Medtronic plc (NYSE: MDT), a global leader in medical technology, recently released its financial results for the second quarter of fiscal year 2025, which ended on April 30, 2025. This analysis covers the company’s overall performance, with a special focus on the Spine segment (Cranial & Spinal Technologies – CST), as well as market expectations and the impact on its stock price.

1. Solid Q2 FY25 Results Driven by Operational Strength

Medtronic reported total revenues of $8.403 billion, representing a 5.3% year-over-year growth adjusted for currency fluctuations, along with an adjusted (non-GAAP) earnings per share (EPS) of $1.26, slightly exceeding analyst expectations of $1.23 (Medtronic Q2 FY25 Press Release).

This solid growth is attributed to:

- Improvements in supply chain and operational management.

- Increased demand for surgical devices and implantable technologies.

- Positive performance across nearly all business units, especially Surgery, Cardiovascular, and Spine.

2. Segment Breakdown: Spotlight on Spine

The Cranial & Spinal Technologies (CST) segment, which includes products for cranial and spinal surgery, posted revenues of $1.2 billion, up 6.7% compared to the same quarter last year. This segment remains a strategic pillar for Medtronic due to its strong growth potential in minimally invasive procedures and advanced spinal solutions (Beckers Spine, May 2025).

Key drivers behind Spine growth:

- Technological innovation: The AiBLE™ platform (Advanced intelligent Bone Leveraging Equipment) has gained traction in leading hospitals by enabling more precise, less invasive procedures. This innovation has boosted adoption of spinal implants and robotic systems, driving demand in spinal surgery (Medtronic Investor Relations).

- Growth in biologics and neurosurgery: Sales of biologic products related to spinal surgery grew in the low double digits, while neurosurgery sales increased in the mid-single digits. These trends reflect increasing complexity and specialization in treatments.

- Market expansion: Medtronic has broadened its footprint in emerging markets, where aging populations are fueling demand for degenerative spine disease treatments.

3. Outlook and Risks

Medtronic reaffirmed its guidance for fiscal 2025, projecting annual revenues between $34.3 billion and $34.8 billion and adjusted EPS in the range of $5.10 to $5.20 (Medtronic FY25 Guidance).

Opportunities:

- Acquisition integration: Ongoing strategic acquisitions are expected to strengthen the spine surgery and implantable devices portfolio, potentially accelerating organic growth.

- Continuous innovation: Sustained R&D investments position Medtronic as a leader in minimally invasive surgery, robotics, and neuromodulation—high-demand segments with promising growth.

- International expansion: Emerging markets, particularly in Asia and Latin America, offer substantial growth opportunities.

Risks:

- Regulatory pressures: Changes in healthcare regulations could slow device approvals and raise costs.

- Supply chain challenges: Potential logistical disruptions or material cost increases may affect profit margins.

- Intense competition: Rivalry with companies such as Stryker, Globus Medical, and Johnson & Johnson demands continuous innovation and cost control.

4. What Do Analysts Expect from Medtronic’s Share Price?

Medtronic’s shares recently closed at $89.92 (Yahoo Finance, July 11, 2025), with a market capitalization approaching $150 billion (Yahoo Finance).

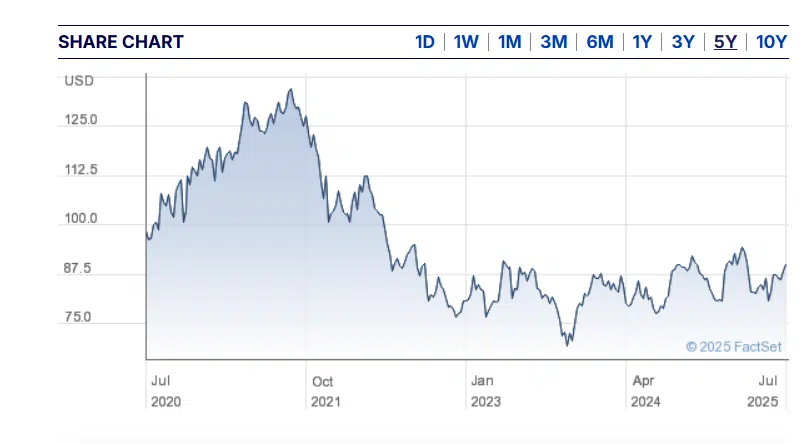

In recent years, Medtronic’s stock has shown mixed performance. According to the attached chart, the share price has experienced significant fluctuations, reaching a peak of around $125 at some point before 2020, followed by a decline to levels near $75 in later periods. Currently, the stock is trading at $89.92 (Yahoo Finance, July 11, 2025), reflecting a moderate recovery but still below its all-time highs.

Will the stock return to its peak levels?

Analysts remain cautiously optimistic. Most expect the price to trade in a range of $85 to $95 in the near term, with potential upside if the company accelerates growth in key segments like Spine and other core businesses. However, reaching previous highs would require not only strong innovation and market expansion but also a more stable macroeconomic environment, free from inflationary pressures and regulatory uncertainties.

Analyst views:

- Most analysts maintain “Buy” or “Hold” ratings, noting that the current valuation reflects moderate but stable upside potential.

- The stock is expected to trade in a range between $85 and $95 in the near term, with upside possible if Medtronic accelerates growth in the Spine segment and other core units.

- Some experts caution about possible volatility due to global macroeconomic risks, inflation, and regulatory uncertainties.

5. Is Medtronic Well Positioned for Continued Growth – and Will It Grow in Spine?

Medtronic appears well positioned for continued growth, as reflected in its solid Q2 FY25 results. The company reported revenues of $8.403 billion, representing 5.3% year-over-year growth adjusted for currency fluctuations, and delivered adjusted EPS of $1.26, slightly beating analyst expectations. A standout performer was the Cranial & Spinal Technologies (CST) segment, which grew 6.7% year-over-year, reaching $1.2 billion in quarterly revenue. Key growth drivers in Spine include the adoption of innovative platforms like AiBLE™, expansion in biologics and neurosurgery, and increased demand from emerging markets. Looking ahead, Medtronic reaffirmed its FY25 guidance with projected revenues between $34.3B–$34.8B and EPS of $5.10–$5.20. Analysts largely maintain “Buy” or “Hold” ratings, and expect the stock to trade in the $85–$95 range in the near term, with further upside if growth in Spine and other strategic areas accelerates.

While regulatory, supply chain, and competitive pressures remain, Medtronic’s operational discipline and focus on innovation suggest it may indeed be back on track—not only overall, but especially in Spine.

###