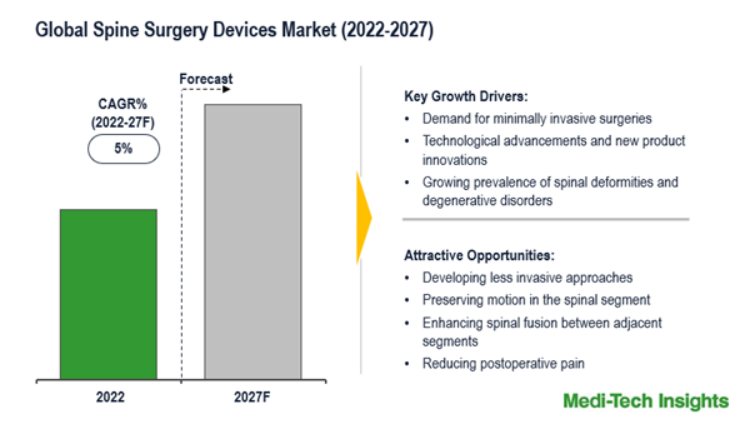

BRUSSELS, BELGIUM, Jan. 30, 2023 (GLOBE NEWSWIRE) –Spinal surgery devices are used to restore or enhance the mechanical stability of the spine, correct and maintain spinal alignment, and enhance spinal fusion caused by trauma or slipped discs originating from degenerative intervertebral disks.

A Slowdown in the Demand for Spine Surgery Devices Points to A Looming Recession

Due to the looming recession, patients are expected to delay the elective surgical procedures including spinal fusion surgeries until the future of the broader economy looks more promising. Considering the current economic and financial conditions, patients are expected to be less willing to incur the costs of these private pays or discretionary procedures and may choose to forgo such procedures. Another factor that will be limiting the placements of these devices is tighter spending by hospitals amid an economic slowdown and a looming recession risk.

Innovation in Spine Surgery Procedures Fuels the Spine Surgery Devices Market Demand

For many patients experiencing pain or discomfort from a spinal condition, spine surgery can be an excellent option to relieve pain and return to day-to-day activities. Currently, four common types of procedures represent about 90% of all spine surgeries. The ongoing investment in minimally invasive surgery and robotic-assisted surgery technology is transforming spine surgery. For instance,

- In November 2022, NuVasive, Inc, announced the commercial launch of its NuVasive Tube System (NTS) and Excavation Micro, a new minimally invasive surgery (MIS) system that provides comprehensive solutions for both TLIF and decompression

Growing Prevalence of Spine Disorders Are Driving the Growth of Spine Surgery Devices Market

Spinal problems like scoliosis, kypho scoliosis (spinal deformity), cervical stenosis, craniovertebral junctional anomalies, and spinal cord tumour are the most common disorders affecting the cervical spine. Although, low back pain and neck pain are considered the most common spinal disorders. The recent advancements in spine surgery devices for treating spinal disorders increase accuracy, reduce the incidence of complications, and deliver consistently good results. For instance,

- In October 2022, Centinel Spine, LLC announced the continued expansion of the availability of the prodisc Cervical Total Disc Replacement (TDR) portfolio that allows the disc to be matched to patient anatomy.

Key Market Challenges: Spine Surgery Devices Market

The high costs of spinal treatment procedures and the risk & complications associated with spinal surgery such as paralysis or a spinal infection during the surgery is likely to hamper the growth of the global spine surgery devices market in the upcoming years.

North America Expected to Continue to Hold a Major Share in the Spine Surgery Devices Market

From a geographical perspective, North America holds a major market share of the spine surgery devices market. This can be mainly attributed to the growing prevalence of spinal disorders, the rising number of spinal injuries in athletes, advancements in spine surgery technology, and increased demand for minimally invasive procedures in the region.

Competitive Landscape Analysis: Spine Surgery Devices Market

Some of the established and emerging players operating in the spine surgery devices market are as follows:

- Medtronic

- DePuy Synthes

- NuVasive

- Globus Medical

- Stryker Corporation, among others

Organic and Inorganic Growth Strategies Adopted by Players to Establish Their Foothold in the Market

All major players operating in the global spine surgery devices market are adopting organic and inorganic growth strategies such as collaborations, acquisitions, and new product launches to garner a higher market share. For instance,

- In October 2022, DePuy Synthes, announced they have received 510(k) clearance from the FDA for its ALTALYNE™ Ultra Alignment System for adolescent spinal deformities, such as scoliosis.

- In September 2022, NuVasive, Inc. announced the commercial launch of its Reline Cervical, a new fixation system for posterior cervical fusion (PCF), in targeted regions.

Explore Detailed Insights on Spine Surgery Devices Market with Table of Content (TOC) @ https://meditechinsights.com/spine-surgery-devices-market/

About Medi-Tech Insights:

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services.

Contact Us:

Ruta Halde

Associate, Medi-Tech Insights

+32 498 86 80 79