These days, most companies are publishing their 2020 results. In this article, we have collected all of them to measure the impact of Covid on all of them. It has not been easy as each company measures and presents the spine results differently.

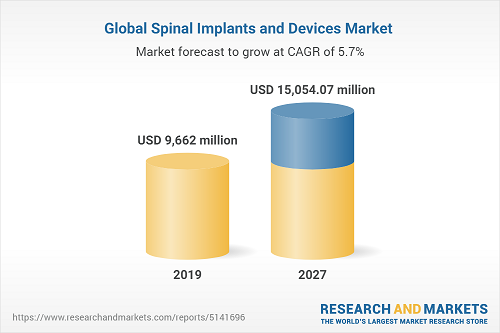

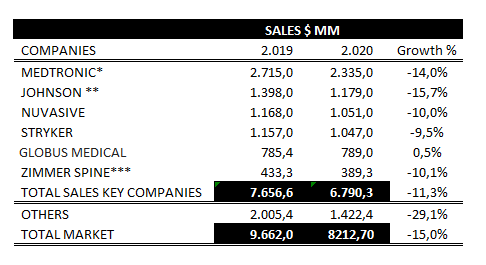

According to Research and Markets, the global market for the Spine in 2019 was USD 9662 million. In 2020, due to COVID.19, it has been estimated that the market has fallen an average of 15%, and therefore remaining at USD 8212 million.

But this market drop has not affected all the Companies in the same way. Except for Globus Medical with a growth of 0.5% due mainly to robotics, the rest of the large companies have fallen at least 10% (See Table 1).

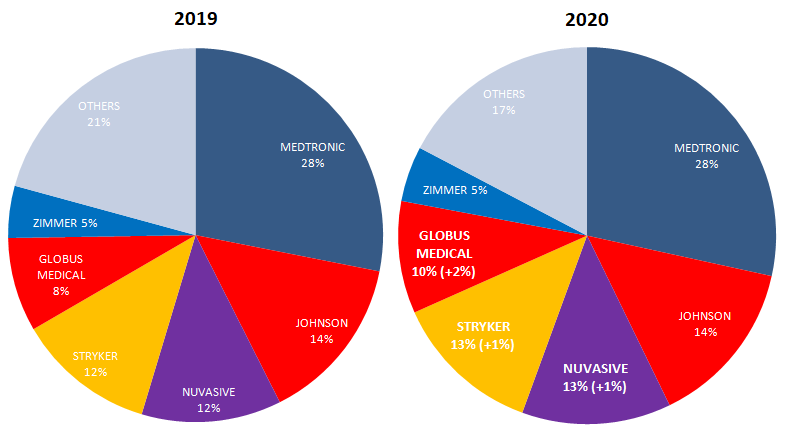

However, the situation in terms of market share are several companies that have changed their participation (See Table 2):

- Globus Medical has grown two points of market share, going from 8% to 10%. However, it is still the 5 Company in the market far from the next Competitor.

- Nuvasive continues to be the first competitor after the big market leaders like Medtronic and Johnson&Johnson. Despite a 10% decrease in sales, its market share has grown 1%. However, this has not served to increase his distance from the next competitor Stryker.

- Stryker: Despite having incorporated K2M, it still cannot surpass Nuvasive even though they have practically the same market share. In 2020 due to COVID-19, sales have fallen by 9,5%

What have been the Sales results of the Strongest Spine Companies in 2020?

1.-Medtronic

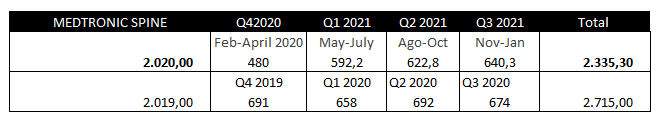

Medtronic’s sales in 2020 have been USD 2335 MM and have fallen by 14% compared to 2019. It continues to maintain a solid leadership position and with a 28% market share. (*) All Medtronic Column data is taken from the period February 2020-January 2021. Medtronic presents its data according to its Fiscal year. That is why I include the following table where you can see the months that have been taken to configure the final figure.

