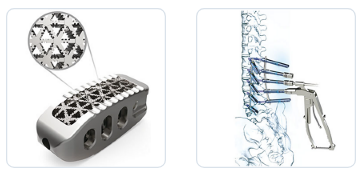

100 year ago, Nakashima Foundry was founded in Shimoishii, Okayama City as a propeller manufacturer. The company achieved dramatic growth and eventually embarked on the development and manufacture of medical devices. They entered the medical devices industry in 1987. Starting with a capital tie-up with Teijin Limited in 2015, they became a comprehensive manufacturer of orthopedics products through business acquisitions, aiming at expanding product areas and lineups. In 2018, Teijin Nakashima Medical acquired and took over the spine business of Century Medical Inc. In October 2021, Otsuka Medical entered into an agreement with Teijin Nakashima Medical Co. to transfer the spinal and fracture business of its KiSCo subsidiary through a takeover division.Their main spine products are the UNIOS PL Spacer and the Saccura Spinal System for PPS . Please for more information visit: https://www.teijin-nakashima.co.jp/en

UNIOS PL Spacer and the Saccura Spinal System

#####

We hope you find it useful and we appreciate and welcome any suggestions or comments. We may have missed some of the information or it may be inaccurate. In that case, we apologize for this. Please contact us and let us know.

All video parts, images, and documents related to the products are the sole property of the different companies. All the information is for Educational purposes only! No copyright infringement intended. We encourage you to contact us if you have any comments or suggestions or if you want us to include/remove your videos, images, or brochures. Please contact us at: [email protected]