Bordeaux, Boston, October 26, 2022 – 6:00pm CEST – IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for PEA-PME plans), a medical technology company specializing in vertebral implants, today announced its revenues for the third quarter of 2022 and for the first nine months ended September 30, 2022.

Ludovic Lastennet, IMPLANET’s Chief Executive Officer, said: “We have achieved solid growth in the first nine months of 2022, both in our domestic market and in exports. This growing third quarter was also an opportunity to strengthen our positioning in the United States and to return to an annual sales rate of approximately 2 million euros in this strategic region. We also recently announced the success of our €2.77 million capital increase, combined with an additional €2.77 million fundraising to take place in Q1-2023, with the support of our partner Sanyou Medical. These funds will allow us to deploy our range of products dedicated to spine surgery on the Chinese market while reinforcing our investments in R&D and securing our products at the regulatory level. By building on all of these elements and capitalizing on our strategic partnerships, we are confident in Implanet’s ability to reach a new milestone and achieve financial stability in the medium term.”

Third quarter of 2022

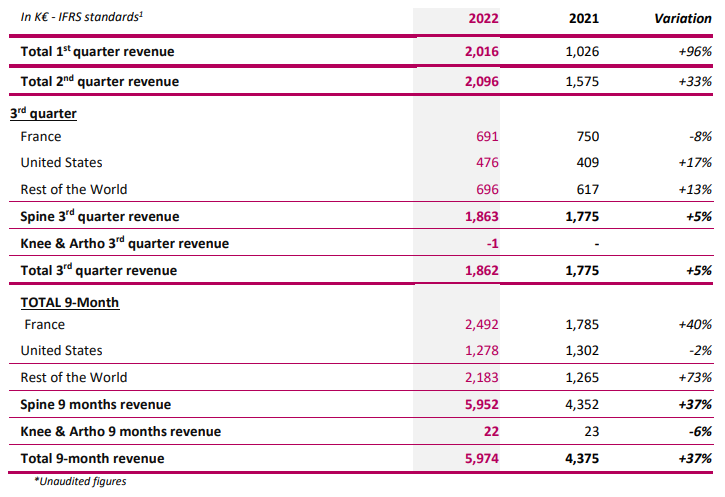

During the third quarter of 2022, the activity recorded a +5% growth, from €1.78M over the same period in 2021 to €1.86M.

Despite the fact that business in France is still affected by the shortage of hospital staff, which has prevented a return to normal levels of activity, the growth observed in the quarter is explained by:

- a 17% increase in sales in the United States, to €0.48 million from €0.41 million in the third quarter of 2021, enabling the company to return to an annual sales rate of €2.0 million in this territory. This growth is also marked by the resumption of orders and deliveries to SeaSpine.

- the acceleration of commercial development in the rest of the world, with growth of +13%, to reach €0.70 million compared to €0.62 million for the same period in 2021.

First nine months of 2022

In the first nine months of 2022, the activity increased by a factor of 1.4, i.e. by +37%, from €4.38 million in the same period in 2021 to €5.97 million. This increase is explained both by the organic growth of the JAZZ activity (+18%) and by the acquisition of OSD which generated revenues of €2.21 million in the first nine months of 2022.

In France, the activity amounts to 2.49 M€, a growth of +40% compared to the same period in 2021. Activity in the United States has returned to the level observed in 2021 thanks to the good performance recorded in the third quarter of 2022 (+17%), ensuring revenues of €1.28 million for the first nine months of 2022, compared with €1.30 million for the same period in 2021.

In the rest of the world, the export activity has been multiplied by 1.7, going from 1.27 M€ in 2021 to 2.18 M€.

Cash position

Following the success of the capital increase with preferential subscription rights announced on October 20, 2022, Implanet now has a cash position of €2.8 million. Sanyou has also informed the Company of its irrevocable intention to exercise the warrants it holds for an amount of €2.5 million during the first quarter of 2023. Completely, the payment of the balance of the MADISON businessTM , for a total amount of €2.3 million, is spread over time depending on the achievement of regulatory milestones related to CE marking, of which €0.6 million is expected in 2022 and €0.9 million in the first half of 2023. These funds will be allocated to the commercial development of the JAZZ® range in China, as well as to the finalization of the new complete range of ORION hybrid fixtures initiated with Sanyou Medical.

With these new financial resources, the Company has also decided to put an end to the issuance of new convertible bonds within the framework of the financing line, ensured by the company Nice & Green and signed on January 13, 2021.

2022 Highlights

- First surgeries in the United States with JAZZ™ PF, an innovative solution from the JAZZ® line

- First surgeries in the U.S. with the ORIGIN Cervical Spine Plate marking the first successful synergies with OSD products

- Signature of a commercial, technological and financial partnership with Sanyou Medical, the second largest Chinese manufacturer of medical devices for spinal surgery:

- Distribution agreement for Implanet’s JAZZ® platform in China, the world’s largest market (by volume) for spine surgery;

- Technology partnership: joint development of a new European range of hybrid fastening systems;

- Financial partnership: proposed capital increase with preferential subscription rights through the issue of shares with warrants attached (ABSA), guaranteed to the tune of €5 million by the partner Sanyou Medical.

- Success of the capital increase with preferential subscription rights for shareholders for an amount of € 2.77 million.

Upcoming financial event:

- 2022 annual Revenue, January 17, 2023, after market close

About IMPLANET

Founded in 2007, IMPLANET is a medical technology company that manufactures high-quality implants for orthopedic surgery. Its activity revolves around a comprehensive innovative solution for improving the treatment of spinal pathologies (JAZZ®) complemented by the product range offered by Orthopaedic & Spine Development (OSD), acquired in May 2021 (thoraco-lumbar screws, cages and cervical plates). Implanet’s tried-and-tested orthopedic platform is based on the traceability of its products. Protected by four families of international patents, JAZZ® has obtained 510(k) regulatory clearance from the Food and Drug Administration (FDA) in the United States, the CE mark in Europe and ANVISA approval in Brazil. IMPLANET employs 39 staff and recorded a consolidated revenue of €6.1 million in 2021. Based near Bordeaux in France, IMPLANET opened a US subsidiary in Boston in 2013. IMPLANET is listed on the Euronext Growth market in Paris. For further information, please visit www.Implanet.com.

1 Unaudited figures

Contacts

IMPLANET

Ludovic Lastennet, General Manager

David Dieumegard, Chief Financial Officer

Tel: 05 57 99 55 55

[email protected]

NewCap

Investor Relations

Mathilde Bohin

Nicolas Fossiez

Tel: 01 44 71 94 94

[email protected]

NewCap

Media Relations

Arthur Rouillé

Tel: 01 44 71 94 94

[email protected]