2.-Johnson&Johnson

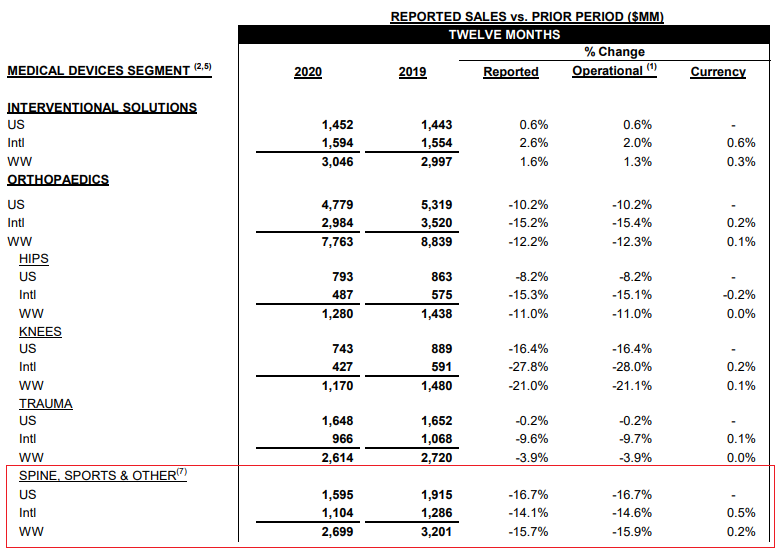

Spinal worldwide sales, declined by 15,7 %. The decline was primarily driven by the negative impact of the COVID-19 pandemic and the associated deferral of medical procedures.They have maintained their market share of 14% being the second market leader after Medtronic

(**) The Johnson and Johnson column sales are our estimate since (as you can see in the following table), the published sales also include Sport & Others.

3.-Nuvasive

- NuVasive reported full year 2020 total net sales of $1.051 billion, a 10.1% decrease compared to $1.168 billion for the full year 2019. On a constant currency basis, full year 2020 total net sales decreased 10.2% compared to the full year 2019, which reflects the impact of the COVID-19 pandemic.

- Nuvasive have just acquired Simplify Medical to advance their C360 portfolio and the 510(k) submission for the Pulse platform.

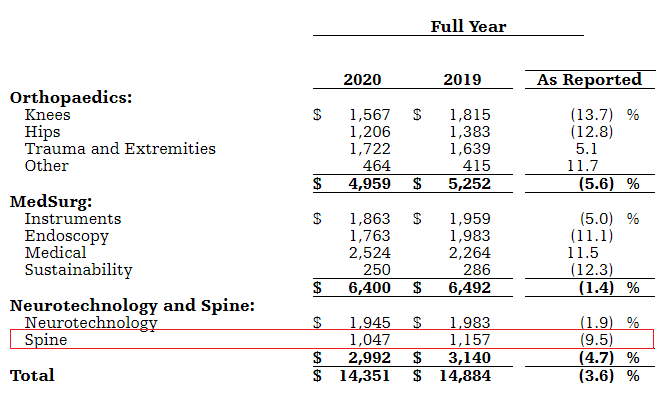

4.- Stryker

Stryker in 2020 has made sales of USD 2,992 MM, which represents 9.5% less than last year, mainly due to the effects of COVID 19 and the deferral of medical procedures. This year has also been the year of the integration of K2M in your organization. Without a doubt, as soon as the pandemic ends. Stryker will be an aggressive competitor with its magnificent product portfolio.

