In recent years, Globus Medical has pursued a clear and ambitious goal: becoming the leader in the spine market. Meanwhile, Medtronic Spine has focused on defending its position against Globus. This strategic battle has driven significant moves that are reshaping the industry’s landscape.

Globus Medical’s Strategy: From Challenger to Contender

Globus faced two major challenges in achieving leadership. First, it needed a strategic acquisition to gain the market share required to compete directly with Medtronic. The purchase of NuVasive addressed this need, propelling Globus from fifth to second place in the market rankings. Second, the company had to ensure a seamless integration of NuVasive to solidify its position and drive further growth.

Initially, this acquisition raised concerns on Wall Street, as past deals in the spine market had failed to deliver. However, Globus’s recent performance has alleviated these fears. Its stock has rebounded to the $80 per share level seen before the purchase, signaling confidence in its strategy. Today, the question is no longer if Globus will catch up to Medtronic but whether it already has.

A Tight Race: Sales and Market Shares

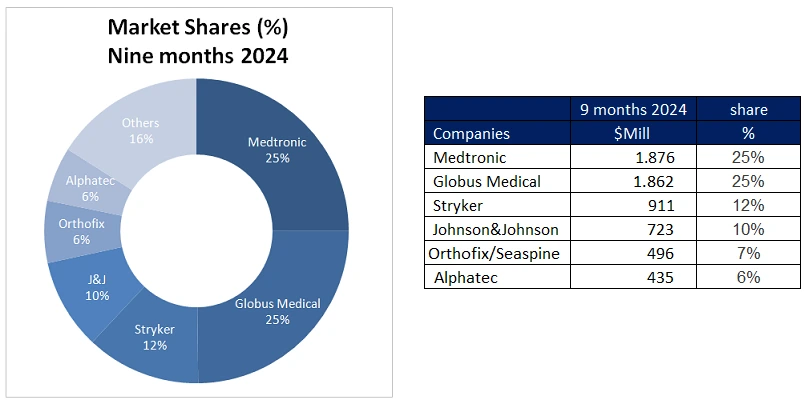

Looking at the first nine months of the year, Globus Medical and Medtronic report similar revenues, each around $1.8 billion. However, there are nuances to consider:

- Different fiscal calendars: Globus reports data for January–September 2024, while Medtronic’s results cover February–October (Q4 of 2024 and Q1–Q2 of 2025). This timing difference complicates direct comparisons.

- Combined Cranial & Spine reporting by Medtronic: Historically, Spine represents approximately 51% of this segment, which adds some uncertainty to the comparison.

Despite these differences, it’s clear that Globus is now very close to Medtronic (if it hasn’t surpassed it already).As for market shares, the current standings place Medtronic and Globus Medical in a tie for leadership, each holding 25%. Trailing behind, Stryker overtook Johnson & Johnson (J&J) for third place with 12%, while J&J fell to fourth with 10%.

J&J: Sell, Acquire, or Stagnate?

J&J’s decline from second to fourth place in just a few years highlights a significant loss of competitiveness in this critical market. This raises important questions about the company’s future in the spine segment. Three scenarios are possible:

- Selling the Spine Business

Given its declining performance, J&J may view this segment as non-core and opt to sell it, reallocating resources to more profitable areas. This move could simplify its portfolio and generate capital for growth initiatives. Potential buyers: Stryker could solidify its hold on third place, or smaller players might seize the opportunity to scale up rapidly. - Acquiring to Regain Leadership

Alternatively, J&J could pursue acquisitions to revitalize its position in the market. This strategy would require significant financial investment and flawless execution in integrating new companies—something Globus successfully demonstrated with NuVasive. - Stagnation or Gradual Exit

Should J&J decide to maintain the status quo, it risks further market share erosion and irrelevance against more dynamic competitors.

Our Opinion

The current scenario suggests that J&J is likely to divest its spine business. This aligns with a broader trend among corporations simplifying their portfolios to focus on high-growth, high-return areas, such as digital health or precision medicine. However, the decision will depend on internal factors (business performance, strategic priorities) and external ones (sale opportunities, competitive landscape).

As Globus and Medtronic compete neck and neck for leadership, Johnson & Johnson faces a pivotal moment that will shape its role in this rapidly evolving market.