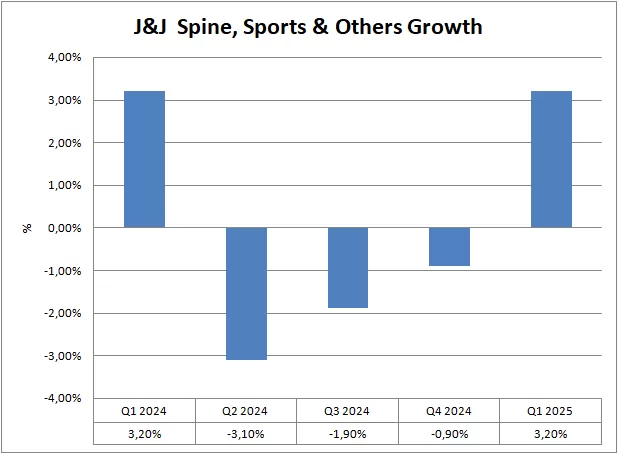

The latest results from Johnson & Johnson’s “Spine, Sports & Other” segment raise more questions than answers, especially for those of us closely watching the spine market.Over the last five quarters, the business has shown little change, with no clear growth trend. In fact, it ended Q1 2025 with the same sales figure as Q1 2024—$752 million. On the surface, that might look like stability. But in a market where innovation and execution are crucial, flat performance over an entire year suggests missed opportunities.

The main issue here is that J&J doesn’t break out the spine business separately. It’s grouped with sports medicine and “other” orthopaedic lines, which makes it hard to know how spine is really doing. Is it gaining ground or simply treading water?

What we do know is this:

- The U.S. has been the only area driving growth, while international markets have struggled.

- They started 2024 strong, but then saw a decline (especially in Q3), with only a slight recovery by year-end.

- Q1 2025 brought them back to the same numbers as a year ago.

J&J continues to invest in digital surgery and enabling technologies, which could help boost the spine business in the future. But without more transparency, it’s hard to know if the spine portfolio is evolving or just holding steady.

In a fast-moving market, standing still can be a risk. And for those of us watching this segment, the lack of clarity is part of the problem.

Q1 2024

- Worldwide Sales: $752 million

- Growth: +3.2% reported / +4.0% operational

- U.S. Sales: $432 million (+6.5%)

- International Sales: $320 million (-0.9% reported / +0.9% operational)

The year started strong, especially in the U.S., suggesting a rebound after a volatile 2023.

Q2 2024

- Worldwide Sales: $743 million

- Growth: -3.1% reported / -1.7% operational

- U.S. Sales: $430 million (-0.8%)

- International Sales: $314 million (-6.1% reported / -2.9% operational)

Momentum slowed in Q2, with a slight contraction in the U.S. and a more notable decline in international markets.

Q3 2024

- Worldwide Sales: $696 million

- Growth: -1.9% reported / -2.0% operational

- U.S. Sales: $400 million (-3.6%)

- International Sales: $296 million (+0.4%)

The downward trend continued, particularly in the U.S., while international sales remained flat.

Q4 2024

- Worldwide Sales: $735 million

- Growth: -0.9% reported / -0.6% operational

- U.S. Sales: $434 million (+1.1%)

- International Sales: $300 million (-3.6% reported / -2.9% operational)

There were modest signs of recovery in the U.S., though international performance remained under pressure.

Q1 2025

- Worldwide Sales: $752 million

- Growth: +3.2% reported / +4.0% operational

- U.S. Sales: $432 million (+6.5%)

- International Sales: $320 million (-0.9% reported / +0.9% operational)

The year began on solid footing, mirroring Q1 2024’s results, which may signal stabilization.

Key Takeaways

- Lack of granularity: J&J does not separate spinal sales from the broader “Spine, Sports & Other” category, limiting transparency into the spine business.

- U.S.-led performance: The U.S. market has consistently outperformed international markets, which have been more volatile.

- Signs of resilience: After two weak quarters mid-year, the segment is showing signs of recovery, though not yet on a sustained growth trajectory.

About Johnson&Johnson

At Johnson & Johnson, we believe health is everything. As a focused healthcare company, with expertise in Innovative Medicine and MedTech, we’re empowered to tackle the world’s toughest health challenges, innovate through science and technology, and transform patient care. All of this is possible because of our people. We’re passionate innovators who put people first, and through our purpose-driven culture and talented workforce, we are stronger than ever. Learn more at http://www.jnj.com