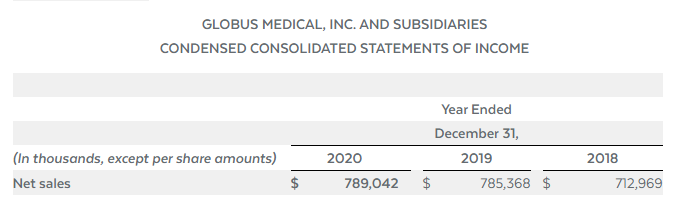

5.- Globus Medical

Globus Medical has been the only major company that has grown in a Pandemic year like 2020, reaching USD 789 MM and increasing the market share up to 10% (+ 2%). Like all spinal companies, it has been greatly affected by surgeries deferred by COVID and robotic technology has been the engine of growth.

Globus Medical’s fourth quarter growth of 10% was led by Enabling Technologies at $18 million, up 30% in the quarter, and US Spine, which grew by 12%, even though COVID-related cancellations caused an estimated drag of about five percentage points,” said Dave Demski, President and CEO. “Our 2020 second half performance, which produced almost $450 million in revenue; 10% overall growth; 14% growth in US Spine.

6.-Zimmer Biomet

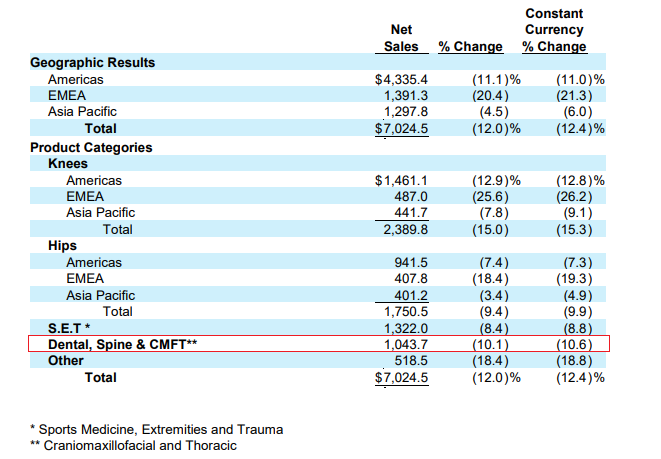

Zimmer Biomet’s sales in the spine have fallen by 10% in 2020. Despite all the acquisitions made in the past (Biomet, LDR …), they have not finished obtaining a leadership position in the column and remain in the fifth position with a 5% market share. Therefore, we assume that they have decided to spin off their spine business and focus more on other areas of growth. As they comment, they continue the transformation of their business to drive growth, increase shareholder value and prioritize resources.

(***): Zimmer Biomet Spine sales are an estimation because in the results published in 2019 the Spine and CMF come together and in 2020, they have included Dental in the same group.

7.- Alphatec Spine:

- Expanded contribution from new products to 75% of Q4 U.S. revenue, up from 48% in Q4 2019;

- Increased Q4 average U.S. revenue per case by 13% year-over-year, driven by continued strong performance from AlphaInformatiX and lateral interbody fusion (LIF), which includes Prone TransPsoas (PTP™);

- Continued sales network transformation, resulting in 47% year-over-year revenue growth from strategic distribution in Q4;

- Increased Q4 revenue per surgeon by 15% year-over-year;

- Advanced clinical distinction with 11 new product launches in 2020, including the Q4 release of the novel PTP procedure, of which, well over 1,000 surgeries have been successfully performed;

- Announced agreement and planned tender offer to acquire EOS imaging, S.A. (“EOS”), taking another significant step toward advancing ATEC clinical prowess with improved information from diagnosis to follow-up; and

- Secured over $250 million of new capital through public and private placements of common stock to fully fund the acquisition of EOS and provide additional operating capital.

8.- Seaspine: Revenue for the year ended December 31, 2020 totaled $154.3 million, a decrease of 3.0% compared to the prior year. U.S. revenue was $138.9 million, a 2.1% decrease compared to 2019. Spinal implants revenue totaled $75.9 million, a 2.3% decrease compared to 2019. Orthobiologics revenue totaled $78.4 million, a 3.6% decrease compared to 2019.

Very comprehensive report.

Thank you