It’s only been two years but a lot has happened since 2019 that has affected the spine market. For this reason, today we want to compare the results and market shares of 2019 with those of 2021 and see what changes have occurred and which companies have been strengthened.

The Global Spine Market 2019-2021

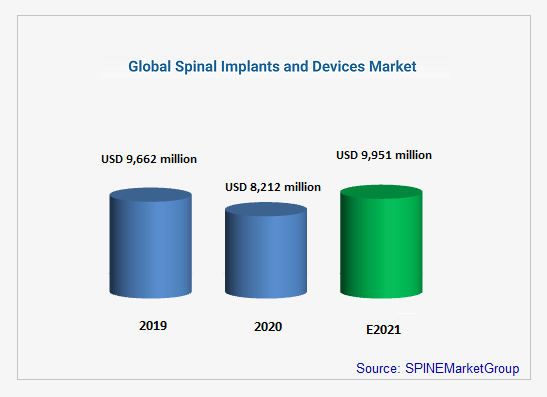

We estimate that the market value in 2019 was USD 9,662 million, falling 15% in 2020 due to Covid. Our estimate for 2021 is USD 9,951 million, which represents a growth of 3% compared to 2019.

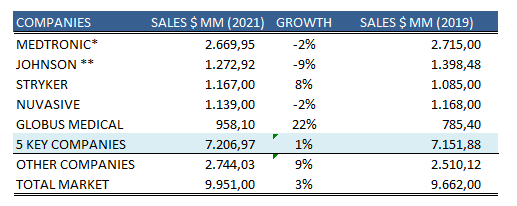

Key Companies Growth 2019-2020 Who has grown the most in the 2019-2021 period?

The most successful company in this 2019-2021 period has been Globus Medical, which has grown by 22% mainly due to the success of its Excelsius GPS robot. They have also increased their global sales by 21.4% compared to the full year 2020.As mentioned, the clinical superiority of ExcelsiusGPS® continues to be the primary factor driving Enabling Technology momentum. It is also worth mentioning ATEC, which has doubled its sales (113%) with significant organic growth and inorganic growth with the incorporation of EOS technology.

Also noteworthy is the growth of the rest of the companies above the market (+9%).The five Key Companies have only grown by 1% on average.

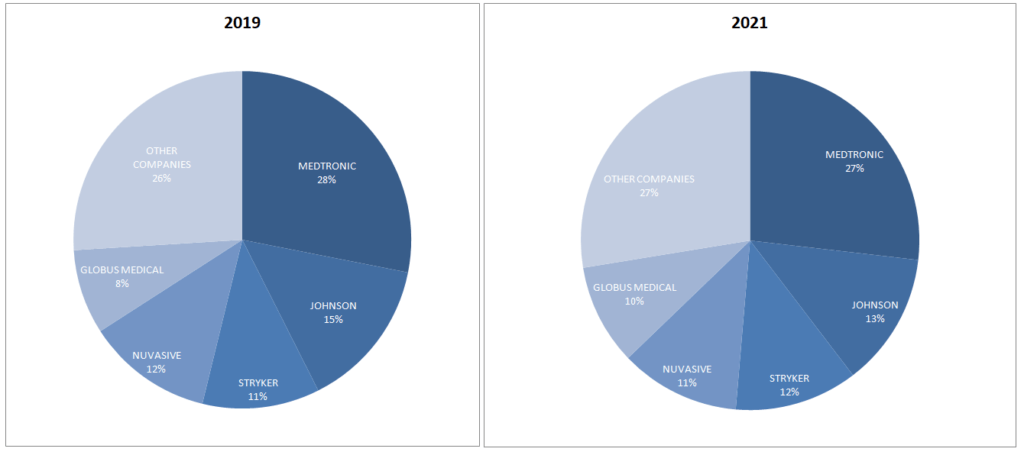

How have the Spine market shares have changed from 2019 to today?

In this period, we can see how, with the exception of Globus Medical (+2%), the key companies are losing market share in favor of the other players. Thus, we see Medtronic (-1%), Johnson (-2%) and Nuvasive (-1%). decreasing. Stryker grows slightly (+0.5%) and consolidates its third position ahead of Nuvasive mainly due to the recent addition of K2M. Globus consolidates its fifth position, very far from Zimmer (Zimvie).

Three issues to pay attention to:

- Stryker (12%) is already one point away from catching up with Johnson & Johnson (13%). The second position of J&J in the market may be in danger soon.

- Globus Medical in 2019 with an 8% market share was four points behind Nuvasive (12%). Today in 2021, only one point separates them since Globus has 10% and Nuvasive 11%. Let´s pay attention to them because if this trend continues, we will see changes soon.

- What would happen if Globus buys Nuvasive as rumored a few months ago? If that were to happen, Globus would be second in the market with a 21% share, well ahead of any other competitor… Will we see it?