Founded in 1990 by Shunshiro “Roy” Yoshimi, Alphatec Spine initially operated as a medical device contract manufacturer. However, in July 1991, the company opted for vertical integration, pivoting to develop, manufacture, market, and sell its orthopedic trauma products.

In 2003, Alphatec Spine expanded its focus to include spinal products. Following its initial success, it allocated a higher percentage of its manufacturing and commercial resources towards the rapidly expanding spinal fusion market. As a result of this strategic shift, Alphatec Spine sought and obtained numerous product clearances from the FDA for spinal fusion products in 2004.

Happy times!

In March 2005, investors led by HealthpointCapital (a private equity fund affiliated with HealthpointCapital, LLC, an orthopedic investment bank) acquired all of Alphatec’s shares. This acquisition provided it with additional capital, which allowed it to enhance its operational capabilities in management, sales, manufacturing, and research and development. Additionally, to expand its offering of spinal implant products, it substantially acquired all of Cortek’s assets in September 2005.

In 2010, Alphatec Holdings Inc. acquired the French company Scient’X (the fifth-largest spinal implant provider in Europe) and established a consolidated global platform for its international expansion. In addition to its subsidiaries in Japan and Hong Kong, it added a direct sales force in France, Italy, and the United Kingdom and independent distributors in Europe, South America, the Middle East, China, and Latin America.

The Drama!

In 2014, a legal case culminated in a jury ruling that Surgiview, a subsidiary of Scient’x (acquired by Alphatec in 2010), had improperly transferred assets below fair market value during its acquisition of Eurosurgical S.A. in 2006, and had infringed upon contractual rights held by OrthoTec. The case alleged that HealthpointCapital had orchestrated this asset transfer to Surgiview to prevent OrthoTec from recovering a debt. Following the unanimous jury decision declaring the asset transfer fraudulent, OrthoTec received damages amounting to $48 million, along with pre-judgment interest. Subsequently, Alphatec agreed to provide OrthoTec with an initial payment of $17.5 million, followed by quarterly payments of $1.1 million, alongside 7% interest, spread over the following seven years. Additionally, Alphatec secured a $50 million loan facility with Deerfield Management to fulfill its obligation to OrthoTec.

Following the verdict, Alphatec Spine’s shares plummeted abruptly:

The Solution!

In 2016, Alphatec Holdings announced a definitive agreement whereby Globus acquired its international operations and distribution channel for a purchase price of $80 million. As part of the transaction, Globus agreed to provide Alphatec with a five-year senior secured credit facility of up to $30 million. Alphatec utilized portions of the cash consideration to pay down approximately $69 million of existing debt and debt-related costs. The combination of this new term loan and a revolving line of credit from MidCap provided the company with ample liquidity and suitable financing to facilitate its transition to a U.S. market-based company.

In the agreement, Globus acquired Alphatec’s international distribution operations and agreements, including its wholly-owned subsidiaries in Japan and Brazil, and substantially all of the assets of its remaining international business, including its sales operations in the United Kingdom and Italy. This transaction included an agreement through which Alphatec would supply its products to Globus for up to five years. Alphatec committed not to compete in the international market for the term of the supply agreement plus an additional two years. The idea behind Alphatec’s actions was to realign its business to focus solely on the U.S. market.

Transformation: Ownership and management structure changes!!

In 2017, following the Globus agreement, Alphatec experienced significant changes in its ownership and management structure. Patrick Miles assumed the role of Executive Chairman, while Quentin Blackford joined as a board member. Both brought extensive experience in the medical devices industry, having previously held key positions at NuVasive. Miles served for over 17 years at NuVasive, including roles as President and Chief Operating Officer. Blackford’s tenure at NuVasive included positions as Executive Vice President, Chief Financial Officer, and Head of Strategy and Corporate Integrity. As part of their commitment, Miles and Blackford personally invested over $3.5 million in Alphatec common stock. Concurrently, Mortimer Berkowitz III, who had served as Chairman since December 2016, transitioned into the role of Lead Director. Additionally, Stephen O’Neil resigned from his position as a member of the Company’s Board of Directors but remained a member of the Alphatec Board.

In 2018, Alphatec, led by Pat Miles, embarked on a business transformation that replaced 100% of the executive team, 94% of the Board of Directors, and over 90% of the remaining team with experienced professionals. Efforts that year founded their Organic Innovation Machine™, an in-house product design, development, and testing capabilities.

