Globus Medical made a strategic move to challenge industry dominance by acquiring NuVasive just over a year ago. This acquisition propelled Globus from the fifth to the second position in the market. The synergy between the two companies expanded Globus’s product portfolio and fortified its competitive edge in the industry. While there are notable cultural differences between Globus Medical and NuVasive, both companies share common strengths that complement each other. Despite initial challenges in integration, their collective focus on product excellence, training, technology, and service provides a solid foundation for mutual benefit. While Globus leans towards profitability, NuVasive relies more on marketing, creating a symbiotic relationship. While the aspiration to become the world’s premier spine company is evident following the NuVasive acquisition, the exact timeline for this achievement remains uncertain. However, multiple indicators suggest that Globus Medical is on a path toward becoming the leading authority in spinal care.

Who is number 1 today?

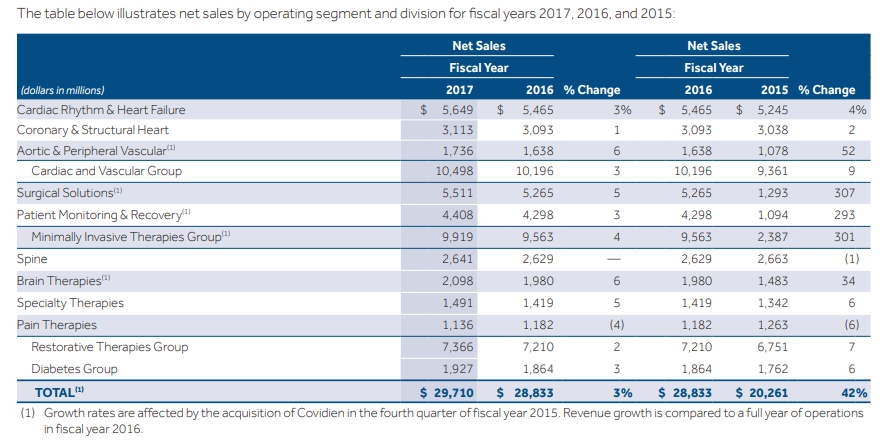

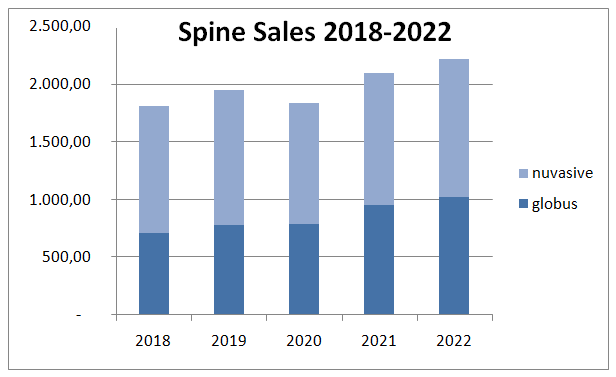

The world market leader is Medtronic, which became the top player in 1998 when it purchased Sofamor Danek Group Inc. for about $3.7 billion in stock. Sofamor Danek, based in Memphis, was the leader in spine surgery technologies worldwide. Since then, Medtronic has been the clear leader by far. However, we’ve noticed that its growth has been slower in recent years. Specifically, if we look at the period from 2015 to 2020 (Chart 1), (footpage) its sales decreased by 6%. It doesn’t seem like things have improved since 2021, as they have not published separate spine data but have combined it with cranial, suggesting there may not be much positive to report. It also indicates a lack of focus in that business, or at least that’s how it appears.

What has been the evolution of Globus + NuVasive in recent years?

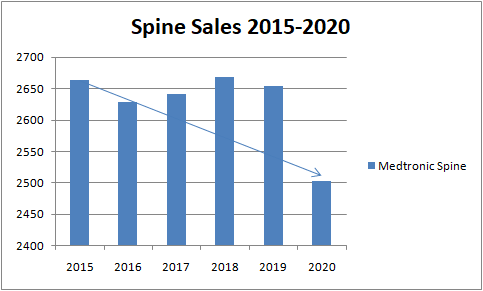

In the period from 2018 to 2022, both companies have grown separately. (Chart 2) Globus has grown by 43%, steadily increasing each year, even during the 2020 pandemic. NuVasive has grown by 9% in the same period. Combining both companies, their joint growth has been 23%, from $1.814 billion in 2018 to $2.224 billion in 2022. Medtronic published spine figures for 2020, which were $2.503 billion.

Which are the Key Factors Driving Globus Medical’s Rise?

- Vision and Focus: Globus Medical demonstrates a clear vision and relentless focus on becoming the best in the spinal market. In contrast, competitors like Medtronic lack the same level of understanding and commitment to the spine market, possibly due to their diversified focus across various sectors.Medtronic knows where it’s heading, but not in spine. They’ve been lacking focus and showing minimal interest in the spine sector for quite some time. The impression is that they’re confused and don’t seem to be comfortable in this market.

- Strong Leadership: Led by a great team like Dan Scavilla and Dave Hole, with the influence of Globus Medical’s founder David Paul, Globus Medical has a leadership team aligned with the goal of spinal market dominance. Their cohesive vision and strategic direction set them apart from competitors like Medtronic, which face challenges in maintaining focus amidst diverse business units.

- Potent Sales Network: The merger with NuVasive has fortified Globus’s commercial capabilities, establishing a formidable sales network that enhances its market position.

- Extensive and Innovative Product Portfolio: The combined strengths of both companies result in an unparalleled portfolio of high-quality spinal products, positioning Globus as a frontrunner in meeting the evolving needs of spinal care.Additionally, they offer state-of-the-art technologies like expandables. While Medtronic also offers a comprehensive range, they have been slow in introducing new products and are somewhat behind in interbody fusion cages.

- Technology: Globus Medical, with its Excelsius platform (GPS, 3D), and incorporating NuVasive’s Pulse (Neuromonitoring, Global alignment, Rod Bending, Navigation), has cutting-edge technology better than any other company, including Medtronic.

When is Globus Medical likely to surpass Medtronic and become the leader in the spine industry?

With a clear vision, strong leadership, a potent sales network, advanced technology, and an innovative product portfolio, Globus Medical will achieve its objective soon. By 2025, it is likely to surpass Medtronic unless the latter demonstrates a renewed determination to maintain its leadership through strategic acquisitions and focused efforts in the spine sector. The stage is set for Globus to redefine spinal care and emerge as the undisputed leader in the field.

###

Data: Source Medtronic Annual Reports