From 2019 through 2021, Alphatec focused on building an organization prepared to scale into a larger business.

- They developed and released several key elements of their approach-based portfolio, including a comprehensive posterior fixation system and approach-specific IdentiTi implants.

- They also acquired and integrated SafeOp, technology that integrates with their approaches to provide information about the location and the health of nerves intra-operatively. SafeOp became the informational backbone of the Prone TransPsoas (“PTP”) approach, which was developed and launched in 2020 to advance lateral spine surgery.

- They invested in new headquarters to substantially increase surgeon and sales training capacity and opened a distribution facility in Memphis, TN to ensure predictable and expedient surgical support as growing.

- They also acquired EOS imaging to expand on the informational competitive advantage established with SafeOp. EOS systems enable full-body, calibrated, 3D images that integrate throughout the arch of patient spine care to influence procedure planning and improve and objectify the understanding of global alignment.

Back to Success!

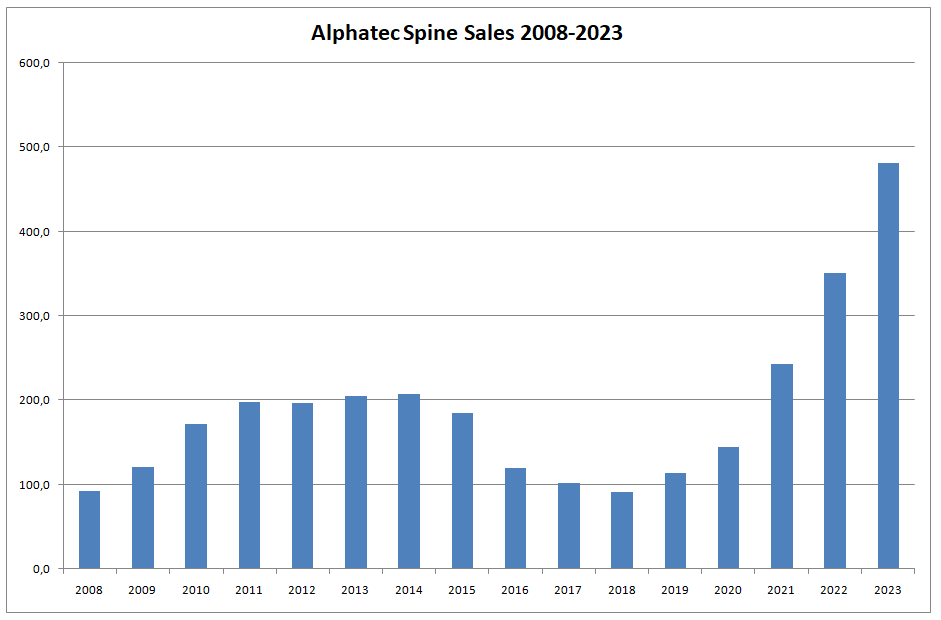

Since 2018, Alphatec has returned to growth, and its performance in recent years has been spectacular!

2024 and beyond!

As a medical technology company focused on designing, developing, and advancing technology for improved surgical treatment of spinal disorders, they have evolved significantly. Through their wholly-owned subsidiaries, such as Alphatec Spine, Inc., SafeOp Surgical, Inc., and EOS Imaging S.A., their mission is to revolutionize the approach to spine surgery by emphasizing clinical distinction. Their efforts are aimed at developing new approaches that seamlessly integrate with their expanding Alpha InformatiX™ product platform, to enhance surgical outcomes and make spine surgery more predictable and reproducible. With a diverse product portfolio tailored to address various spinal pathologies, their ultimate vision is to become the standard-bearer in the field of spine surgery.

Conclusion

Despite the challenges encountered along the way, Alphatec Spine’s sales have undergone a remarkable evolution. From humble beginnings to becoming a global leader in spine surgery technology, the company’s sales trajectory is a testament to its resilience, innovation, and unwavering dedication to excellence.

Starting in 2018, Alphatec Spine doubled down on innovation, restructuring its executive team and spearheading the Organic Innovation Machine™ initiative. Through strategic acquisitions and product developments, the company solidified its position as a trailblazer in the field of spine surgery.

Alphatec Spine in 2024 continues to evolve in sales and expand its product portfolio, with a relentless focus on excellence and a commitment to revolutionize spine surgery. However, it will need to demonstrate efficient management and meet sales growth targets to return to profitability. While recent results may not have met expectations, we hope they will soon.